Coinbase Reports Revenue Miss, Shares Dip Amid Market Cooling and Economic Concerns

Coinbase (COIN) shares dropped nearly 3% in after-hours trading following a disappointing earnings report for the first quarter, which missed Wall Street’s expectations. The crypto exchange attributed the weak quarter to a drop in crypto prices caused by U.S. President Donald Trump’s tariff policies and the ongoing macroeconomic uncertainty.

The company posted $2 billion in revenue for Q1, a decrease from $2.27 billion in the previous quarter, and below analysts’ consensus of $2.1 billion. Earnings per share (EPS) came in at $0.24, significantly missing the anticipated $1.93.

Quarterly trading volume fell 10% to $393.1 billion, with transaction revenue declining 19% to $1.3 billion compared to Q4.

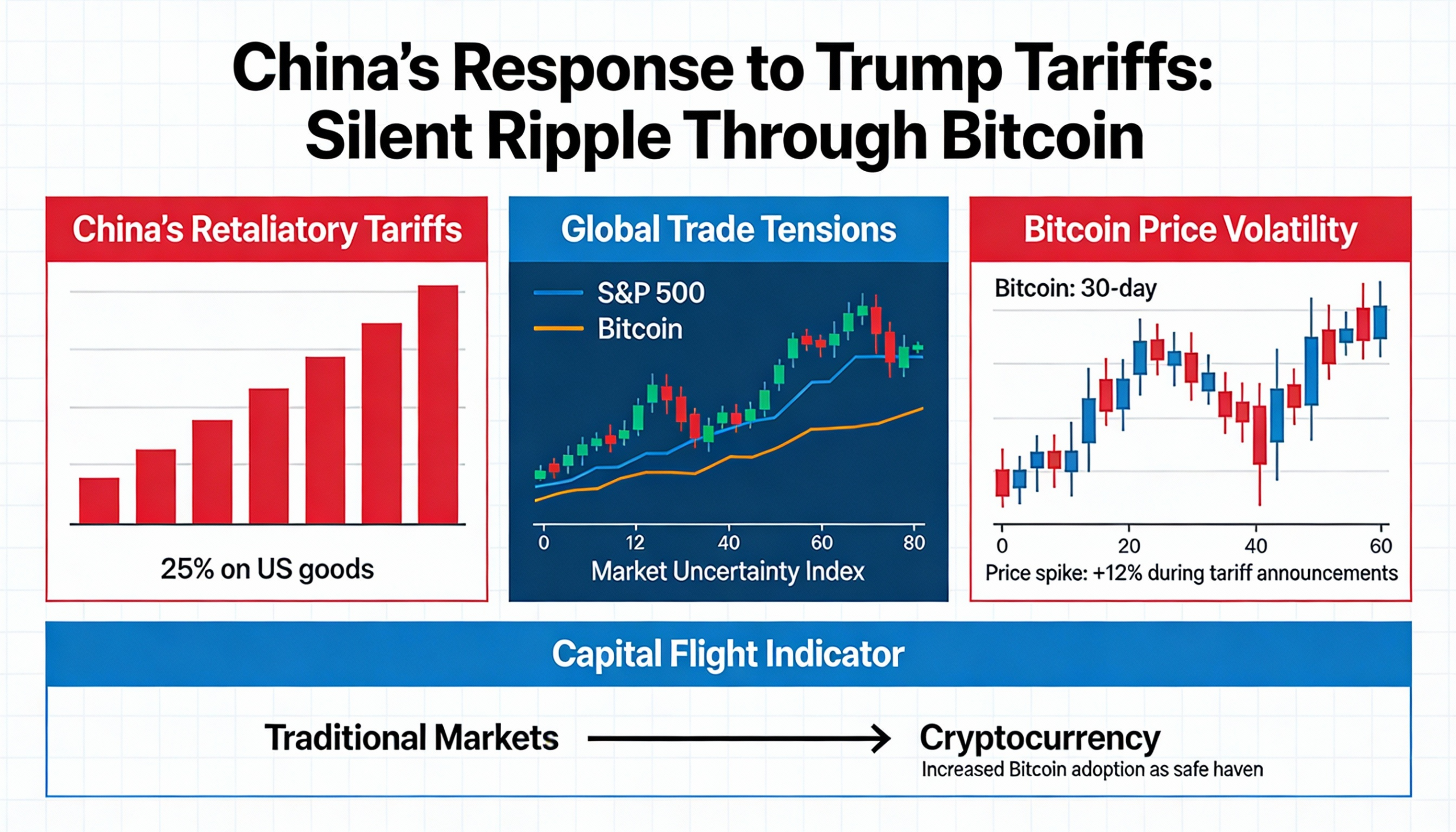

In its shareholder letter, Coinbase highlighted that while cryptocurrency volatility remained high with Bitcoin hitting a record price in January, broader market declines, fueled by tariff tensions and economic instability, led to a decrease in crypto prices. This broader market weakness resulted in a slower pace of trading activity.

J.P. Morgan, Barclays, and Compass Point had already lowered their forecasts for the company prior to the earnings release, as crypto trading volumes showed signs of cooling off in the first months of the year.

Meanwhile, Robinhood (HOOD), which has a similar retail investor base, also reported a 13% drop in transaction-based revenue in April, reflecting the same market challenges faced by Coinbase.

Despite the earnings miss, Coinbase’s $2.9 billion acquisition of the crypto derivatives exchange Deribit positions the company as a new leader in the global crypto options market. The move surpasses competitors like Binance and signals a strategic shift towards dominating the increasingly popular derivatives space, attracting attention from both institutional and retail investors.