Major cryptocurrencies remained under strain Thursday, even as equity markets showed signs of improved risk appetite. A firmer U.S. dollar and lingering uncertainty around Federal Reserve policy continued to cap any meaningful recovery in digital assets.

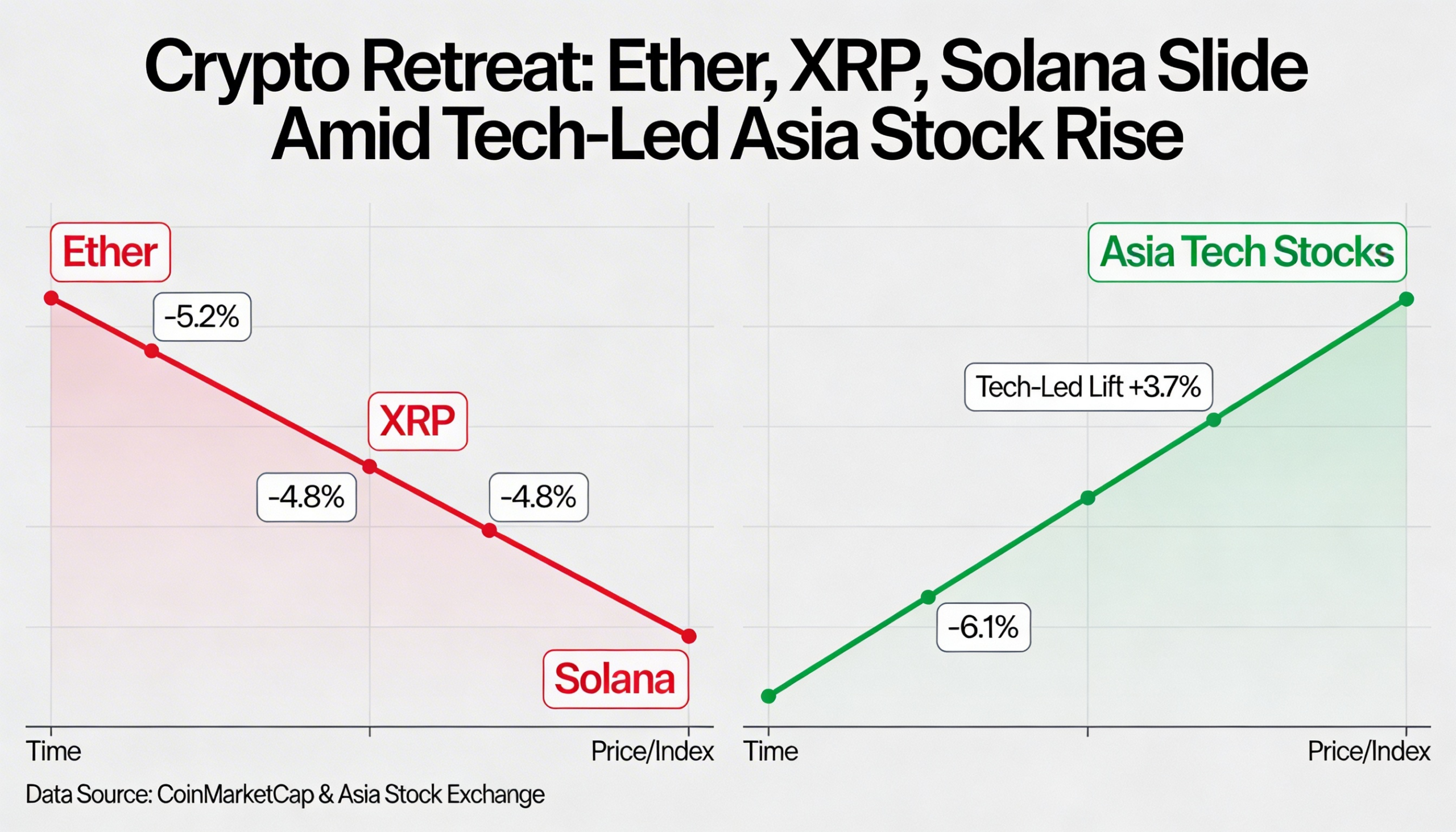

Prices declined across large-cap tokens, with ether, XRP and Solana leading the downside as traders failed to build on this week’s tentative stabilization. Bitcoin hovered near $66,700, down roughly 1.7% over the past 24 hours, according to CoinDesk data. Ether slipped by a similar margin to around $1,965, while XRP dropped close to 5% and Solana shed nearly 4%. BNB and Dogecoin also traded lower, underscoring broad-based weakness rather than any token-specific catalyst.

The downturn in crypto came despite gains in Asian equities during light holiday trading. MSCI’s Asia-Pacific index excluding Japan rose about 0.5%, Japan’s Nikkei advanced roughly 0.85%, and South Korea’s Kospi surged around 3% to a record high.

The equity strength followed a rebound in U.S. technology shares after Nvidia announced a multi-year agreement to supply Meta Platforms with AI chips.

Digital assets, however, failed to share in that optimism. Recent rebounds have been met with persistent selling, with gains fading quickly once momentum cools. While the market is no longer unraveling on every downtick as it did earlier in the quarter, it is also struggling to attract sustained spot demand that could shift the broader tone.

The U.S. dollar strengthened after minutes from the Federal Reserve’s latest meeting indicated policymakers are in no hurry to cut interest rates. Some officials even left the door open to further tightening if inflation proves sticky. A stronger greenback typically tightens global liquidity conditions and pressures risk assets, and crypto’s pullback followed that familiar pattern.

Meanwhile, gold has continued to display relative resilience, quietly absorbing macro uncertainty even as other risk assets churn. The contrast has reignited debate over bitcoin’s claim to “digital gold” status.

Alex Tsepaev, chief strategy officer at B2PRIME Group, told CoinDesk that gold’s steadiness reflects investors gravitating toward the simplest hedge in a market unsettled by geopolitics, monetary policy and Fed uncertainty.

“I believe that gold will continue to be a default haven and will probably attempt to break through the tough $5,000–$5,100 ceiling. That said, once risk appetite returns, ETF flows stabilize, and U.S. regulations stop dragging, Bitcoin may recover considerably more quickly,” he said.

“After all, Bitcoin attracts liquidity faster than gold, partly because it’s still sometimes referred to as a speculative asset.”

Oil prices also held onto recent gains amid ongoing U.S.-Iran tensions, keeping geopolitical risks in focus. For now, crypto remains caught between intermittent relief rallies and a macro backdrop that is not yet supportive enough to turn those bounces into a sustained recovery.