Crypto markets remained on the defensive Monday even as U.S. equity futures ticked about 0.25% higher since midnight UTC.

Bitcoin hovered near $68,710, down 0.1%, while several altcoins — including HYPE, ZEC and XMR — slid more than 3%.

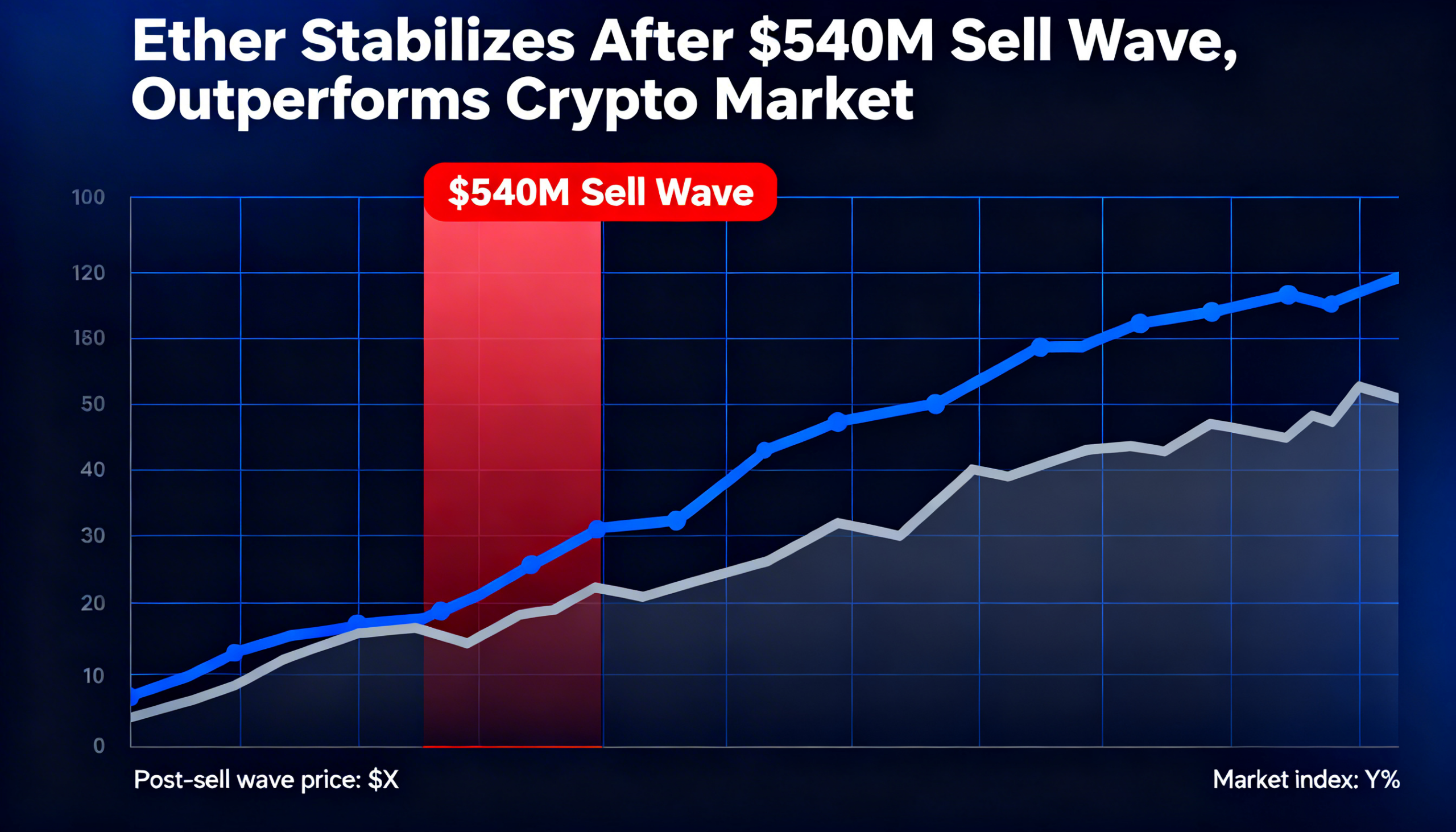

Ethereum stood out, edging up 0.43% to trade just below $2,000 as it recovered from a bruising weekend sell-off. The earlier decline was triggered in part by heavy selling linked to trader Garrett Jin. On-chain data indicates a wallet attributed to Jin moved over $540 million worth of ETH to Binance, driving a spike in exchange-specific sell volume and pushing the token into oversold territory — conditions that paved the way for Monday’s rebound.

Meanwhile, gold changed hands around $5,000, retreating from its Jan. 29 high of $5,600 but still outperforming silver and major cryptocurrencies, which have fallen 36% and 21%, respectively, over the same stretch. U.S. markets were closed for a public holiday.

Derivatives positioning

Futures markets continue to reflect cautious sentiment. Aggregate open interest (OI) across crypto futures dropped to $98 billion, signaling ongoing capital outflows.

OI declined 1% in bitcoin futures and 2.7% in ether futures over the past 24 hours, while contracts tied to XRP, DOGE, SUI and ADA saw steeper drops of 6% or more. In contrast, OI in futures linked to tokenized gold (XAUT) rose 8%, suggesting a tilt toward traditional safe-haven exposure.

Implied volatility has also cooled. BTC and ETH’s 30-day implied volatility has retraced from nearly 100% annualized — reached during the recent price crash — back toward 50%, reflecting a repricing of risk and improving prospects for stabilization. However, the volatility spread between ether and bitcoin is widening, pointing to expectations of larger relative swings in ETH.

Funding rates for several alternative tokens, including XRP, TRX, DOGE and SOL, remain negative, highlighting a bias toward short positioning. If prices hold firm, that setup could fuel a short squeeze.

On the CME, SOL futures trade at near-zero annualized premium, signaling fading buy-side appetite, while BTC and ETH contracts maintain modest premiums.

Options flows show mixed sentiment. On Deribit, a trader spent $3 million on a $75,000-strike bitcoin call option, a sizable bullish wager. Still, put options on BTC and ETH continue to command higher premiums than calls across maturities, underscoring lingering downside hedging demand.

Token performance

Altcoins drifted lower in thin Sunday liquidity before stabilizing slightly Monday morning.

DOGE fell more than 10% over 24 hours but steadied after midnight UTC. XRP gained 1% since midnight, though it remains down roughly 8% from Sunday morning levels.

LayerZero’s ZRO extended its pullback, dropping more than 34% over the past five days, including a 10% slide in the past 24 hours. The decline follows the rollout of its native blockchain in collaboration with Citadel Securities and Depository Trust & Clearing Corporation.

Index performance reflected the divergence. The bitcoin-heavy CoinDesk 5 Index gained 0.38% since midnight UTC, while the altcoin-focused CoinDesk 80 Index slipped 0.17%, highlighting continued relative weakness across the broader altcoin complex.