The Japanese yen continued its steep slide, trading at 157.20 per U.S. dollar—a substantial move for a major currency—raising expectations that the Bank of Japan (BOJ) may step in to slow the decline.

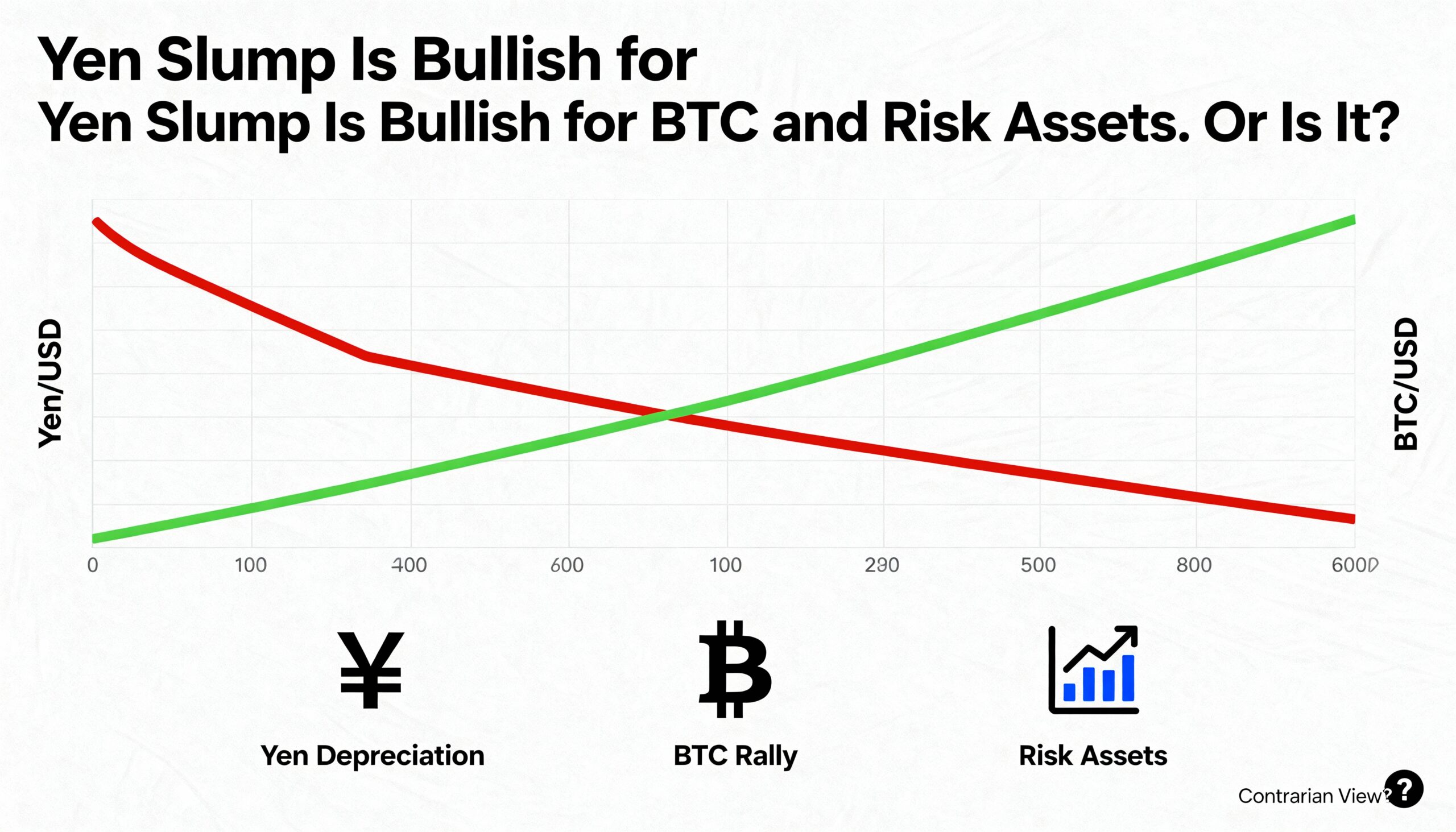

The reason this FX weakness matters is its historical connection to global risk appetite. For decades, investors have borrowed yen at Japan’s ultra-low interest rates and converted it into higher-yielding currencies such as the U.S. dollar, using the spread to fund carry trades. This dynamic typically pressures the yen and amplifies risk-on flows. A depreciating yen makes these trades even more lucrative, since fewer dollars are required to repay yen-denominated loans.

By contrast, periods of yen strength have often accompanied broad market stress. During the August 2024 downturn, for example, bitcoin plunged from about $65,000 to $50,000 in just one week as the BOJ raised rates for the first time in ten years, pushing the yen higher and choking off carry trades.

Given that the BOJ’s policy rate remains at 0.5%—far below the U.S. rate of 4.75%—it might seem reasonable to assume that renewed yen weakness should once again fuel risk-taking across assets, including BTC and altcoins. Indeed, Japanese retail investors have reportedly been seeking yield abroad, even in the volatile Turkish lira.

However, Japan’s macro backdrop has shifted in ways that complicate this familiar playbook. The country faces significant fiscal strain, and its environment is no longer as stable as when the yen reliably served as both a carry currency and safe-haven asset. That undermines the prospect of a broad revival in yen-funded risk-on trades.

Fiscal Pressures Are Driving Yen Volatility

Japan’s debt burden—roughly 240% of GDP, among the highest in the world—has become a growing concern amid post-pandemic inflation and the new prime minister’s commitment to aggressive fiscal expansion. On Friday, the government approved a ¥21.3 trillion ($135 billion) stimulus package, adding to borrowing needs and pushing long-term yields higher.

Market pressures have already forced Japanese government bond yields upward. After spending nearly six years near or below zero, the 10-year yield has climbed to 1.84%, its highest level since 2008. The 20- and 30-year yields are also at multi-decade highs, even as the yen continues to weaken—a sharp break from the traditional positive correlation between yields and currency strength. Fiscal concerns are now overwhelming historical relationships.

Japan faces a difficult dilemma: allowing yields to rise risks igniting a fiscal crisis, but capping them could accelerate yen depreciation and worsen inflation. As Brookings Institution economist Robin Brooks summarized: “If Japan stabilizes the yen by allowing yields to rise, there’s a fiscal crisis. If it keeps rates low, the yen goes back into a devaluation spiral. Too much debt is a killer.”

This precarious balance makes the yen more volatile and less reliable as a funding currency or safe haven than in previous cycles.

The Swiss Franc Is Emerging as a New Risk Gauge

Some analysts say traders may need to look elsewhere for carry-trade signals. According to Marc Chandler, chief market strategist at Bannockburn Global Forex, the Swiss franc (CHF) is increasingly filling that role. With Switzerland’s benchmark interest rate at 0% and its 10-year government bond yielding just 0.09%—the lowest among developed economies—the franc offers a fresh carry-trade alternative to the yen.

For crypto markets, this shift may be meaningful. Instead of looking to the yen for risk-on/risk-off cues, BTC traders may find CHF pairs provide a clearer macro signal going forward.