Bitcoin held near weekly highs on Thursday as market concerns eased, while most altcoins remained muted. The crypto market shows early signs of recovery despite broader downtrends.

Bitcoin traded around $93,500, and Ether rose to $3,200 following the Fusaka upgrade. The Fear & Greed Index climbed to 27/100, exiting the “extreme fear” zone and signaling growing optimism.

Despite the uptick, Bitcoin and most altcoins are still in downtrends from early October, forming a series of lower highs and lower lows. Analysts note that Bitcoin would need to surpass $98,500 to signal a meaningful bullish reversal. The CoinDesk 20 (CD20) Index rose 1.13% in the past 24 hours, building on Tuesday’s gains.

Derivatives Overview

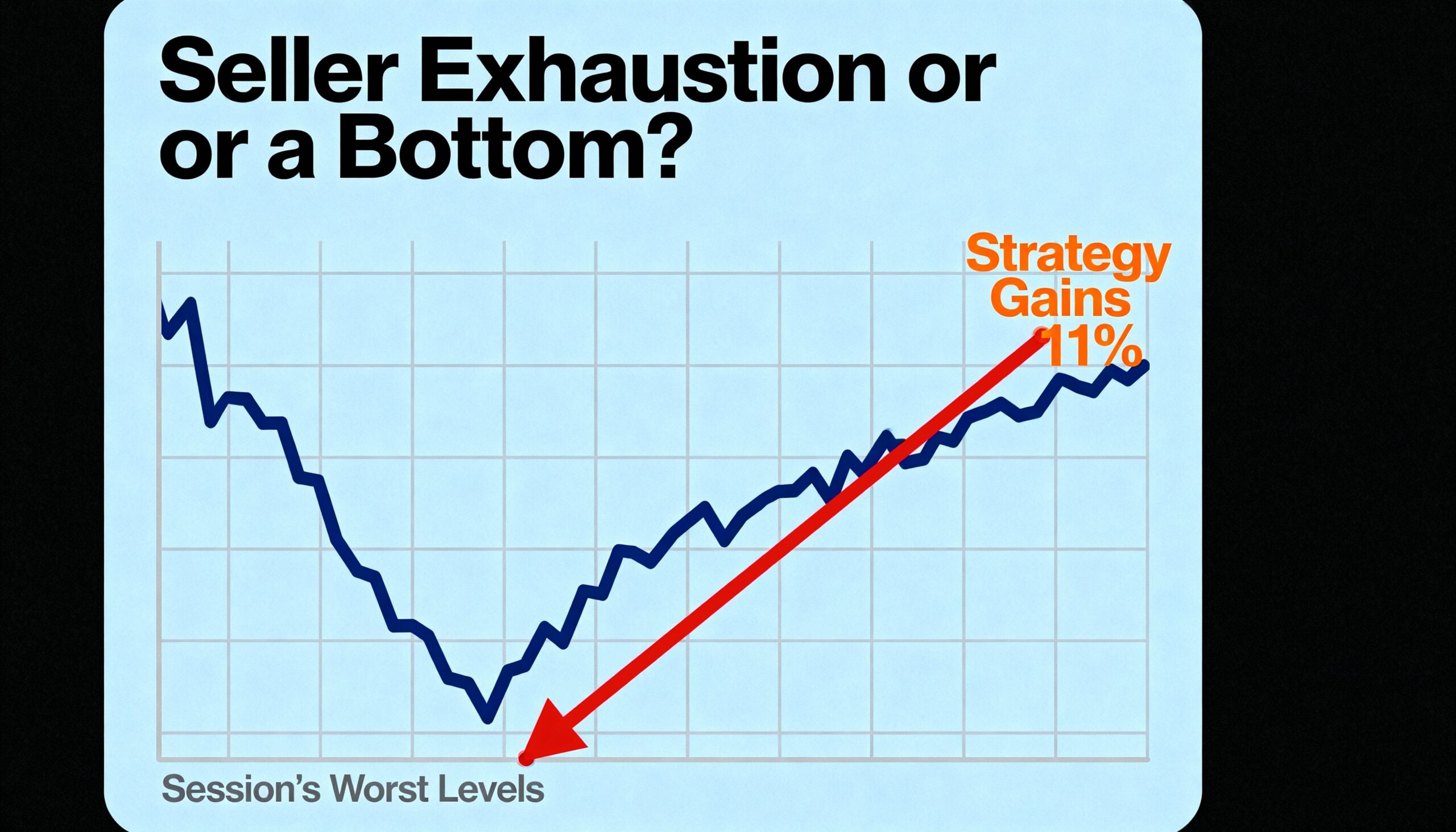

- Bitcoin’s 30-day implied volatility (BVIV) fell to 48.44%, the lowest since Nov. 14, after spiking to 65% on Nov. 21 when prices dipped toward $80,000.

- Ether volatility fell to 72%, the lowest since Nov. 3.

- BTC puts continue to trade at a premium over calls, while Ether options show mild bullishness after August 2026, reflecting demand for protective puts and call-overwriting strategies.

- The $100K BTC call leads options open interest at $2.82 billion. Strangles dominate block flows for BTC and Ether.

- Futures activity shows ZEC OI up 6%, ETH OI up 4%, and FART OI up 22%, signaling speculative trading.

Altcoins

Altcoins remain largely subdued. CoinMarketCap’s “altcoin season” indicator fell to 20/100, showing investor preference for Bitcoin. TAO, ENA, and AVAX gained 4.5%–8.5%, while Hedera (HBAR) dropped 3.8% as trading volume declined 15% to $245 million.

Compared to late 2024, when memecoins and decentralized derivatives dominated, the altcoin market has matured, with token performance increasingly tied to development. Privacy coins, which rallied from September to November, are now correcting: ZEC down 29.4% and DASH down 22% over the past week.