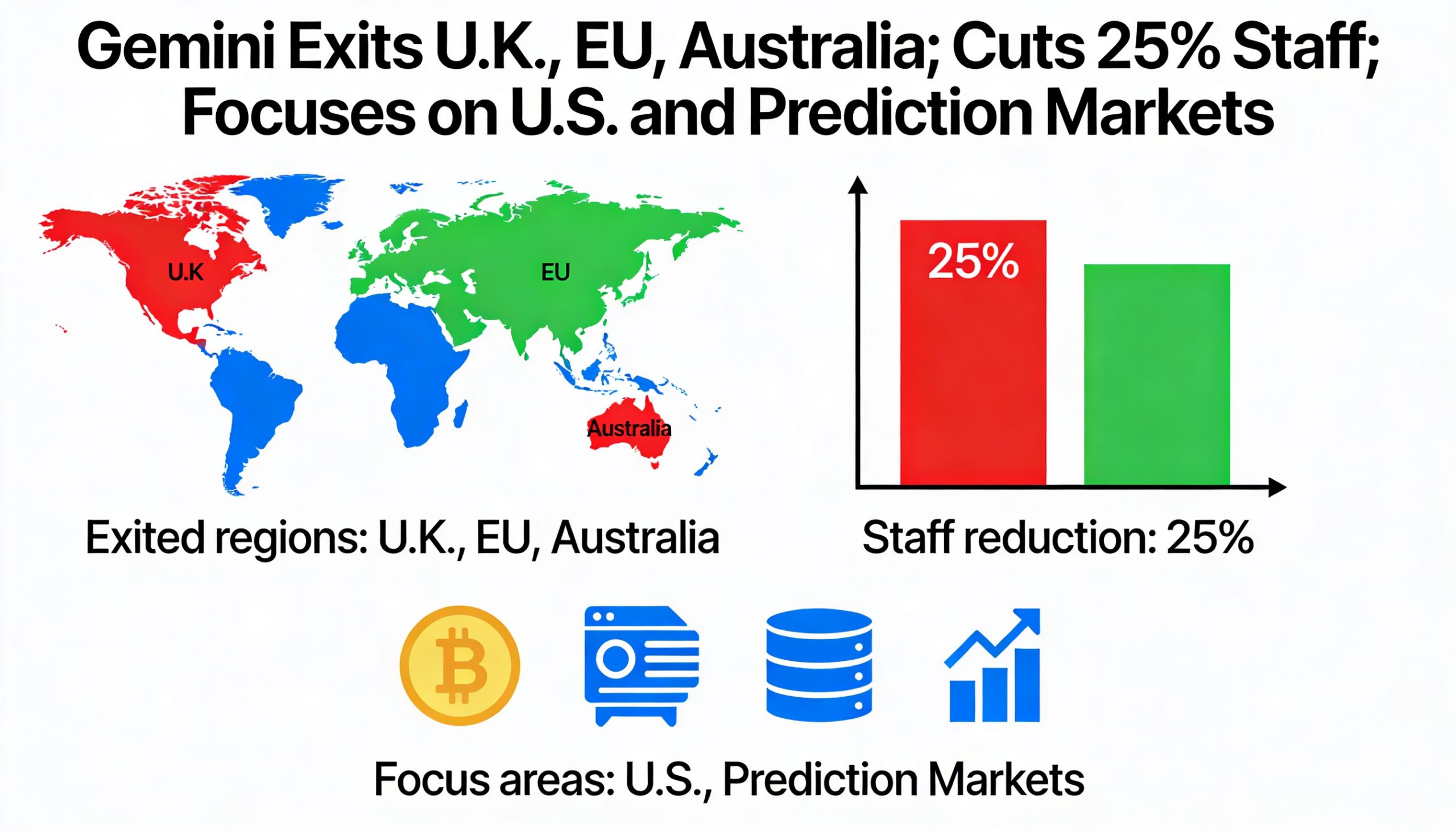

Gemini Space Station Inc. (GEMI) is exiting the U.K., European Union, and Australian markets while cutting its workforce by 25% to focus on U.S. operations and prediction markets.

In a blog post Thursday, the New York-based crypto exchange outlined its offboarding plan, instructing affected customers to sign up with brokerage platform eToro by the end of March to facilitate withdrawals. New accounts and deposits in these regions have been suspended, and full account closures are scheduled for April.

“Effective 6 April 2026, Gemini will be ceasing operations in the United Kingdom,” the company said in an email to customers reviewed by CoinDesk. Accounts in these regions will enter withdrawal mode starting 5 March 2026. Gemini is partnering with eToro to assist users in transferring their assets.

The decision reflects challenges in gaining traction outside the U.S., according to Gemini co-founders Tyler and Cameron Winklevoss. “America has the world’s greatest capital markets and has always been where it’s at for Gemini,” they said. “It’s time for Gemini to focus and double down on America.”

The Winklevosses also highlighted the firm’s push into prediction markets, citing the sector’s growth potential relative to traditional capital markets. Gemini Predictions, which launched in mid-December, has already attracted over 10,000 users trading more than $24 million. The founders view securing a license for a dedicated prediction marketplace as an opportunity to establish an early foothold in the space.

The move comes amid broader weakness in crypto equities. Despite gains in major stock indices in early 2026, leading digital-asset–linked equities have slid, reflecting lower investor appetite and tighter liquidity. Gemini, which went public in September, has seen its shares fall roughly 23% since the start of 2025, with a 2.8% decline recorded Thursday.