Dogecoin Drops to Multi-Month Lows as Exchange Flows Turn Positive

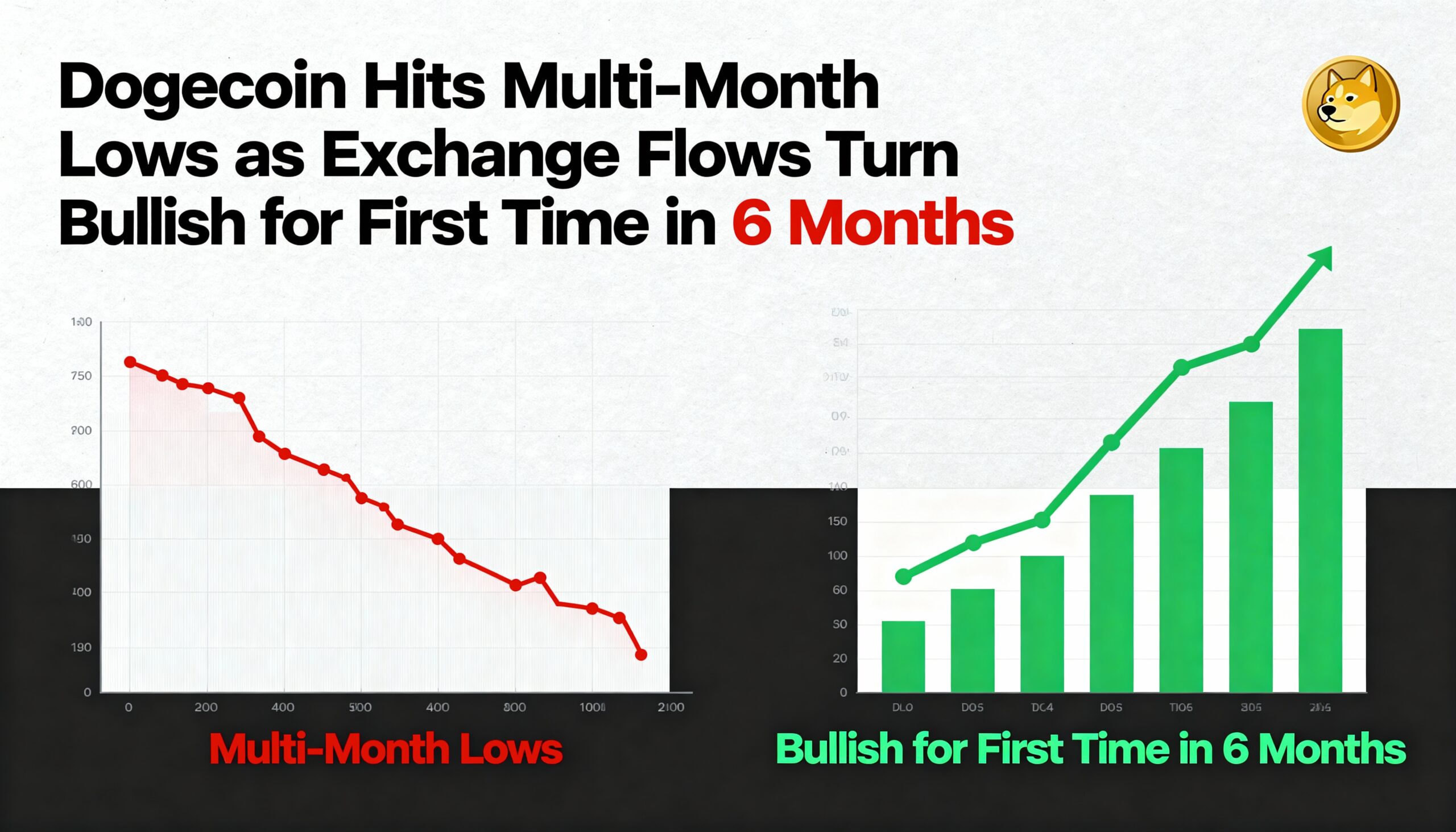

Crypto markets remain under pressure as Bitcoin’s looming “Death Cross” and risk-off sentiment weigh on altcoins. Dogecoin (DOGE), however, showed a notable structural shift: exchange flows turned positive for the first time in months—a pattern historically seen near market bottoms. Analyst Ali Martinez notes that similar inflection points in previous cycles often preceded reversible capitulation phases.

DOGE fell 7.42% over the past 24 hours, sliding from $0.160 to $0.149 and breaking the critical $0.155 support that had held the prior consolidation. Trading volume surged 18.39% above weekly averages to 177.9 million tokens, suggesting institutional participation rather than retail panic.

The decline breached the 0.5 Fibonacci retracement from the previous bull cycle and drove the price into the lower boundary of DOGE’s year-long descending triangle. After testing multiple intraday floors, the token stabilized near $0.149–$0.151. Technical indicators show a mixed picture: RSI formed bullish divergence against fresh lows, while brief MACD death crosses signaled temporary exhaustion in downward momentum.

Key Technical Signals

DOGE now sits at a critical crossroads between confirming the breakdown and potential reversal. The move below $0.155 completes the descending-triangle resolution, suggesting possible continuation toward $0.145–$0.140. Yet several bullish counter-signals are emerging:

- Whale Accumulation: Large wallets absorbed over 4.7 billion DOGE as prices fell, indicating strong hands entering the market.

- Positive Exchange Flows: Net inflows have flipped positive for the first time in months, historically a sign of tradable bottoms.

Momentum indicators reinforce this divergence. RSI continues rising despite lower price lows, and MACD bearish signals are fading, creating a setup where technical breakdown collides with early reversal signs from on-chain data.

Price Outlook

DOGE is likely to remain range-bound between $0.149 support and $0.158 resistance until ETF catalysts or macro sentiment provide a decisive push. Traders are monitoring several key factors:

- Section 8(a) DOGE ETF Deadline (Monday): A surprise approval could trigger immediate repricing.

- Reclaim of $0.155: Necessary to neutralize near-term bearish bias and target $0.162–$0.165.

- Failure at $0.150: Could accelerate a decline toward $0.115–$0.085 demand zones.

- Exchange Flows: Continued positive net inflows would support a reversal thesis.

- Macro Sentiment: Extreme fear across BTC and altcoins may produce sharp relief rallies but also increases breakdown risk.

As DOGE approaches the apex of a multi-year descending triangle, the intersection of ETF catalysts and on-chain accumulation sets up a high-risk, high-reward scenario for directional traders