Bitcoin Near $90K as Europe Leads November Sell-Off, Markets Eye Fed

Bitcoin (BTC) hovered around $90,400 on Tuesday as crypto markets steadied following one of November’s steepest declines since 2018. Liquidity remained thin ahead of Wednesday’s Federal Reserve announcement, with the broader market holding recent gains.

Over the past 24 hours, BTC rose about 1%, while Ether (ETH) gained 0.2%, according to CoinGecko. Other major altcoins were mixed: BNB climbed nearly 1%, SOL slipped 0.6%, and XRP edged lower.

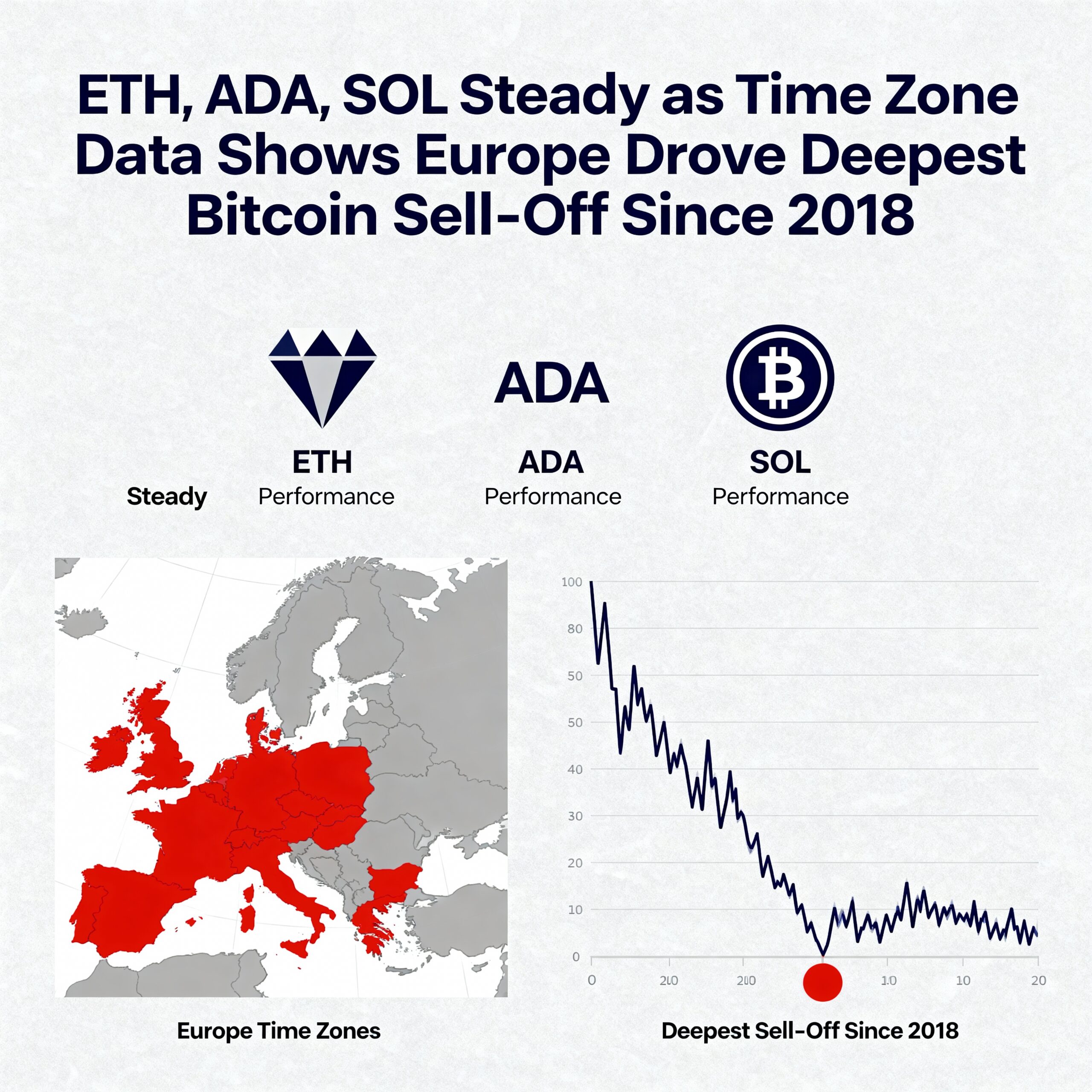

Europe Drives Downturn

Time zone data from Presto Research showed Europe as the main contributor to November’s 20–25% drawdowns in BTC and ETH. European trading sessions turned deeply negative, while Asian and U.S. sessions were largely flat, reflecting diverging regional flows amid crypto de-leveraging.

Institutional Moves

Institutional activity picked up as Strategy disclosed its largest Bitcoin purchase in over three months, acquiring 10,624 BTC for $963 million. Funded mainly via new equity issuance, total holdings now total roughly 660,600 BTC, worth around $60 billion. The company’s shares traded near $180, down about 50% over six months as investors weigh index inclusion risks.

Macro and Sentiment Pressures

Macro conditions remain a key constraint. Asian equities slipped as traders anticipated Fed guidance on rate cuts and easing into 2026. Bond yields stayed elevated, pressuring high-beta assets. Crypto sentiment is fragile: CryptoQuant’s Bull Score fell to zero for the first time since January 2022, with most BTC on-chain indicators turning bearish.

Outlook

Traders are watching whether BTC can climb toward $94,000–$98,000 or if European trading continues to weigh on prices as year-end positioning tightens. Medium-term catalysts, including potential U.S. 401(k) rule changes in early 2026, could expand Bitcoin exposure to trillions in retirement savings.