Bitcoin Rally Fueled by ETF Inflows and On-Chain Accumulation, Glassnode Says

Bitcoin’s recent surge to nearly $126,000 has been driven by strong institutional ETF demand and steady accumulation from mid-tier holders, according to Glassnode’s latest “The Week On-chain” report. The cryptocurrency has since consolidated near $122,500.

ETF Inflows Drive Momentum

U.S. spot bitcoin ETFs received $2.2 billion in inflows this week, marking one of the largest waves of institutional buying since April. These inflows absorbed exchange supply and helped stabilize prices. Historically, the fourth quarter is a favorable period for bitcoin, as professional investors often shift into higher-risk assets.

Mid-Tier Holders Lead Accumulation

Glassnode data show wallets holding 10–1,000 BTC were the primary buyers, steadily increasing balances while larger whales took moderate profits. About 97% of circulating BTC is now in profit, a level often seen in late-stage bull cycles but without signs of market exhaustion. Key on-chain support lies between $117,000–$120,000.

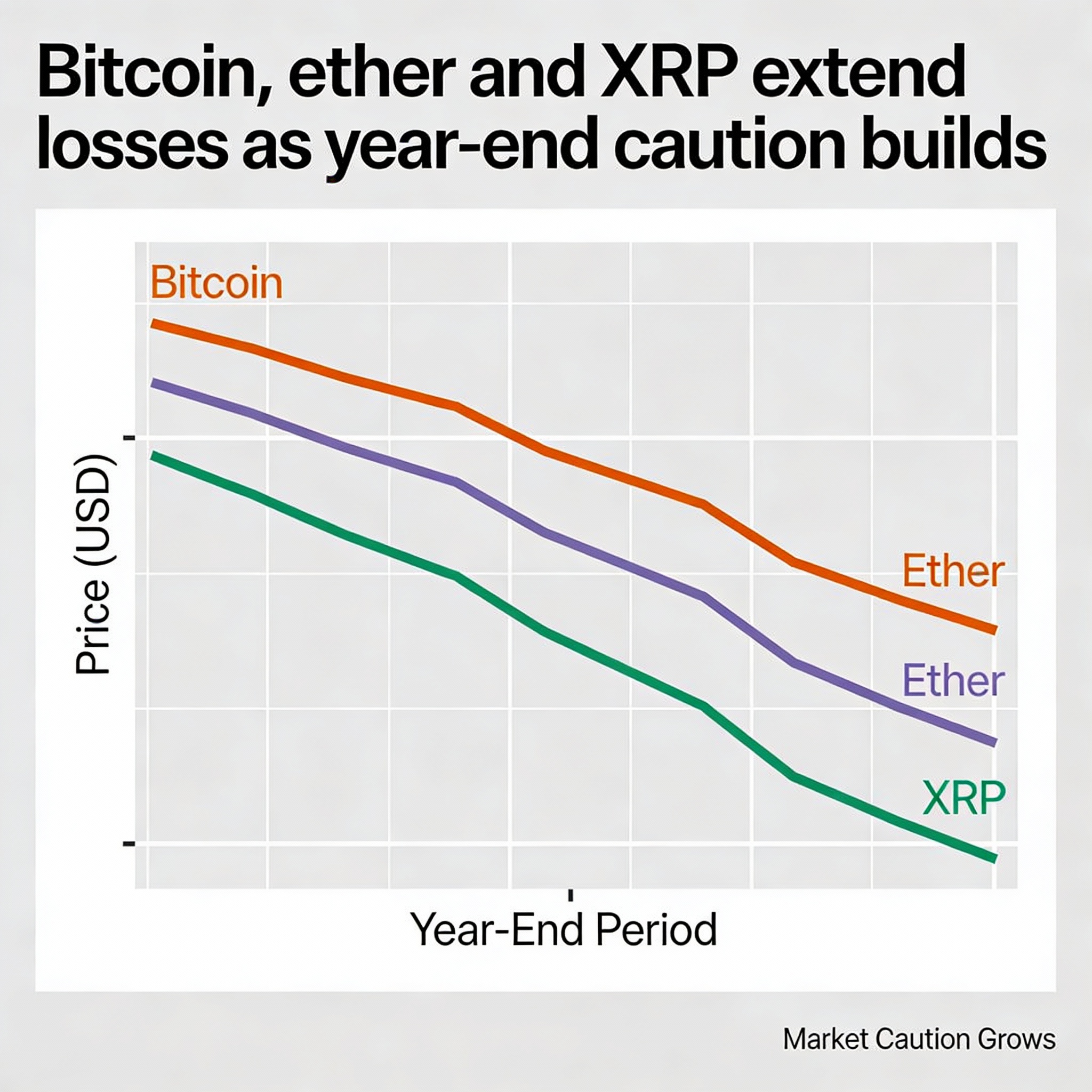

Leverage and Market Caution

Futures open interest and funding rates have climbed sharply, with annualized funding exceeding 8%, signaling higher leverage risk. Despite this, realized profits remain controlled, suggesting rotation rather than panic selling.

Strong Market Structure

Glassnode concludes that bitcoin’s market remains structurally sound, backed by institutional demand, deep liquidity, and broad-based accumulation. Continued ETF inflows could extend the rally through the fourth quarter, supporting one of the most robust uptrends in recent years.