Cryptos Could Benefit if Inflation Report Softens

A softer-than-expected inflation report could lower the 10-year Treasury yield and provide support for cryptocurrencies.

The Fed’s preferred gauge, core PCE, is expected to have risen 2.9% year-on-year in September, exceeding the Fed’s 2% target for the 55th consecutive month, according to FactSet. Persistent inflation could strengthen hawkish Fed voices advocating for slower rate cuts.

Despite these inflation concerns, market volatility remains subdued. Bitcoin’s one-day implied volatility index (BVIV) is around 36%, signaling a 24-hour price swing of roughly 1.88%, according to TradingView. This muted volatility reflects expectations that the Fed will proceed with a 25 basis point rate cut on Dec. 10, as priced in by CME’s FedWatch tool.

A softer report could push the 10-year Treasury yield below 4%, potentially enabling Bitcoin to break out of its $92,000–$94,000 range. “Contained inflation would reinforce the easing narrative supporting crypto’s rebound, while any upside surprise may keep markets range-bound until the Fed clarifies its path,” said Iliya Kalchev, Nexo Dispatch analyst.

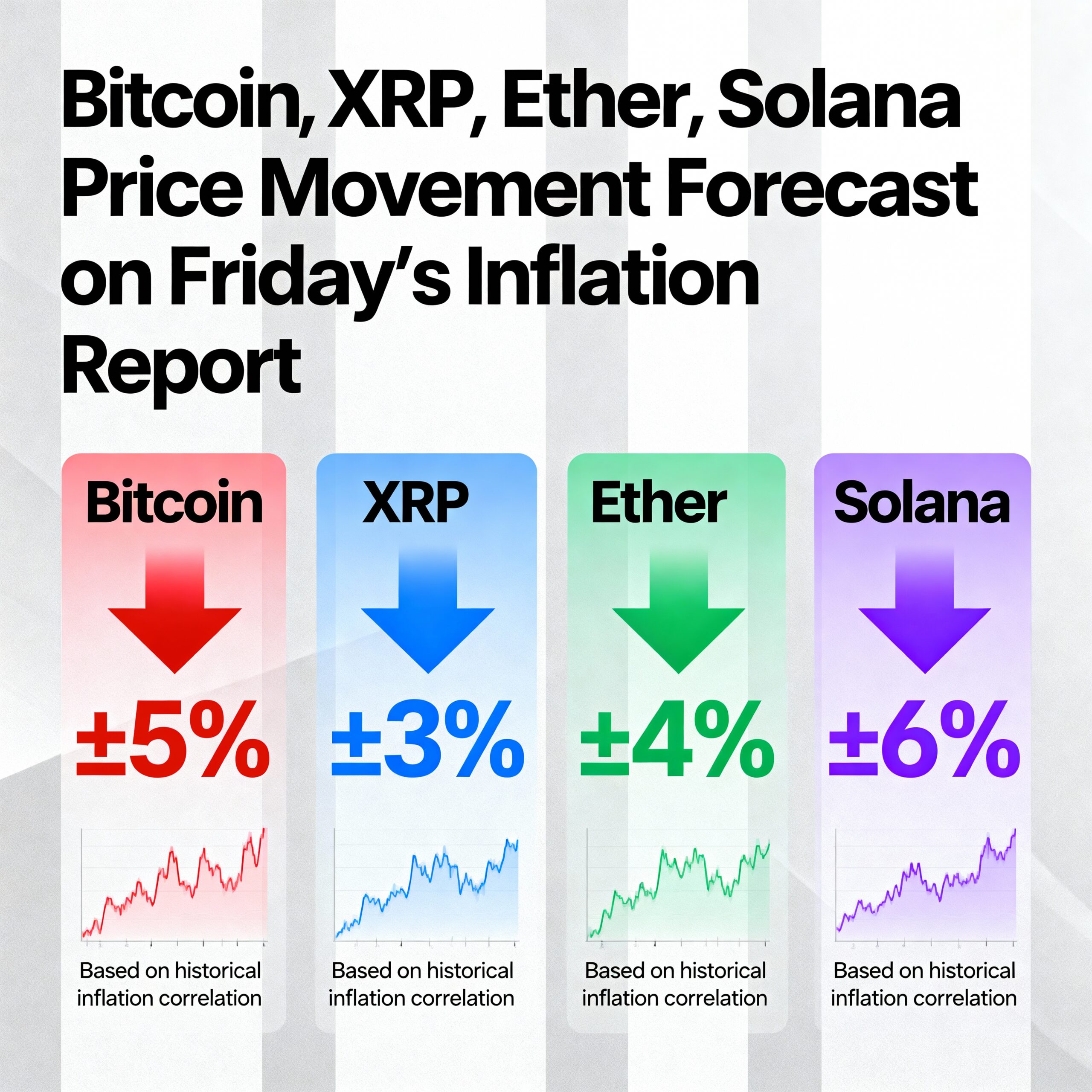

Altcoins may see similar impacts. Ether shows a 24-hour expected swing of 3%, Solana (SOL) 3.86%, and XRP 4.3%, all slightly higher than Bitcoin’s projected moves.