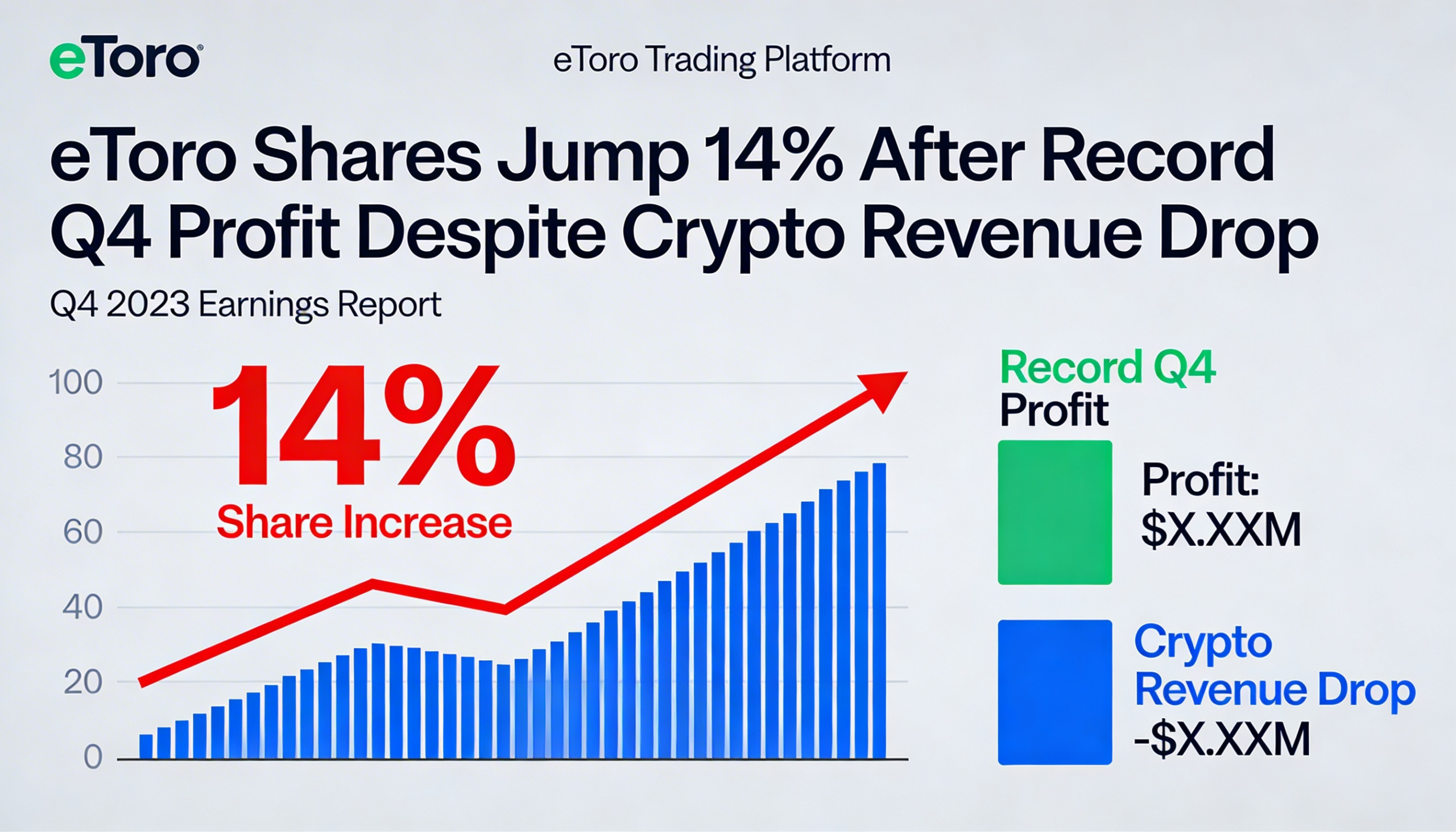

Shares of eToro (ETOR) advanced 14% Tuesday after the multi-asset brokerage posted its strongest quarterly performance of 2025, bucking weakness that has weighed on crypto-focused rivals Robinhood (HOOD) and Coinbase (COIN).

The Israel-headquartered platform reported fourth-quarter revenue of $227 million, up 6% from the prior quarter, and a record net profit of $69 million. Full-year 2025 revenue climbed 10% to $868 million from $788 million a year earlier.

The results contrasted with those of Robinhood and Coinbase, both of which recently delivered underwhelming fourth-quarter figures amid subdued crypto prices and cooling volatility that curbed trading activity.

Although eToro’s crypto-related revenue fell to $3.59 billion in the fourth quarter from $5.8 billion in the same period last year, gains in equities and commodities trading helped offset the decline.

CEO Yoni Assia told analysts that some crypto-centric users have begun reallocating capital toward commodities as volatility shifts across asset classes.

“With crypto volatility moderating, we’re seeing increased interest in assets like gold, silver and other commodities where price swings have picked up,” Assia said.

The platform currently offers more than 100 crypto assets to U.S. investors, but management emphasized its broader positioning as a diversified trading venue. Assia said eToro’s blend of crypto-native infrastructure and global equities access positions it well as financial markets gradually move on-chain.

Despite the robust fourth-quarter performance, early indicators in 2026 suggest activity has softened. January trading volume totaled 4 million trades, with crypto trades down 50% year over year. The average amount invested per trade declined 34% to $182 compared with January 2025.

Still, eToro’s exposure to multiple asset classes appears to have cushioned the impact of the ongoing slowdown in digital asset markets.