Crypto Market Analysis: November 15, 2024

This article originally appeared in First Mover, CoinDesk’s daily newsletter, providing in-depth analysis of the latest market trends. Subscribe for daily updates straight to your inbox.

Latest Prices:

- CoinDesk 20 Index: 2,691.86 (+0.76%)

- Bitcoin (BTC): $90,386.53 (-1.21%)

- Ether (ETH): $3,107.30 (-2.48%)

- S&P 500: 5,949.17 (-0.6%)

- Gold: $2,568.54 (+0.01%)

- Nikkei 225: 38,642.91 (+0.28%)

Market Overview:

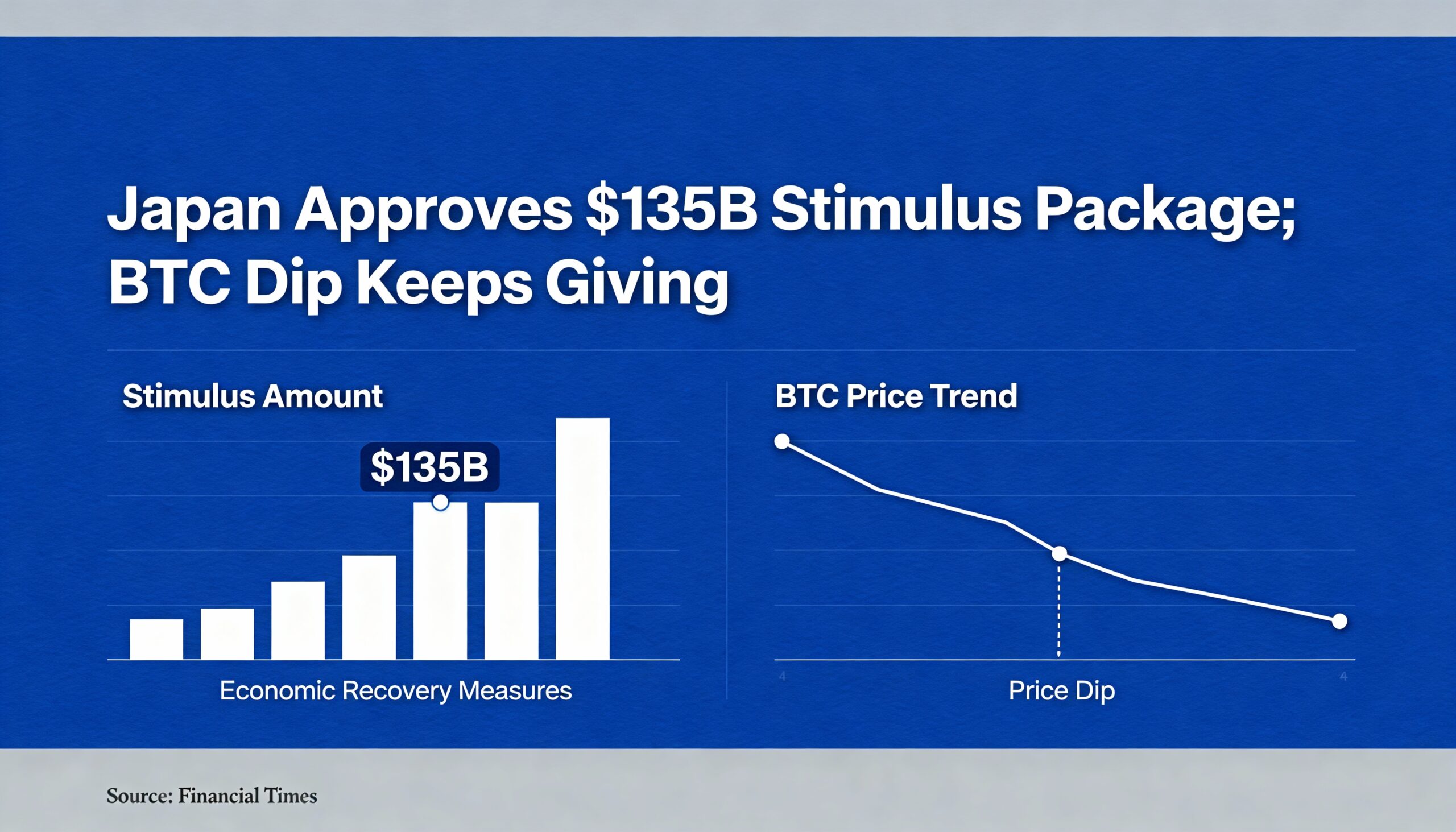

Bitcoin (BTC) has seen a slight retracement after reaching a record high earlier this week, now trading just above $90,000. Over the past 24 hours, Bitcoin is down 1.21%, signaling a period of profit-taking by traders following its surge past $93,000. The market’s decline was prompted by comments from Federal Reserve Chairman Jerome Powell, who indicated that the economy doesn’t show signs of requiring immediate rate cuts. As a result, the probability of a 25 basis-point reduction at the December Federal Open Market Committee (FOMC) meeting has decreased to 66%, down from the previous day’s 83%. However, despite the correction in Bitcoin’s price, the broader crypto market, as measured by the CoinDesk 20 Index, remains in positive territory, up 0.76%.

On Thursday, Bitcoin exchange-traded funds (ETFs) saw a notable $400 million in net outflows, marking the third-largest loss since their inception. Fidelity’s FBTC was hit hardest, with $179.2 million in outflows, followed by Bitwise’s BITB at $113.9 million. Ark’s ARKB saw a drop of $161.7 million, and Grayscale’s products experienced $74.9 million in combined outflows. ETF withdrawals are often seen as a sign of investors cashing out after periods of strong price appreciation. However, BlackRock’s IBIT ETF defied this trend, attracting $126.5 million in inflows, continuing the positive momentum observed since November 7. Historically, significant ETF outflows have often signaled a bottoming out of prices, as was the case on May 1 and November 4, both of which preceded a recovery in Bitcoin’s price.

In contrast, XRP has been the standout performer in the crypto space, surging 17% in the past 24 hours. XRP’s rally is attributed to favorable shifts in U.S. regulatory conditions, with 18 states filing a lawsuit against the SEC, accusing the agency of unconstitutional overreach in the crypto sector. This sparked a speculative rally, pushing XRP above 82 cents, marking a 50% gain over the past seven days. XRP’s strong performance has been further fueled by speculation that a potential second Trump administration might be more favorable toward crypto, which could benefit U.S.-based projects like Ripple Labs and Uniswap.

Chart of the Day:

- BTC Technical Outlook: Bitcoin has recently bounced off its 100-hour simple moving average (SMA) and is showing a bullish crossover in the hourly MACD histogram, indicating potential upward momentum.

- Bullish Scenario: If Bitcoin breaks above the current resistance, it could target new highs, potentially surpassing the $94,000 mark.

- Bearish Scenario: A failure to maintain support at the 100-hour SMA could see Bitcoin dip toward the 200-hour SMA around $82,600.

Source: TradingView