XRP continues to face selling pressure, with the token unable to break through the $2.23–$2.24 resistance band as broader market sentiment stays firmly bearish.

The asset briefly plunged through multiple support zones before staging a steep, high-volume V-shaped rebound — a sign that short-term selling may be losing momentum. Even so, the bounce is occurring in a challenging environment marked by mixed institutional signals and shaky macro conditions. Overall crypto sentiment remains stuck in “fear,” with volatility climbing across major assets and the broader trend still pointing downward.

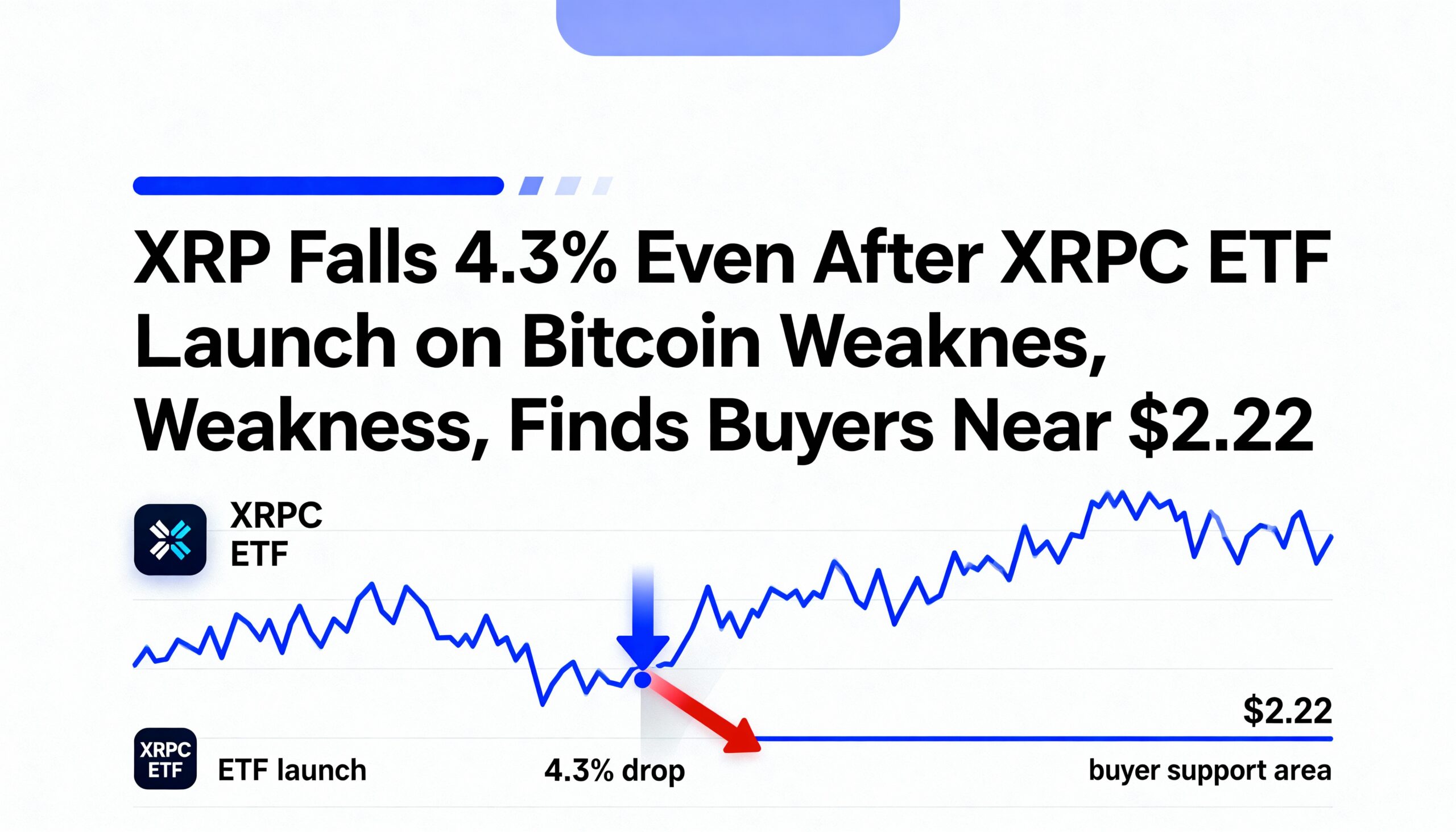

Canary Capital’s launch of the XRPC U.S. spot ETF provided a rare bright spot. The fund generated an impressive $58.6 million in first-day trading volume, well above the $17 million analysts expected. But even with this strong debut, XRP failed to find support. Derivatives markets reflected growing stress, with roughly $28 million in liquidations in 24 hours — nearly $25 million of which came from long positions.

Market strategists note that while ETF inflows show institutional curiosity, persistent risk-off behavior across global markets continues to sap crypto liquidity and momentum.

Price Performance

XRP slid 4.3% between $2.31 and $2.22 during the 24 hours ending Nov. 16 at 02:00 UTC. The move created a $0.10 range and a clean series of lower highs, confirming a bearish short-term structure. Heavy selling arrived around 00:00 UTC, when volume spiked to 74 million XRP — 69% above average — driving price below $2.24 and down to the day’s low at $2.22. Several additional volume bursts above 57 million highlighted ongoing distribution.

Although the ETF launch suggested a positive catalyst, XRP remained under pressure after rejecting $2.31, with no meaningful support from prior consolidation levels. After the breakdown, price stabilized within a narrow $2.22–$2.23 range.

Technical Picture

Support & Resistance

- Primary support: $2.22 (capitulation low)

- Immediate resistance: $2.23–$2.24

- Next major downside level: $2.16 (0.382 Fibonacci). Losing this threatens a quick move toward $2.02–$1.88

Volume Signals

- Capitulation: 74M XRP (+69%) during breakdown

- Exhaustion signals: Two 4.7M spikes at 01:39 and 01:46 UTC

- Recovery: Volume steadied at normal levels, suggesting cautious bottom-buying

Market Structure

- Price carved a sharp V-shaped reversal off $2.22

- Higher lows emerged at $2.209 → $2.217 → $2.227, hinting at short-term momentum building

- The broader downtrend from $2.31 remains unbroken

- Resistance at $2.23–$2.24 continues to cap rallies

Momentum

- Intraday oversold readings helped spark the rebound

- The overall market bias remains bearish with declining 50-day and 200-day moving averages

What Traders Should Focus On

XRP is hovering at a key inflection point:

- Holding $2.22 is essential — losing this level exposes a drop toward $2.16 and potentially $2.02–$1.88

- Reclaiming $2.24, then $2.31, is required to reset the bullish structure

- Early XRPC ETF flows may drive additional volatility and directional bias

- The V-shaped bounce offers temporary relief, but significant resistance limits upside for now

- A decisive break above $2.48 would be needed to re-establish a bullish trend toward $2.60+