Ether-focused digital asset treasury companies (DATCOs) have outperformed peers since Nov. 20, supported by rising mNAVs, stronger risk appetite, and staking-driven strategies, according to B. Riley.

Crypto markets have climbed roughly 10% over the same period, with ether-linked DATCOs among the top beneficiaries. B. Riley attributes the gains to renewed investor confidence after European Central Bank (ECB) comments hinted at a gradual shift away from the U.S. dollar as the dominant reserve currency, alongside expectations for interest rate cuts.

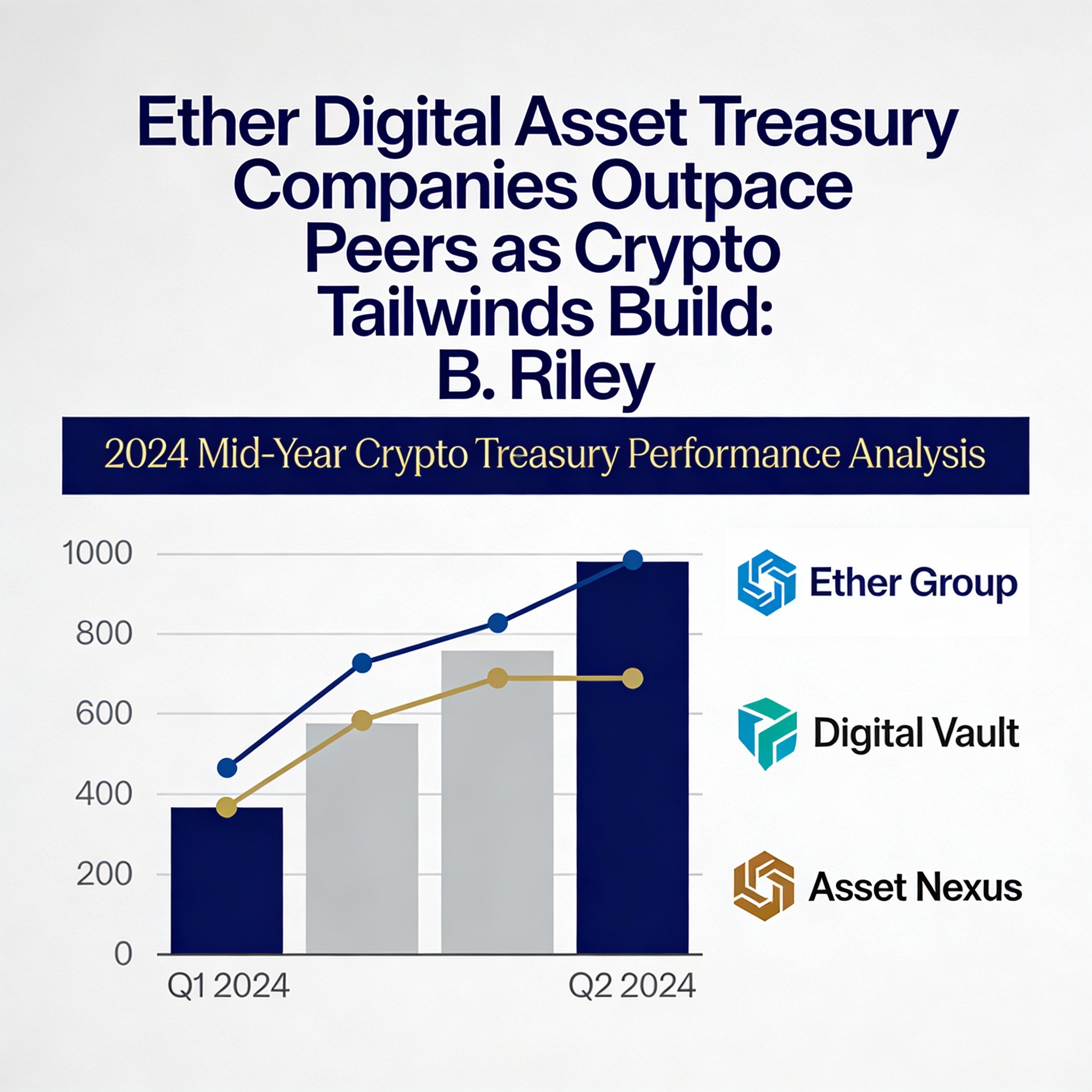

Among 25 tracked DATCOs, median mNAV rose to around 1.0x from 0.9x, with the average following suit. mNAV measures a company’s enterprise value relative to the market value of its crypto holdings. Performance has skewed toward leverage-like exposure to crypto prices. Since Nov. 20, bitcoin treasuries gained ~20%, ether treasuries ~28%, and SOL treasuries ~12%, versus a 7% rise in the Russell 2000, while the underlying tokens gained ~7% each.

B. Riley highlighted BitMine Immersion Technologies (BMNR), rated “buy” with a $47 target after a 51% gain since Nov. 20. SharpLink Gaming (SBET), buy-rated at $19, along with FG Nexus (FGNX), Sequans Communications (SQNS), and Kindly MD (NAKA), were cited as attractive opportunities trading below mNAV.