Strategy (MSTR) has suffered a sharp sell-off alongside Bitcoin, marking one of the company’s most severe drawdowns since adopting its bitcoin treasury strategy in 2020.

A Year After the High

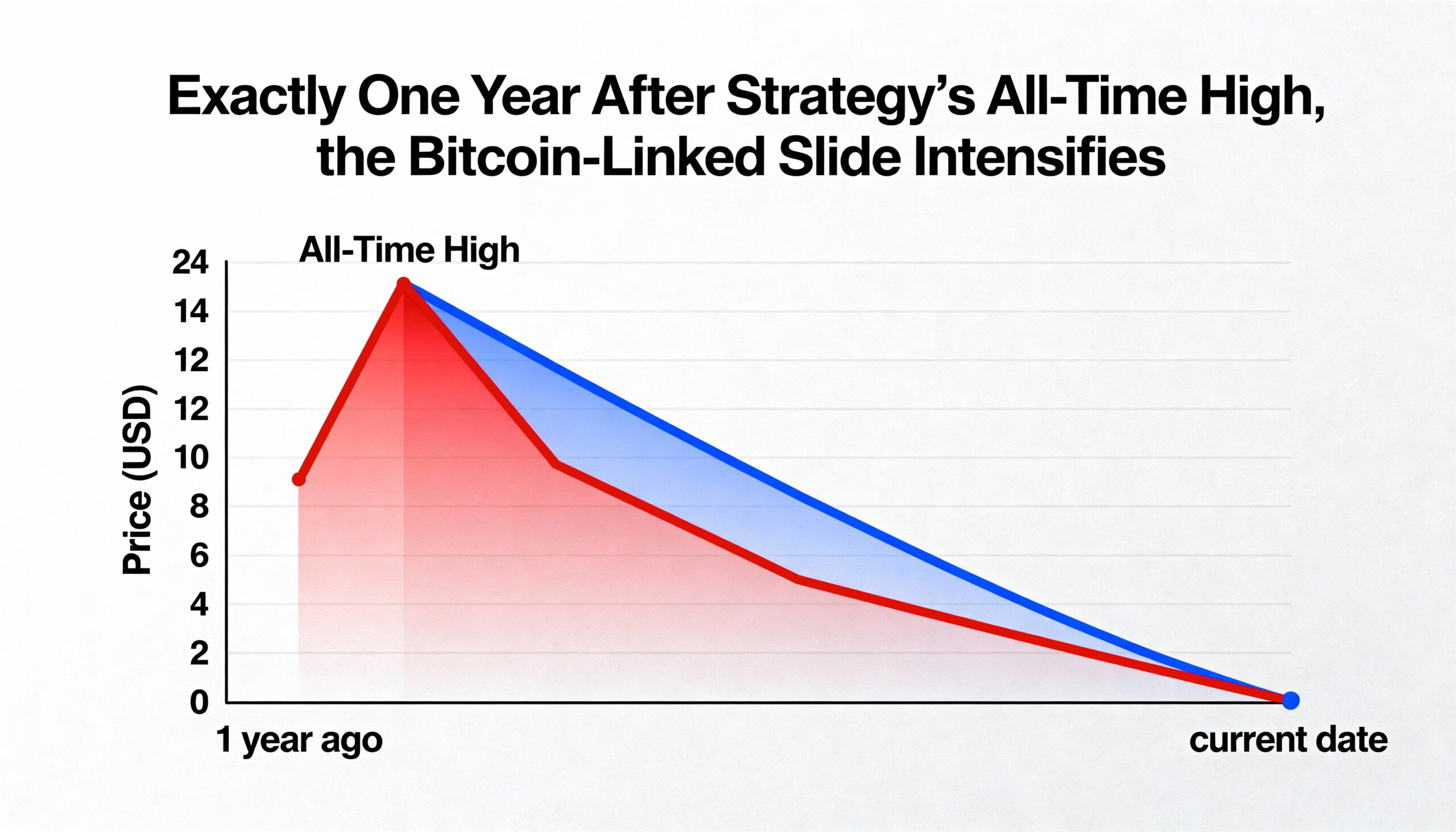

One year ago, Strategy reached an all-time high as Bitcoin approached $100,000. The software company had established itself as a pioneer in holding bitcoin (BTC $87,033.52) as a corporate treasury asset, creating strong investor enthusiasm.

Current Weakness

Today, Strategy trades 68% below its $543 peak, originally set days after President Donald Trump’s election victory. Bitcoin has fallen to $83,142, its lowest level since April, dipping as low as $81,385 on Coinbase on Friday. Strategy’s average purchase price of roughly $74,430 remains a critical level to watch.

Bitcoin’s slide from its October record of $126,000 has amplified Strategy’s decline. The stock has broken below key moving averages and technical supports, making this drawdown the second-largest since the company implemented its bitcoin treasury program in April 2020.

Past drawdowns provide context: a 69% drop between February and May 2021 occurred as Bitcoin fell from ~$60,000 to $30,000, while the largest drawdown followed Bitcoin’s $69,000 peak in November 2021, resulting in an 84% sell-off that bottomed in June 2022. Since August 2020, Strategy has endured multiple declines exceeding 50%.

Market Impact

JPMorgan analysts note that major indices like MSCI USA and Nasdaq 100 could exclude Strategy, potentially triggering $2.8 billion in outflows from MSCI alone. Passive investments, including ETFs, account for approximately $9 billion of Strategy’s market capitalization, highlighting the potential impact on the stock.

Valuation

Despite the sharp declines, Strategy trades at 1.23 times net asset value (mNAV), reflecting the enterprise value relative to its bitcoin holdings. During the 2022 bear market, the stock often traded below mNAV, offering a discount to its underlying cryptocurrency assets.