Launching a crypto token is more accessible than ever, but ensuring it thrives requires a strategic, data-driven approach, says Shane Molidor, founder of Forgd.

“With platforms like pump.fun making token launches easy, the challenge today lies in launching utility tokens that sustain strong performance amid limited investor attention and finite capital,” Molidor told CoinDesk.

Forgd offers free software tools to help crypto projects design tokenomics, coordinate with market makers, navigate exchange listings, and establish valuations at launch. After launch, projects can use Forgd’s analytics to monitor market maker activity, track token unlocks, and fine-tune demand drivers.

The company also provides advisory services for larger projects and has developed a portal where token advisors and market makers manage portfolios and track commitments transparently.

To date, more than 1,500 projects have used Forgd’s tools, ranging from research experiments to serious “blue chip” tokens backed by significant venture capital and valued above $100 million on major exchanges.

Molidor emphasizes that many top market tokens have launched via Forgd, although specific names remain confidential. His goal is to bring transparency and standardization to the go-to-market process, helping protocol teams navigate the complexities of market microstructure.

Data-Driven Insights

Forgd’s methodology relies heavily on analyzing recent token launches to identify what drives success. Metrics examined include token distribution, emission schedules, launch-day price, market capitalization, and trading volume.

Market maker performance is scrutinized by measuring their role in order book depth, trade fills, and bid-ask spreads to guide projects in choosing effective partners.

With markets constantly evolving, Forgd regularly updates its database with fresh launch data. While primarily focused on crypto-native projects, Forgd is also engaging with institutional investors curious about token launch processes.

Addressing an Unsustainable Model

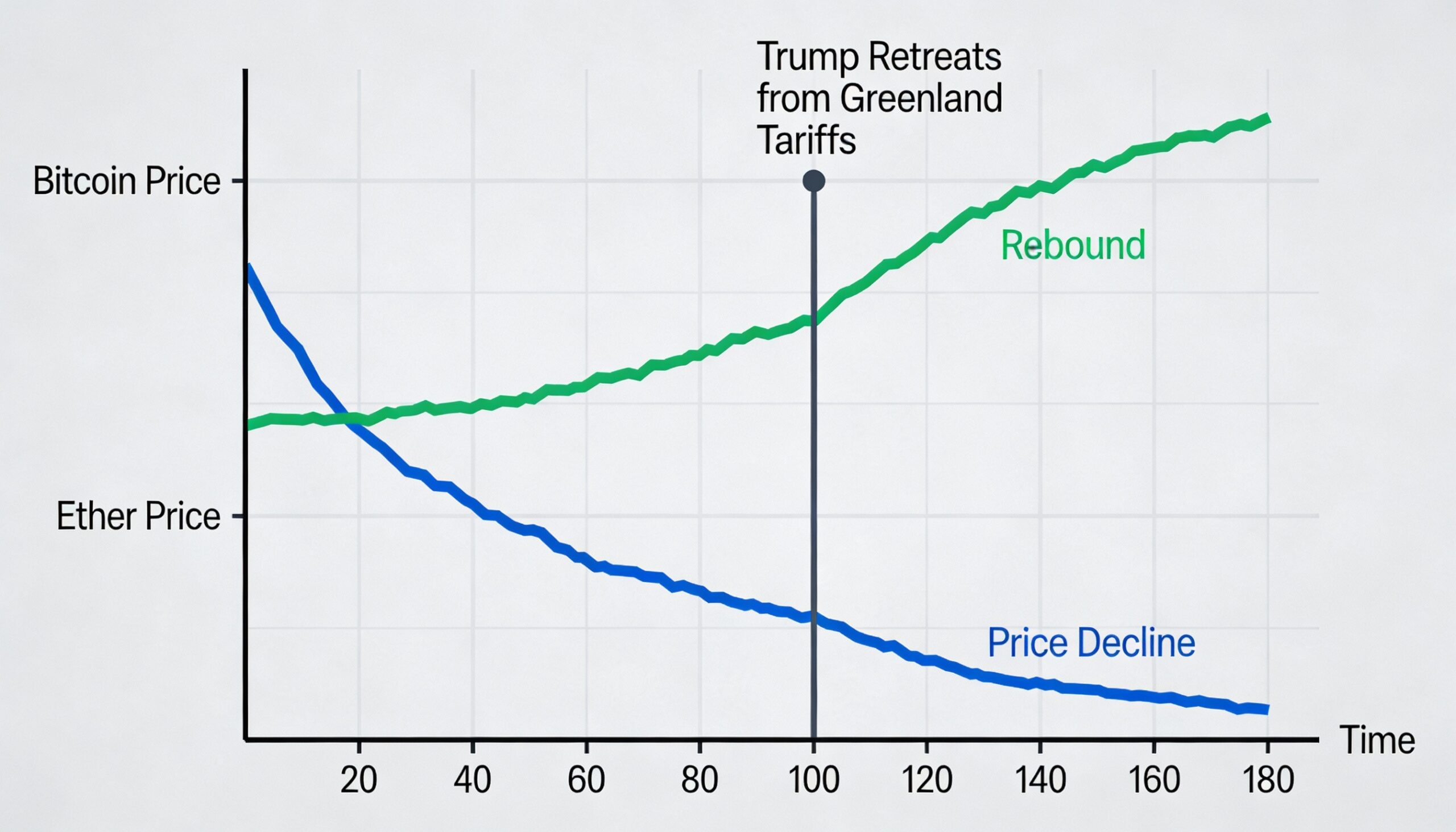

Molidor critiques the current token launch environment, where inflated initial valuations and extended inflationary emissions create unsustainable dynamics. Investor interest often wanes quickly after the initial launch phase.

He also notes that early price surges are frequently manufactured by exchanges or market makers, leaving projects with little control.

Projects often mismanage relationships with market makers, unintentionally encouraging price pumps that may harm token stability.

To improve sustainability, Molidor advocates for launch structures that ensure ongoing secondary market demand. Unlike traditional IPOs with underwriter-backed demand, tokens usually rely on speculative retail buyers.

Proposed solutions include limiting initial institutional investments with reserves earmarked for secondary market support. Additionally, on-chain incentives—such as token or stablecoin rewards—could encourage sustained buy-side demand post-launch.

“Just as DeFi changed liquidity provision, I expect on-chain demand incentives will reshape token launches, helping projects build long-term value beyond the initial hype,” Molidor said.