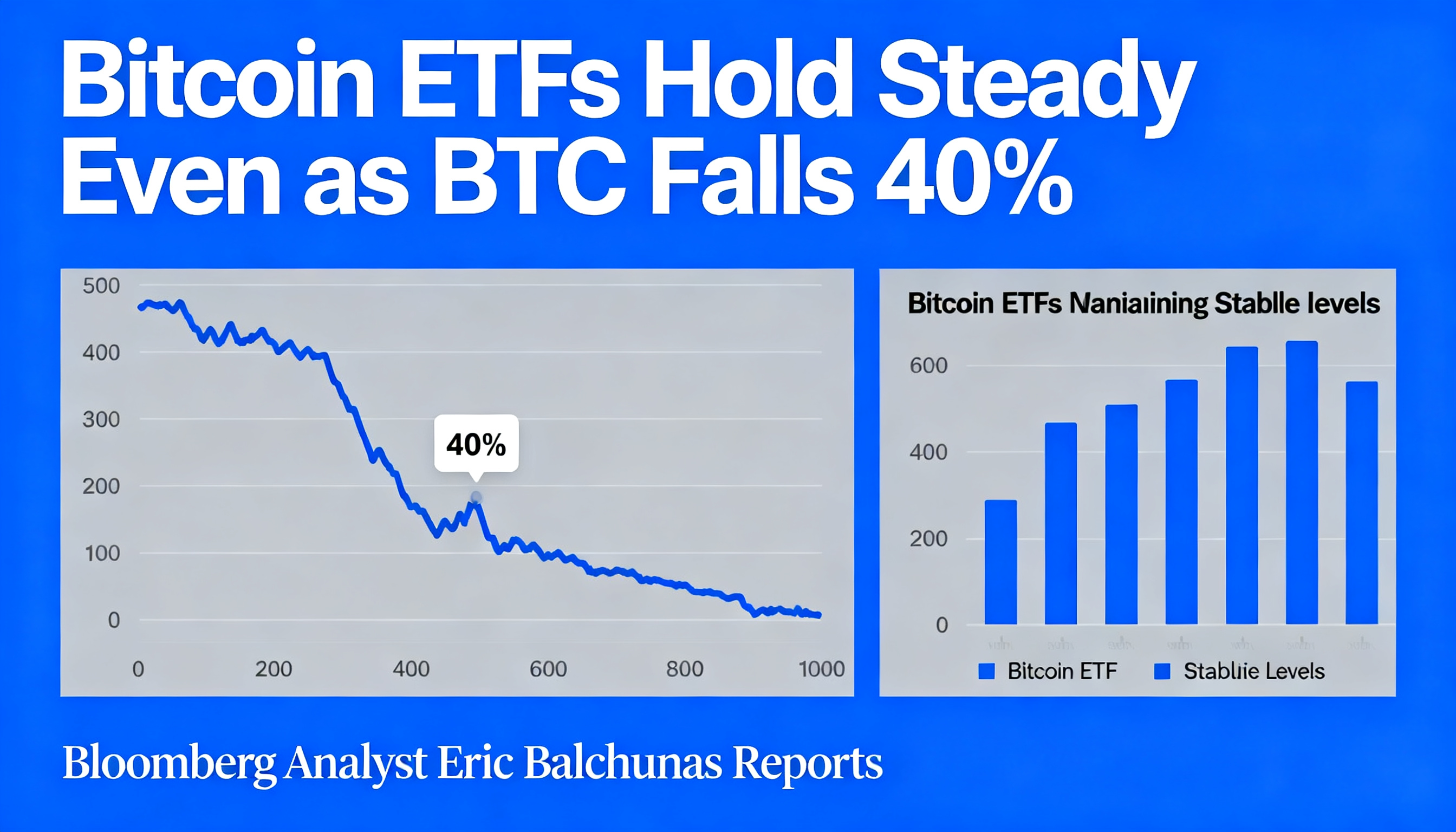

Bitcoin ETFs Remain Resilient Despite 40% Price Drop

Bitcoin has dropped more than 40% from its October highs, yet spot Bitcoin ETFs have held steady, with only 6.6% of assets withdrawn during the selloff.

In a discussion on CoinDesk’s Markets Outlook, Bloomberg Intelligence Senior ETF Analyst Eric Balchunas highlighted why ETF investors are proving more stable than many expected. Unlike crypto-native holders, ETF investors typically treat bitcoin as a small 1%–2% allocation within diversified portfolios of stocks and bonds. Strong equity markets have helped cushion the psychological impact of crypto losses. “For now, the ETF boomers have really come through,” Balchunas said.

By contrast, concentrated bitcoin holders and leveraged traders face heavier selling pressure and the emotional strain Balchunas calls “existential crisis mode.” He noted that bitcoin has historically recovered from seven or eight similar drawdowns.

Balchunas also drew comparisons with gold ETFs. Around a decade ago, gold ETFs fell roughly 40% over six months, shedding a third of assets, only to rebound and now hold about $160 billion. Bitcoin ETFs, which briefly rivaled gold in size before this selloff, show that flows can reverse over time.

Looking ahead, Balchunas said volatility is likely to persist, but ETFs may help anchor bitcoin in mainstream finance. “A selloff doesn’t mean the end,” he added. “It just means it’s a selloff.”