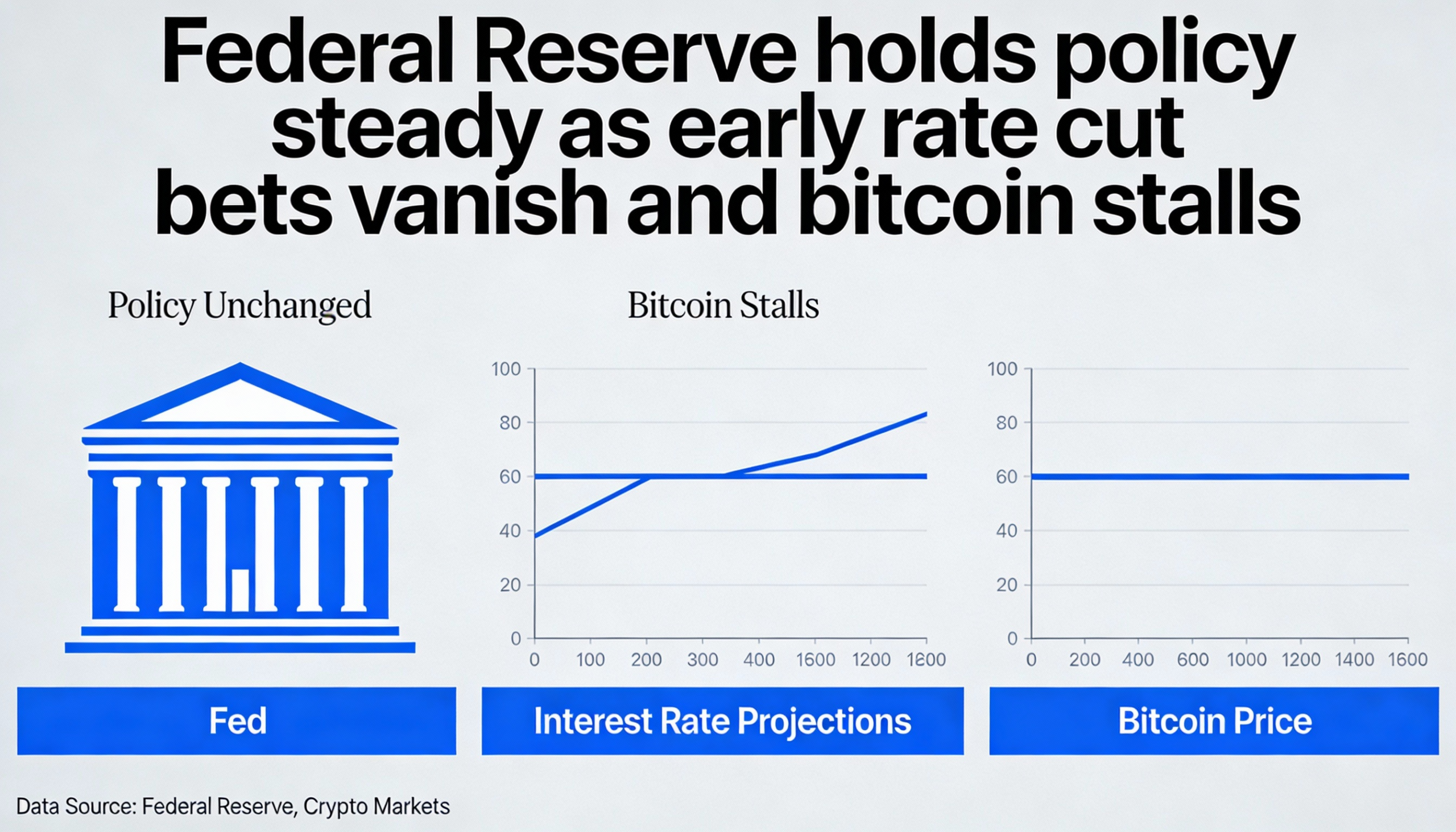

The Federal Reserve’s January policy decision underscored a sharp shift in rate expectations, helping explain the recent weakness across crypto markets.

The Fed held its benchmark interest rate steady on Wednesday, capping a reversal in market pricing that had previously pointed to an early 2026 rate cut.

“Job gains have remained low, and the unemployment rate has shown some signs of stabilization,” the central bank said in its policy statement. “Inflation remains somewhat elevated.”

The decision was not unanimous. Two policymakers—Stephen Miran, a recent Trump appointee, and Chris Waller, who has been mentioned as a potential successor to Chair Jerome Powell—dissented, favoring a 25-basis-point rate cut.

Markets reacted calmly to the expected outcome. Bitcoin hovered just below $89,500, while U.S. equities were little changed. The U.S. dollar rebounded sharply following a steep decline the previous day, and gold extended its rally, climbing 3.7% to near record highs around $5,300 per ounce.

The contrast with expectations just weeks ago was stark. As recently as two months ago, prediction markets placed the odds of a January rate cut above 40%. Those expectations faded through late November, and by the time of Wednesday’s meeting, markets were pricing a hold with nearly 99% certainty, reinforcing the view that the Fed will keep policy restrictive through at least the first quarter.

While the January decision shuts the door on near-term easing, it has not eliminated expectations for rate cuts later in the year. Markets see just a 16% chance of a cut at the Fed’s March meeting, according to CME FedWatch, with odds rising to roughly 30% by April.

“The Federal Reserve’s decision to hold rates reflects lingering inflation pressures and a stabilizing economic backdrop,” said Nick Ruck, director of LVRG Research, in a Telegram message. “That combination could drive near-term volatility in crypto markets as liquidity conditions remain constrained.”

Ruck added that a cautious, “higher-for-longer” tone from Powell—or signals of fewer cuts in 2026—could put short-term pressure on risk assets, including bitcoin.

Investors will now turn their attention to Powell’s post-meeting press conference at 2:30 p.m. ET for further insight into the Fed’s policy outlook.