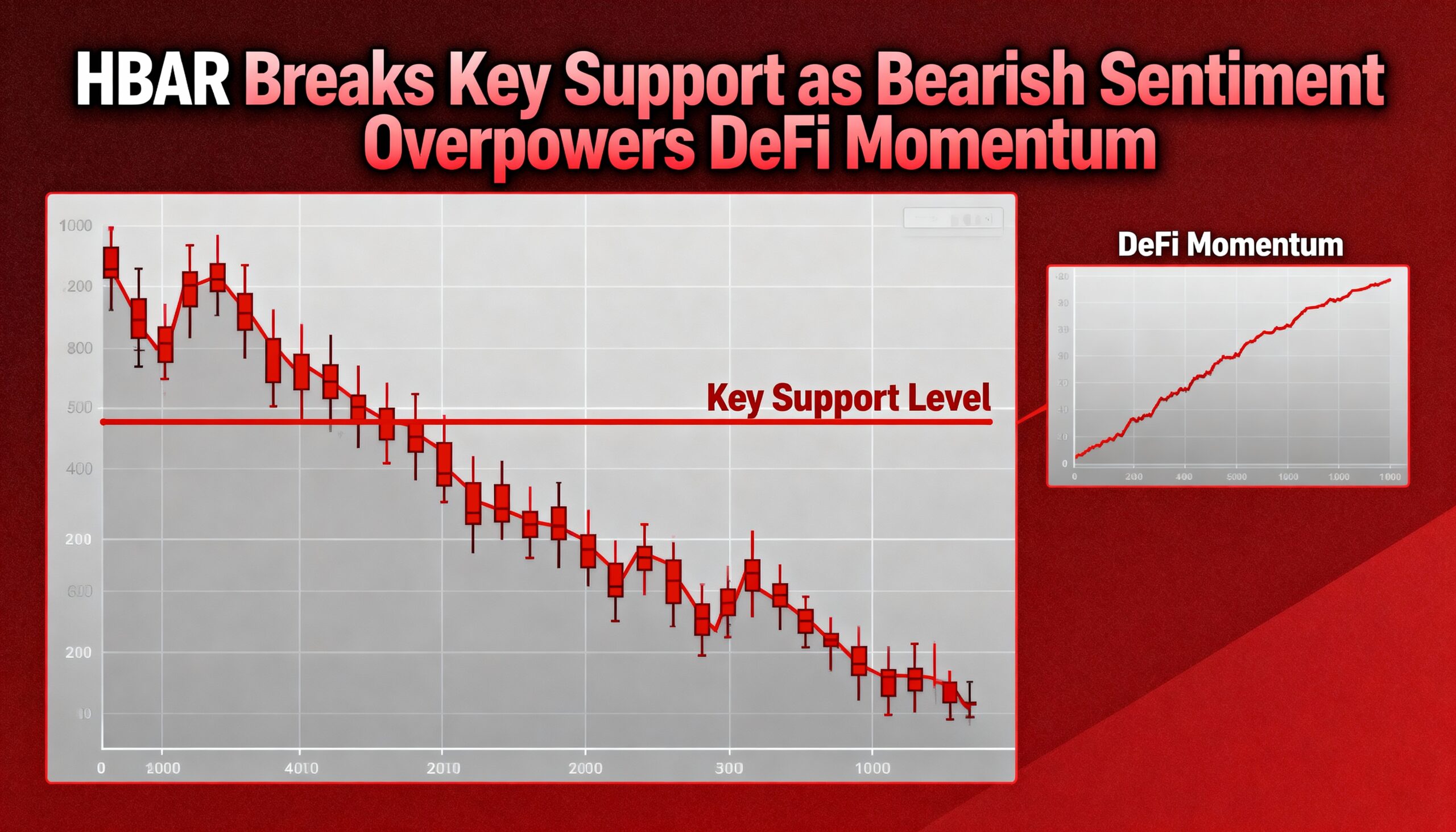

HBAR’s downturn intensified Tuesday as a key support failure triggered cascading sell pressure into the close.

The token slipped 2.5% from $0.1518 to $0.1480 after losing a critical support zone, sparking an influx of fresh downside momentum. The breakdown followed a late-session trading spike on Nov. 16, where 168.9 million HBAR traded — nearly double typical volume — pointing to substantial institutional selling.

Short-term charts show momentum worsening, with HBAR falling another 2.2% to $0.1472 amid volumes soaring 180% above average. A steady pattern of lower highs has now formed a well-defined descending channel, reinforcing the bearish setup traders used to initiate additional short exposure.

The weakness came even as sentiment around Hedera’s coming Wrapped Bitcoin integration continues to build ahead of its 2025 DeFi roadmap. Still, near-term action is dominated by technicals, and $0.1457 now stands as the critical support bulls must defend to prevent a deeper slide.

Key Technical Signals Point to Breakdown Continuation

Support & Resistance Levels

- Primary support has shifted to $0.1457 following rejection on heavy volume.

- Overhead resistance remains firm near $0.1488 after repeated failures to reclaim that zone.

- A descending channel with consistent lower highs confirms the bearish bias.

Volume Dynamics

- The 168.9M-token spike (94% above the 24-hour average) identified the initial reversal event.

- Hourly data shows sell pressure peaking at 6.2M tokens during the sharpest decline.

- A 180% volume surge validated the distribution phase as the breakdown unfolded.

Chart Structure

- The prior consolidation range between $0.1460–$0.1530 has given way to a downside breach.

- Lower-high sequencing confirms the channel pattern.

- Institutional distribution appears to be pressing the broader consolidation lower.

Levels to Watch

- Next support: $0.1457

- Risk marker: $0.1465 (intraday breakdown pivot)

- Upside cap: $0.1488 (rejection zone on high volume)