Hedera’s token HBAR gained modestly in the Sept. 11–12 trading window, edging up from $0.237 to $0.245 before closing at $0.240. The rise was tied to heightened institutional flows after a wave of ETF-related developments brought the network into sharper focus.

Momentum accelerated after Grayscale Investments revealed it is evaluating an HBAR trust, while the Depository Trust & Clearing Corporation (DTCC) logged a Canary HBAR ETF application under the ticker HBR. The move accompanied filings for Solana and XRP, reflecting a broader push from Wall Street firms to diversify digital asset offerings beyond Bitcoin.

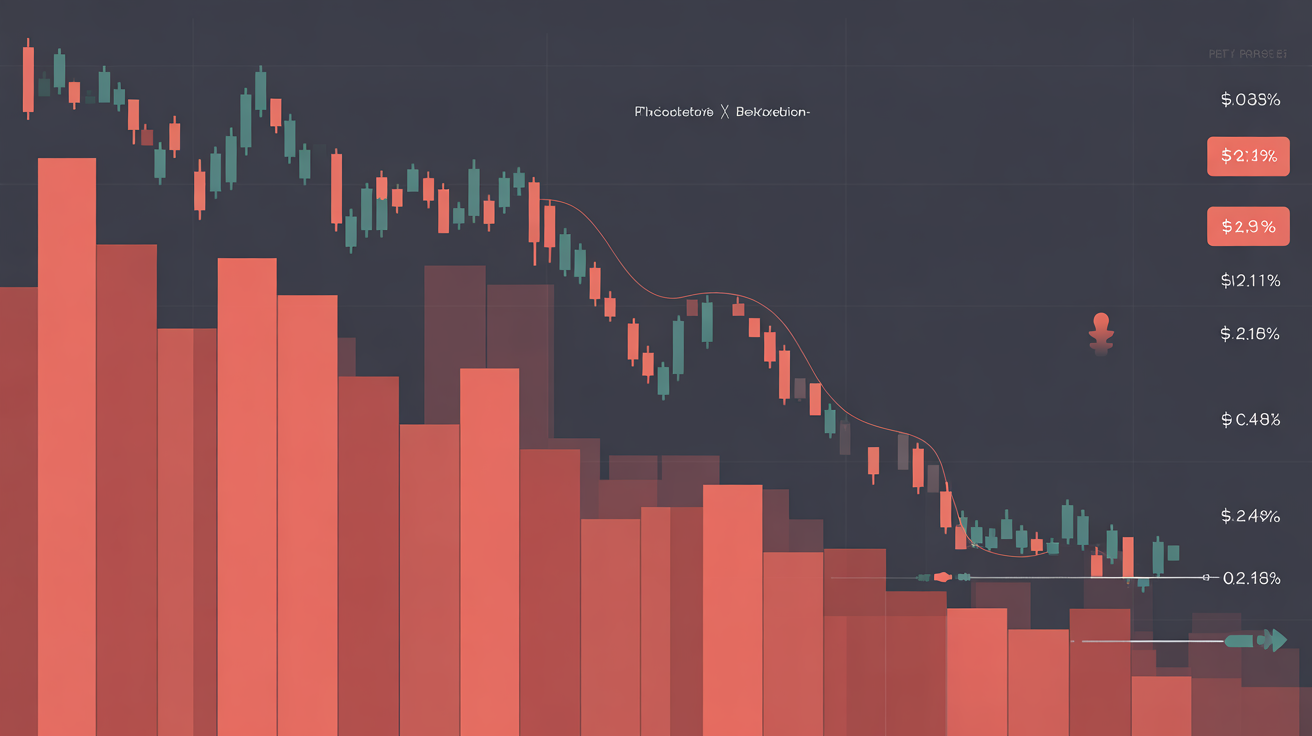

Traders responded swiftly. Resistance at $0.245 prompted selling pressure, while $0.240 proved a strong support level, reinforced by a late-session burst of more than 17 million tokens traded. Analysts said continued demand could see HBAR challenge the $0.25 psychological ceiling in the near term.

But regulatory uncertainty remains the key hurdle. DTCC listings are only administrative entries and do not signify SEC approval. U.S. regulators continue to focus on market manipulation and investor protection in evaluating non-Bitcoin crypto ETFs, leaving the outlook for an HBAR product unsettled.

Market Performance Highlights

- Trading range stretched from $0.2335 to $0.2456, a 4.24% volatility band.

- Strongest rally came overnight, pushing prices from $0.235 to $0.245.

- Breakout activity averaged 54.7M in volume, outpacing the daily mean of 50.1M.

- $0.240 held as institutional support with steady defensive buying.

- Coordinated selling capped advances at $0.245, leading to consolidation.

For now, Hedera’s appearance in ETF filings has positioned HBAR firmly in Wall Street’s line of sight, even as regulatory fog tempers expectations for approval.