Dogecoin Extends Decline as Technical Breakdown Overshadows ETF Momentum

Dogecoin slipped to new session lows on Wednesday, with technical weakness overwhelming rising network activity and renewed optimism around pending spot DOGE ETF filings. Despite strengthening fundamentals, price action continues to favor sellers.

Market Context

DOGE’s decline comes amid a rise in user engagement, with the network posting 71,589 active addresses, its highest level since September. ETF speculation also picked up after 21Shares and Grayscale advanced their spot Dogecoin ETF applications, fueling expectations of broader institutional accessibility in the months ahead.

Even so, the market showed little appetite to support the price. Whale activity remains muted relative to November peaks, and ETF-related inflows have yet to meaningfully increase. With the broader crypto market leaning risk-off, DOGE’s improving on-chain picture has been overshadowed by a deteriorating technical backdrop.

Technical Picture

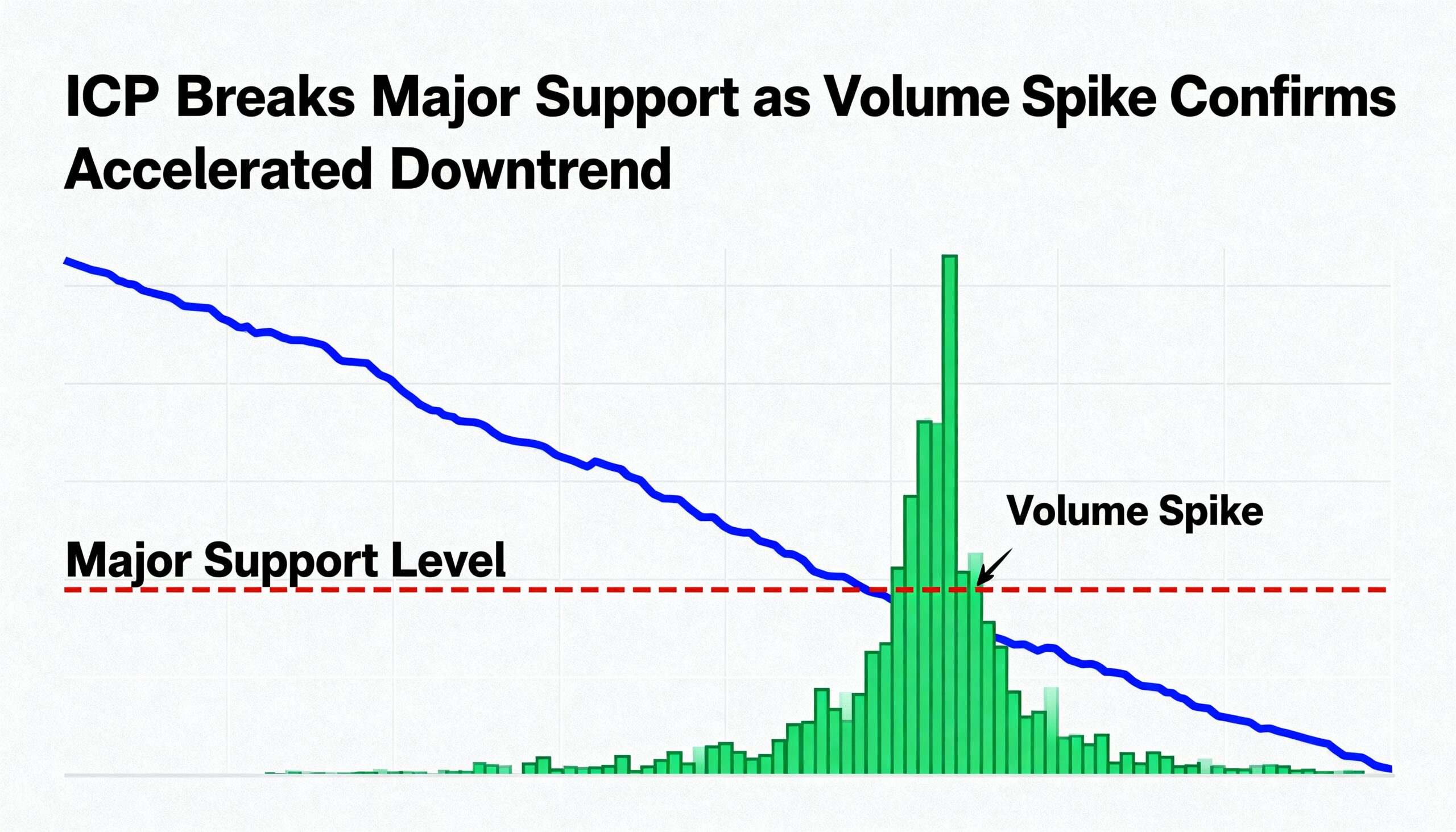

Wednesday’s breakdown was clean and driven by institutional or algorithmic selling, rather than retail capitulation. DOGE repeatedly failed to clear the $0.1522 resistance zone, with each attempt marked by weaker upside volume — a sign buyers were losing conviction.

The key shift occurred when $0.1487 support broke, triggering a surge in activity. Three consecutive hourly candles saw more than 400M DOGE traded, confirming that large players were behind the move. The price structure had already formed a descending triangle, with lower highs pressing into a flat support base, and the eventual breakdown aligned with this bearish formation.

Momentum indicators offer no relief: RSI continues to trend lower, and trend-following signals remain negative. Unless buyers reclaim the $0.1487–$0.1510 band, the path of least resistance remains to the downside.

Price Action Summary

DOGE fell from $0.1522 to $0.1477, a 3% drop contained within a narrow $0.0070 session range. Trading volume surged to 830.7M DOGE during the breakdown — 174% above the daily average — confirming strong sell-side pressure. Attempts to rebound toward $0.1483 were quickly absorbed, with repeated 14.4M-volume spikes met by immediate selling. DOGE now consolidates weakly near the bottom of the breakdown zone, leaving bearish momentum firmly intact.