Dogecoin is under pressure as it hovers near the critical $0.150 support, with further declines likely if this level fails to hold.

DOGE broke below $0.152 in a high-volume sell-off that erased last week’s stability, triggered by collapsing ETF inflows and strong selling pressure. Newly launched DOGE ETFs saw demand plummet from $1.8 million to $365,420 — an 80% single-session drop — even as Bitcoin retested $92,000 and other high-beta altcoins rebounded.

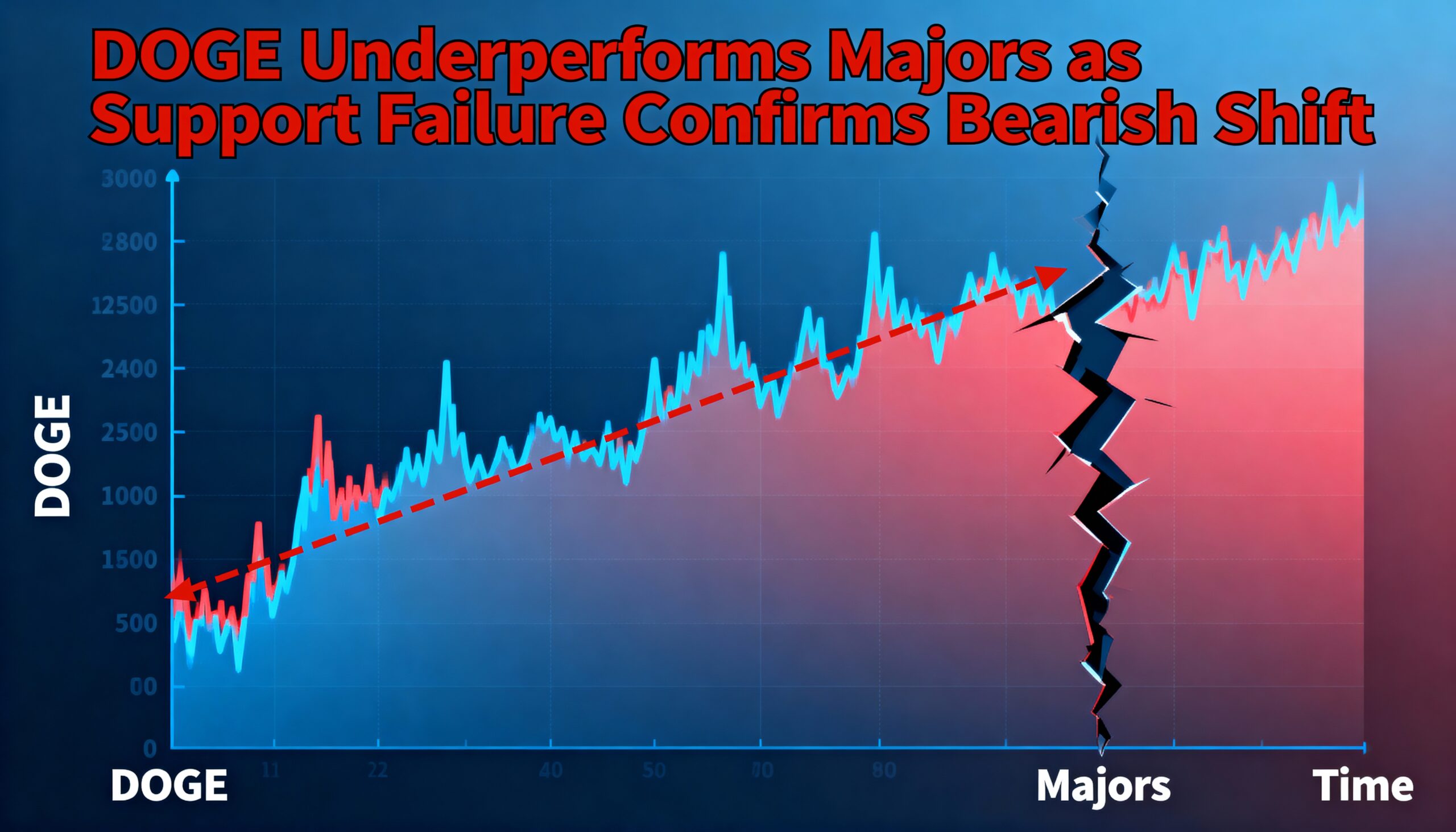

The token underperformed broader markets. While BNB, Solana, and Avalanche posted multi-percent gains, DOGE faced persistent distribution, compounded by weak ETF demand and thinning speculative liquidity, following typical meme coin behavior.

The drop below $0.152 confirmed a shift from consolidation to a clear downtrend. Repeated failures to reclaim $0.155 created lower highs, while volume surged 67% above average, confirming structural weakness. Momentum is decisively bearish, and Fibonacci levels between $0.1495 and $0.1478 mark the next potential support zones.

DOGE briefly stabilized near $0.150 but failed to recover, turning $0.151 into immediate resistance. A decisive move above $0.152 is required to reverse the trend; otherwise, sellers maintain control, with price highly sensitive to liquidity shifts, whale activity, and Bitcoin’s intraday direction.