Strategy Stock Plunges on Capital Raise, Then Stages Dramatic Rebound

Strategy (MSTR) endured a turbulent trading session Monday after announcing it had raised $1.44 billion through common stock sales — a move designed to fund nearly two years of preferred dividend payments. The news, combined with an overnight plunge in bitcoin, sent the stock tumbling 12.5% to its lowest level in almost 15 months during early U.S. hours.

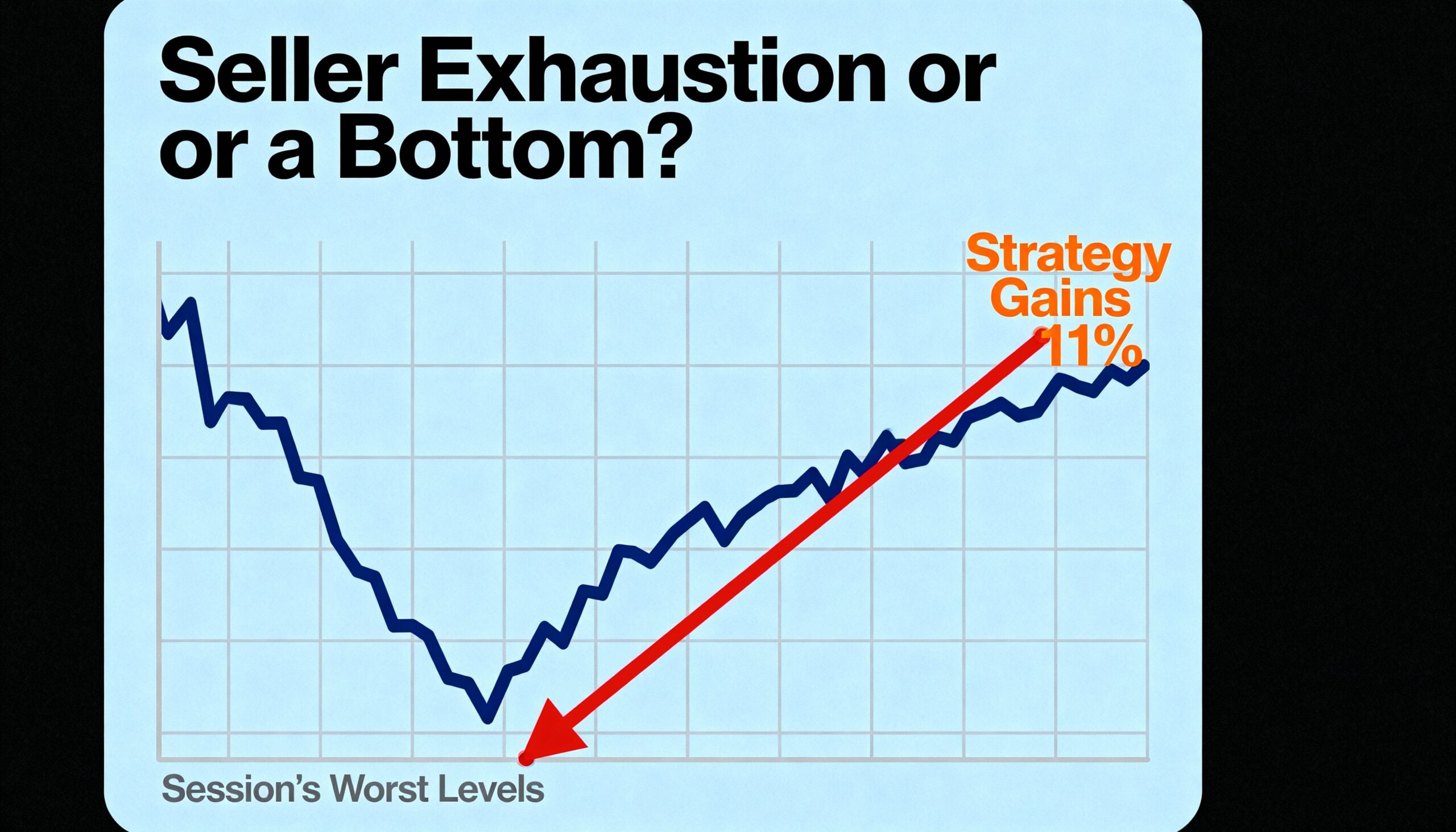

Despite bitcoin hovering near its intraday floor of roughly $85,000 for the entire session, Strategy mounted a striking recovery. By the close, shares had erased the bulk of their losses to end down just 3.25%, a reversal that appears driven primarily by aggressive short-covering. At its session low of $155.61, MSTR was down nearly 40% over the past month and 66% from its mid-July 2025 peak — levels that would leave remaining shorts with little justification for staying in the trade.

Facing persistent concerns about its ability to fund preferred share dividends, Michael Saylor’s team revealed that the company had been selling common stock over recent weeks to build a $1.44 billion reserve. The goal is to secure 21 months of dividend payments, with a longer-term plan to extend coverage to at least 24 months. With bitcoin sliding and Strategy’s valuation falling relative to its roughly 650,000 BTC holdings, the firm appeared determined to avoid dipping into its bitcoin treasury.

Common shareholders reacted swiftly to the potential dilution. The stock initially fell sharply before the afternoon rebound.

The development also drew predictable criticism from gold advocate and bitcoin skeptic Peter Schiff, who used the news to renew his attacks.

“Strategy’s new model is to sell stock, buy 4% Treasuries, and use the yield to pay obligations costing 8%–10%,” Schiff argued. “How long will investors pretend this is sustainable just to gamble on Bitcoin?”

He escalated further: “This is the beginning of the end for Strategy. Saylor had to sell stock not to buy Bitcoin, but to raise dollars simply to meet interest and dividend payments. The business is broken. The model is a fraud, and Saylor is the biggest con man on Wall Street.”

Whether Monday’s sharp reversal signals a durable bottom for the stock remains unclear. But bitcoin and Strategy bulls may find some comfort in the history: Schiff has sounded the alarm during many past downturns — moments that often preceded powerful recoveries in the months that followed.