HashKey Holdings’ shares got off to a subdued start in their Hong Kong market debut, reflecting investor hesitation over whether the exchange’s dominant regulatory position can be translated into sustainable earnings.

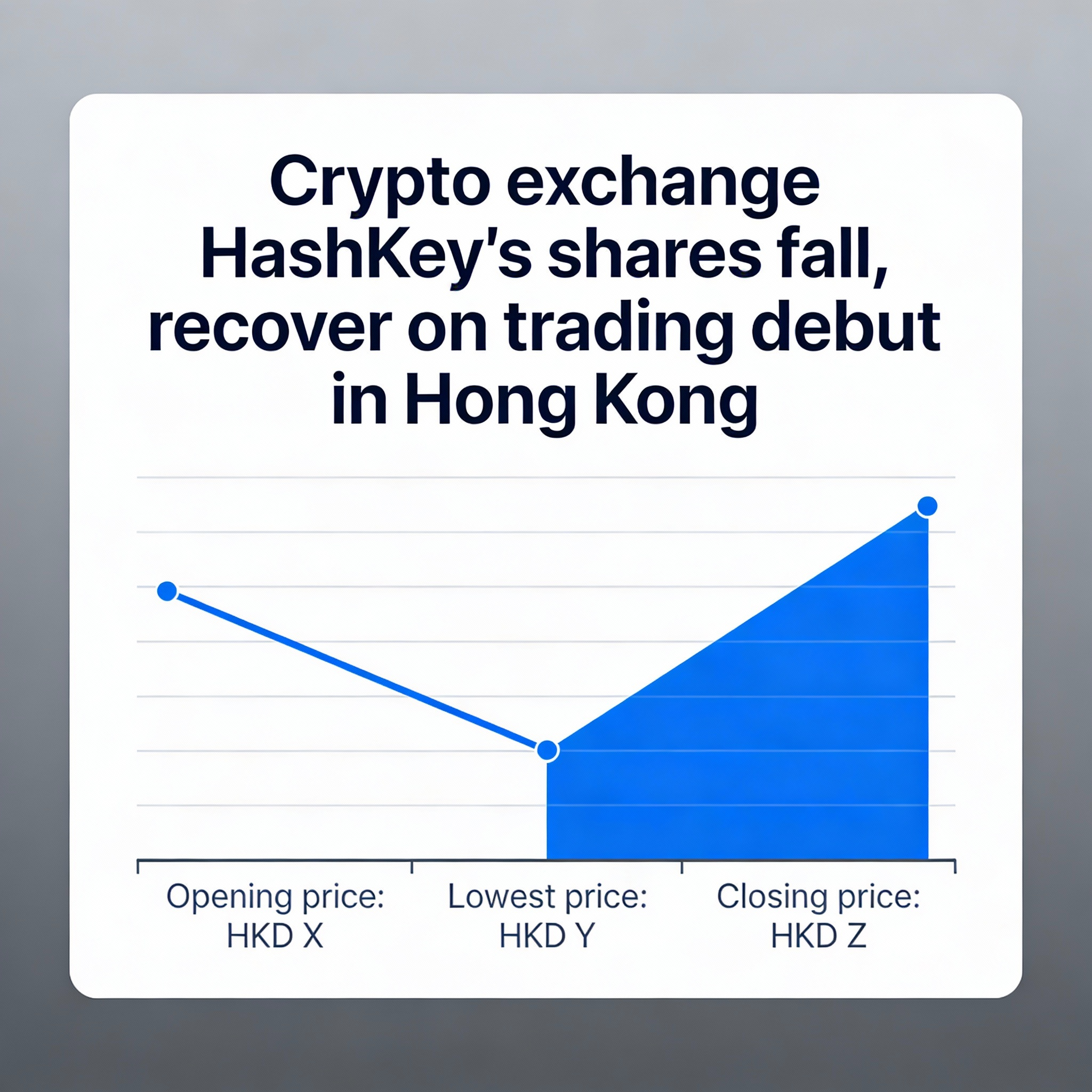

The stock opened below its IPO price and slid about 5% to roughly HK$6.34 in mid-morning trading before recovering to close at HK$6.67, just 0.15% under the offer price. The early decline came after prospectus disclosures released earlier in December highlighted significant losses alongside rapid growth in trading activity and user numbers.

Market conditions also weighed on sentiment. Bitcoin has retreated from the record highs reached earlier this year and was trading around $87,000, a pullback that has pressured valuations across crypto-related equities worldwide.

HashKey controls an estimated three-quarters of Hong Kong’s licensed crypto trading market and processed more than $81.8 billion (HK$638 billion) in trading volume in 2024, according to its prospectus. However, its strategy of charging ultra-low fees—generally below 0.1%—has constrained revenue growth while compliance, custody, licensing and infrastructure costs remain elevated.

Between 2022 and mid-2025, the company reported cumulative net losses of about $385 million (HK$3.0 billion), with monthly cash burn still high. Investors appear to be assessing whether greater scale alone can close the profitability gap, or whether meaningful improvement will require higher fees or expansion into higher-margin services.

The lackluster debut may also reflect a more limited growth narrative. HashKey has scaled back offshore retail operations, closing its Bermuda-registered entity, and is increasingly tied to Hong Kong’s regulatory framework. That focus makes its outlook more dependent on local policy decisions, institutional participation and capital markets activity than on broader global crypto cycles.

HashKey competes with Bullish, the parent company of CoinDesk.