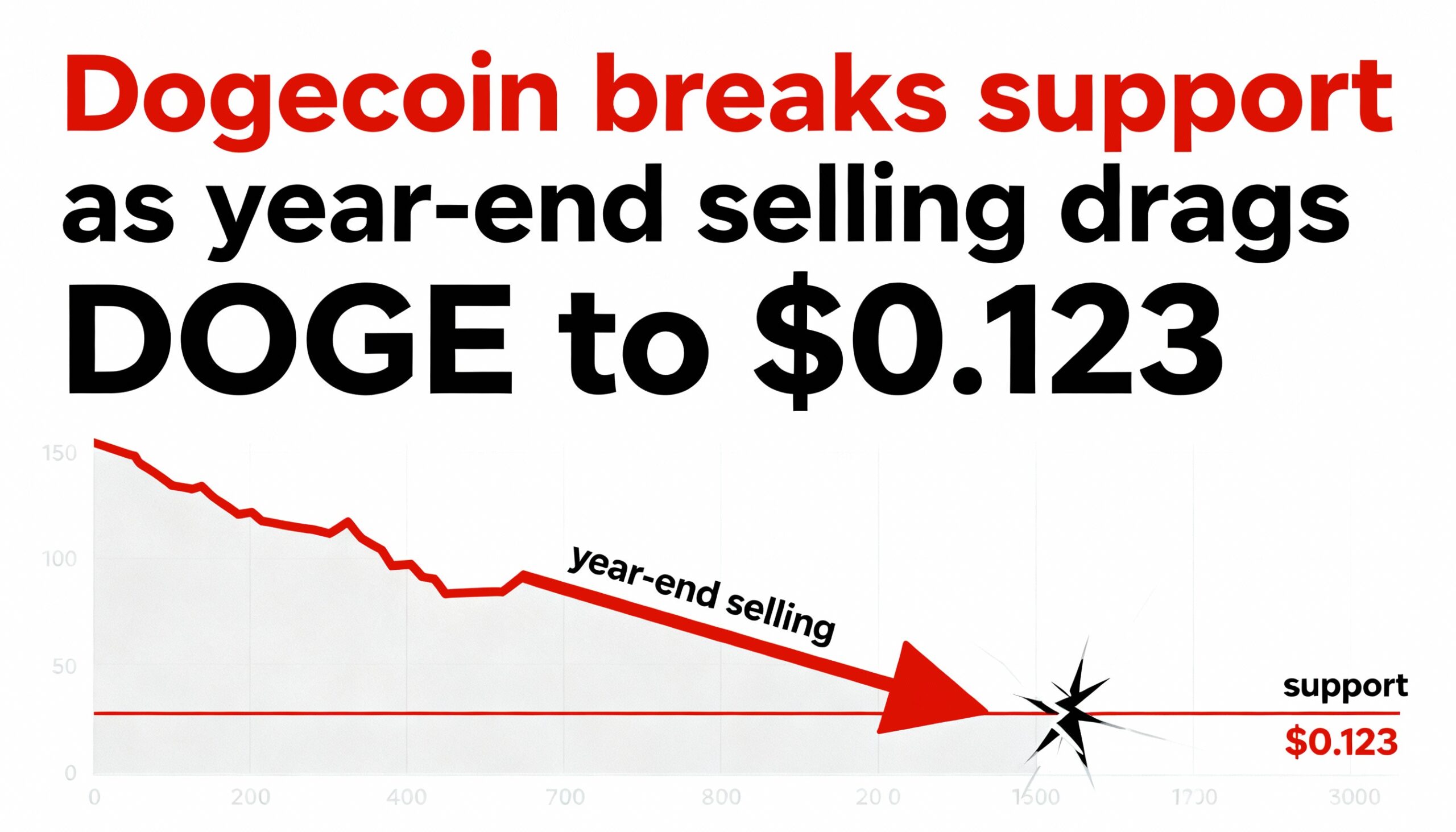

Dogecoin Slides to $0.1226 as Year-End Selling Pushes Token Through Key Support

Dogecoin (DOGE) dropped 3% to $0.1226 as year-end selling pressure drove the token below a critical support zone, keeping it pinned near the lower end of its December downtrend. Open interest in DOGE futures climbed above $1.5 billion, signaling continued trader exposure despite a weakening spot market.

Price Action and Technicals

DOGE broke below $0.1248 during the session’s heaviest trading window, with volume about 157% above average—confirming the decline was driven by active selling rather than thin liquidity. The move extended a broader bearish structure that has dominated December, with sellers using rebounds to reduce exposure and defend lower highs.

The breakdown pushed DOGE into a $0.122–$0.123 demand pocket. Roughly 857 million DOGE traded during the decisive move, consistent with distribution rather than gradual selling. Short-term rebounds toward $0.1270 have struggled, as sellers remain active. DOGE remains trapped in a descending channel with consecutive lower highs. Momentum indicators are stretched, with RSI near 37 signaling oversold conditions, but oversold readings alone have not been enough to reverse the trend.

Market Context

Year-end positioning has weighed on high-beta crypto, with liquidity thinning over the holidays and investors trimming risk. Large holders contributed to selling pressure, distributing roughly 150 million DOGE over the past five days, limiting rally potential.

Meanwhile, derivatives activity remains robust. The rise in open interest above $1.5 billion indicates futures traders are maintaining exposure into 2025, even as spot market conditions turn defensive. This divergence—persistent leverage amid weakening spot structure—supports elevated volatility, especially in a fragile market environment.