Asian Equities Tick Higher as Bitcoin Holds $91K Ahead of Fed Meeting

Asian markets opened modestly higher on Monday as investors await a busy week of central bank decisions, including a Federal Reserve meeting where a 25-basis-point rate cut is largely priced in. MSCI’s Asia-Pacific index rose about 0.2%, led by tech shares, while U.S. futures and the dollar drifted lower.

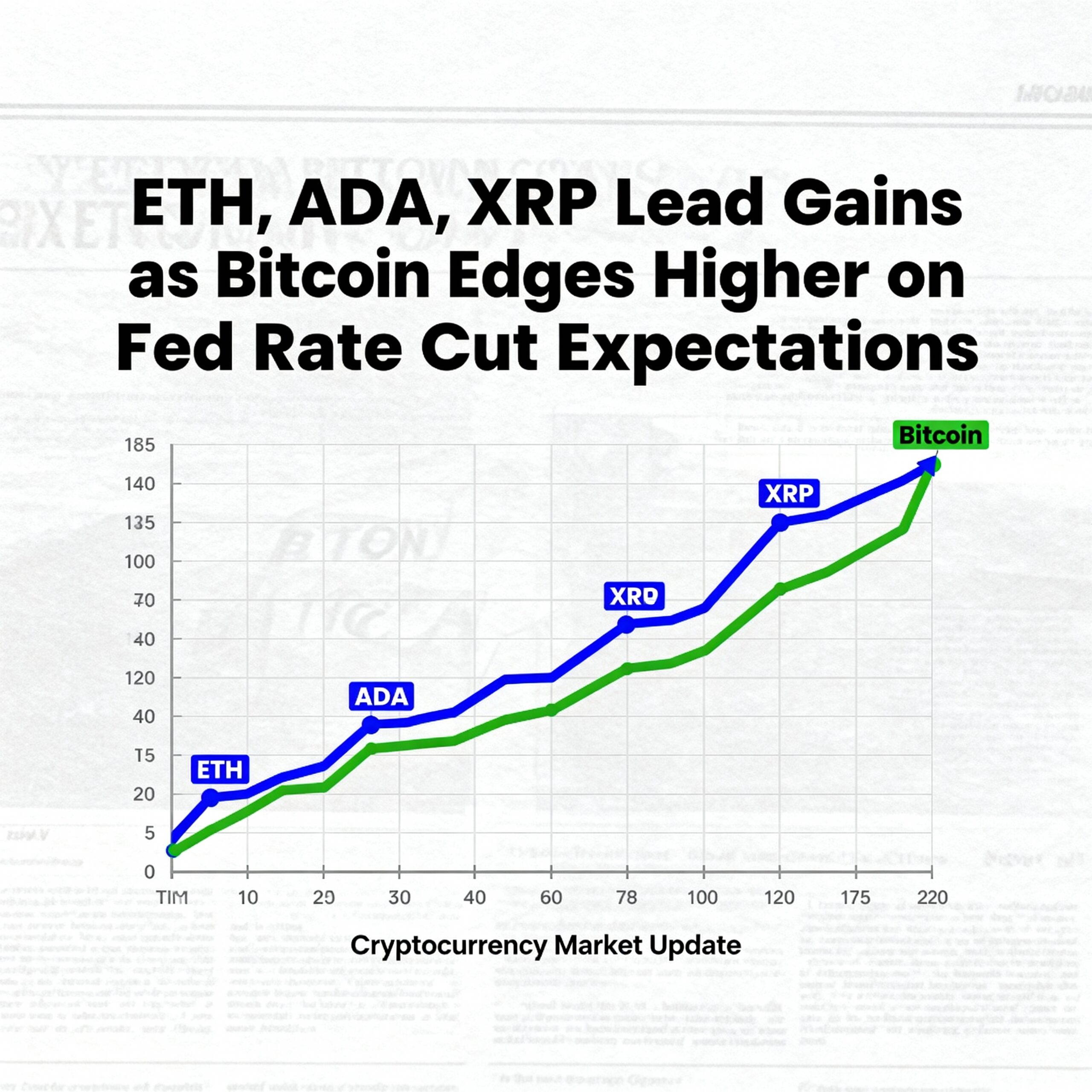

Bitcoin and Crypto Update

Bitcoin held just above $91,300, gaining 2% in the past 24 hours and more than 6% over the week, extending last week’s rebound but facing resistance near $94,000. FxPro analyst Alex Kuptsikevich noted the move aligns with a corrective pattern, with potential to reach $98,000–$100,000 if momentum persists.

Altcoin Moves

- Ether jumped 3% to $3,135, posting a 10.6% weekly gain.

- BNB +1%, Solana +1.6%, stETH +3%, XRP +1.2% to $2.08.

- Cardano lagged, down ~1.4%.

Market Sentiment and Outlook

Despite gains, caution prevails. CryptoQuant’s Bull Score fell to zero for the first time since early 2022, signaling bearish cycle conditions. CEO Ki Young Ju warned that without new liquidity, BTC could drift into $55,000–$70,000 territory next year.

Medium-term catalysts include 401(k) rule changes by 2026 and Ethereum’s Fusaka hard fork upgrades. Traders remain focused on Fed policy and macro conditions, with BTC’s pattern mirroring prior cycle pullbacks in 2013, 2017, and 2021.