Bitcoin and Major Cryptos Retreat as Market Falls Below $3 Trillion

Bitcoin and other leading cryptocurrencies slid on Wednesday, driving the total crypto market capitalization down 1.4% to $2.97 trillion, slipping below the $3 trillion level after another failed rebound attempt.

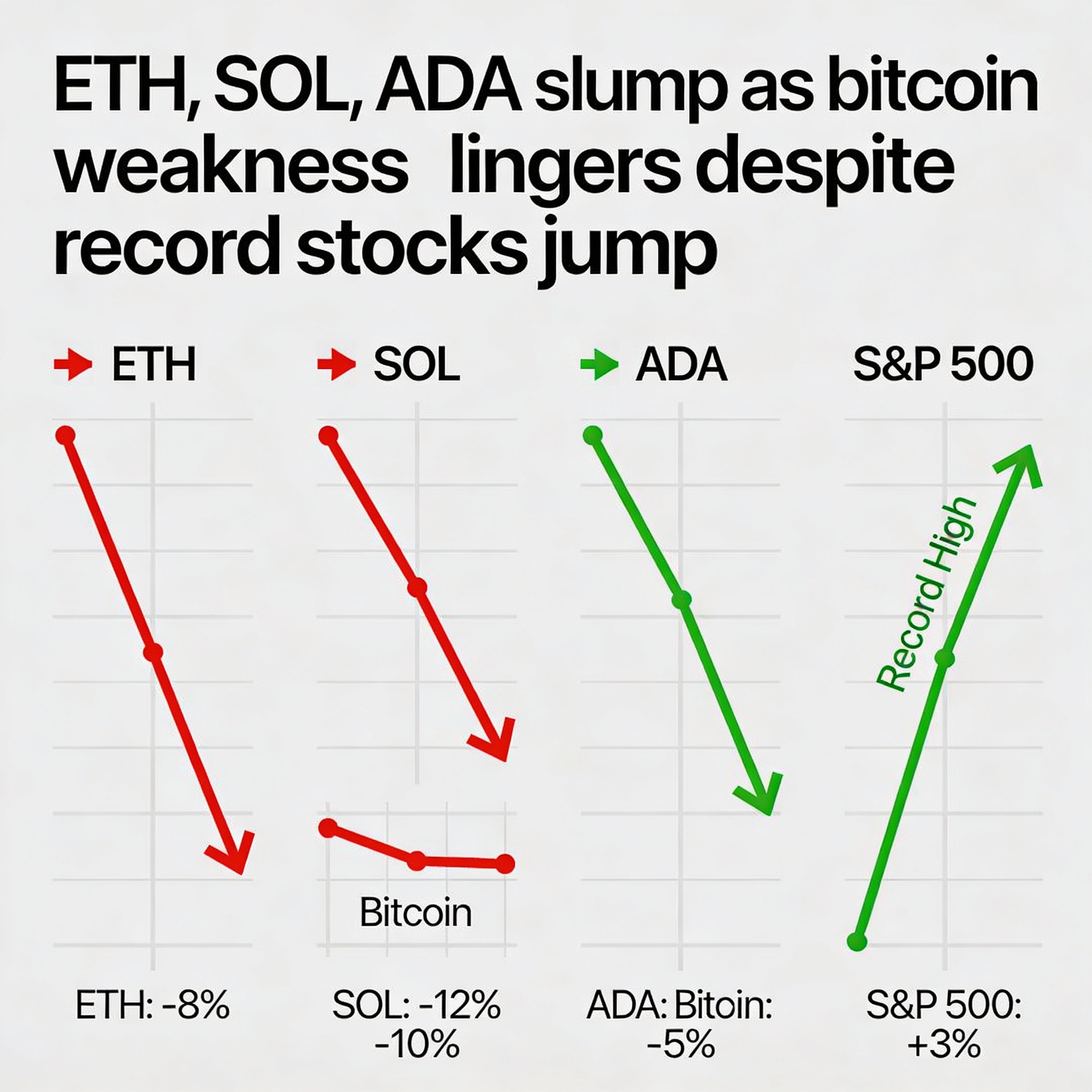

Bitcoin traded near $86,900, unable to sustain a move above $90,000 for the third straight day. Ether fell 1.5% to about $2,927, while XRP, Solana, and Dogecoin posted sharper losses—Solana down nearly 3% and XRP off almost 2%.

The pullback occurred even as stock markets hit record highs, reflecting investors’ preference for safer assets over higher-risk crypto bets. Global equities rose on strong U.S. growth data, with MSCI’s All Country World Index climbing for a fifth consecutive session, extending its year-to-date gain to 21%. Asian markets rose 0.2%, led by tech shares, after the S&P 500 closed at a record on Tuesday.

Trading volumes were light ahead of the Christmas holiday, and European futures signaled a muted open.

Alex Kuptsikevich, chief market analyst at FxPro, noted that repeated crypto rebounds are failing, pointing to growing seller dominance. “The market was unable to repeat the robust rebound from the local bottom, showing increased selling pressure,” he said. He added that larger investors are treating the market as if it is entering a bear phase, favoring cautious selling over retail-driven rallies.

Kuptsikevich also highlighted the broader risk backdrop: Bitcoin sold off after briefly topping $90,000, despite gains in gold and other precious metals and a weaker dollar. “Investors are reassessing risk appetite, and this risk-off sentiment may continue to spread,” he said, forecasting further declines for cryptocurrencies and potential spillover into stocks and emerging-market currencies.

Investor flows support this cautious outlook. CoinShares reported $952 million in outflows from global crypto investment products last week, ending a three-week streak of inflows. Bitcoin products lost $460 million, Ethereum funds shed $555 million, while XRP and Solana saw inflows of $63 million and $49 million, respectively.