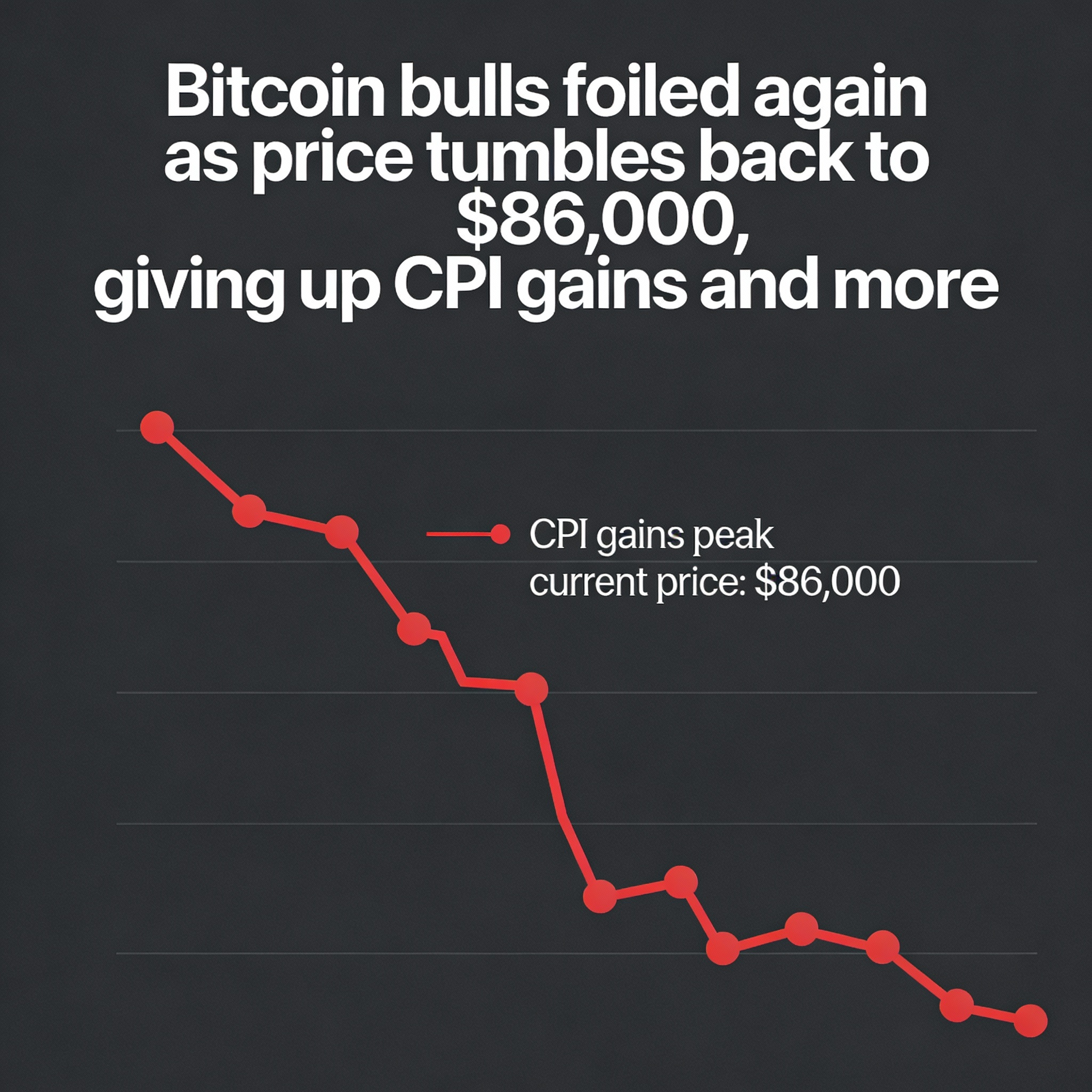

Bitcoin slid to $68,000 on Tuesday as a broader risk-off mood gripped financial markets, tracking losses in U.S. technology stocks and an extended pullback in gold. Memecoins paced declines among altcoins, while bitcoin dominance continued to move within a well-defined range.

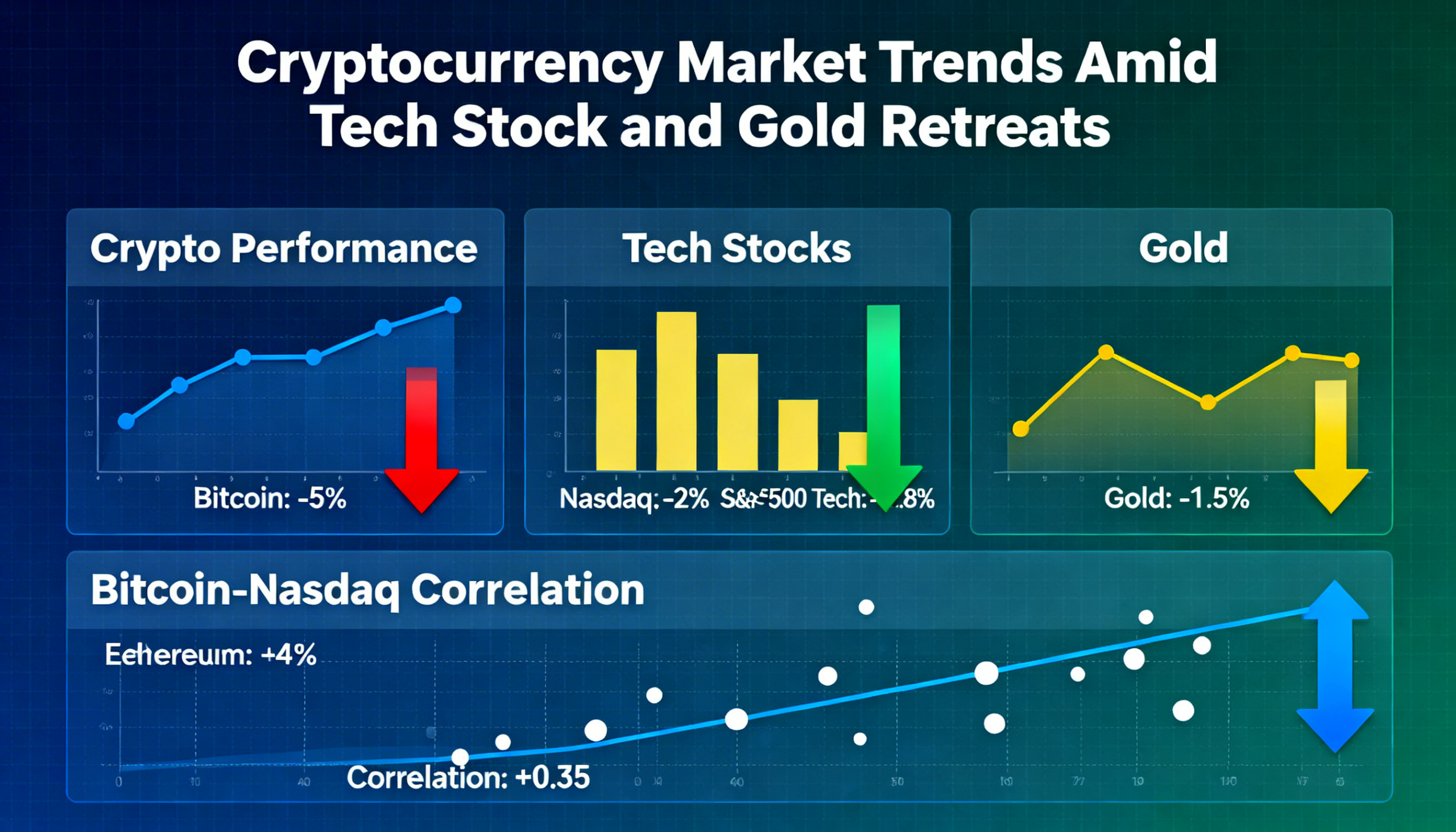

The broader crypto market weakened alongside a selloff in tech-heavy equities. Bitcoin was down 1.25% since midnight UTC. Nasdaq futures lost 0.55% over the same stretch, while gold dropped 2.4%, deepening its correction.

Speculative tokens underperformed. Memecoins including Pepe (PEPE), Dogecoin (DOGE) and Official Trump (TRUMP) fell between 3.5% and 4.5%, leading losses across major altcoins.

The retreat in risk assets has been linked to mounting concerns about artificial intelligence and its potential disruption across sectors, a theme that has pressured technology shares in recent sessions. Over the past two weeks, bitcoin’s relationship with the Nasdaq has strengthened significantly. The correlation coefficient has climbed from -0.68 to +0.72, underscoring bitcoin’s renewed alignment with tech equities.

Gold was trading around $4,928 after failing to sustain a move above $5,000. The precious metal had surged to a record $5,600 on Jan. 28 before undergoing a sharp 21.5% correction in the days that followed.

Derivatives positioning

Futures markets reflected continued caution:

- Total crypto futures open interest declined 1.5% in 24 hours to $93 billion, hitting fresh multi-month lows as capital flowed out of leveraged positions.

- Exchanges liquidated $229 million worth of positions over the past day, with bullish longs accounting for the majority of forced closures.

- DOGE futures open interest dropped 4%, leading declines among major tokens, while PEPE, LINK and AVAX posted 3% to 5% reductions.

- Open interest in HYPE futures cooled to 44.45 million tokens — the lowest level since early December — likely reflecting profit-taking after recent outperformance versus bitcoin and other large-cap assets.

- Implied volatility for bitcoin and ether has pulled back sharply from recent peaks, indicating that acute panic has subsided.

- On Deribit, puts on bitcoin and ether continue to command a premium over calls, signaling lingering downside hedging demand. Still, positioning is less defensive than it was two weeks ago.

Token performance

Altcoins remain largely tethered to bitcoin’s direction. The bitcoin dominance ratio has fluctuated between 57.4% and 60.1% since September, reflecting BTC’s steady share of overall market capitalization.

Some tokens have diverged from the broader weakness. AI-linked MORPHO has gained 23.5% over the past week, while privacy-focused Zcash (ZEC) is up 19% during the same period.

By contrast, layer-1 token LayerZero (ZRO) has fallen 16% in the past week, extending its slide even after announcing a collaboration with Citadel Securities and Depository Trust & Clearing Corporation.

On shorter time frames, pressure remains evident. Tokens such as HYPE, SUI and ASTER have declined between 3% and 4.8% since midnight UTC, as the market continues to search for a catalyst capable of reigniting bullish momentum.