Crypto-Collateralized Debt Hits Record $73.6B in Q3 as Leverage Strengthens, Galaxy Reports

Crypto-collateralized borrowing surged to $73.6 billion in Q3, marking the most leveraged quarter in the sector’s history. Galaxy Research notes that this leverage is healthier and more transparent than during the 2021–22 cycle.

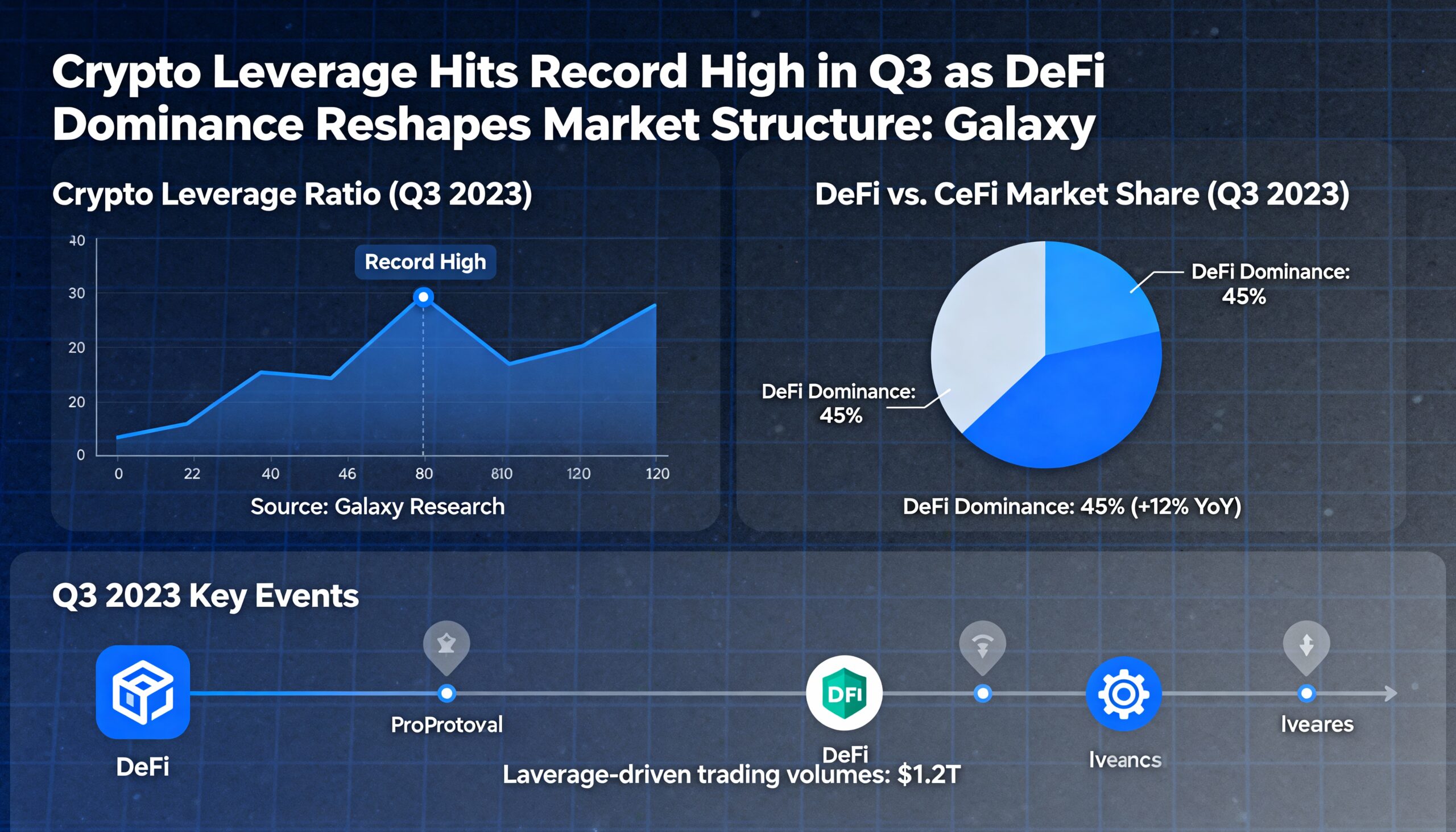

Onchain lending drove the majority of growth, now representing 66.9% of all crypto-backed borrowing, up from 48.6% at the previous peak. DeFi lending alone jumped 55% to $41 billion, supported by incentive programs and improved collateral types like Pendle Principal Tokens.

Centralized lending also rebounded, with borrowing rising 37% to $24.4 billion, though still a third below 2022 highs. Survivors of prior cycles have shifted toward fully collateralized models to attract institutional capital, with Tether dominating CeFi loans at nearly 60%.

DeFi lending apps now capture over 80% of the onchain market, while CDP-backed stablecoins fell to 16%. New chain deployments such as Aave and Fluid on Plasma drove activity, with Plasma surpassing $3 billion in borrows within five weeks.

A leverage-induced liquidation event shortly after Q3 erased over $19 billion in a single day, but Galaxy emphasizes this reflected automatic de-risking rather than systemic weakness. Corporate digital-asset treasuries also rely on leverage, with $12 billion in outstanding debt, bringing total industry debt to $86.3 billion.

Overall, Galaxy concludes that crypto leverage is rising on firmer foundations, with collateralized structures replacing the unbacked credit that fueled prior boom-and-bust cycles.