Bitcoin Rally Sends IBIT Past Major ETFs While Miners Lag

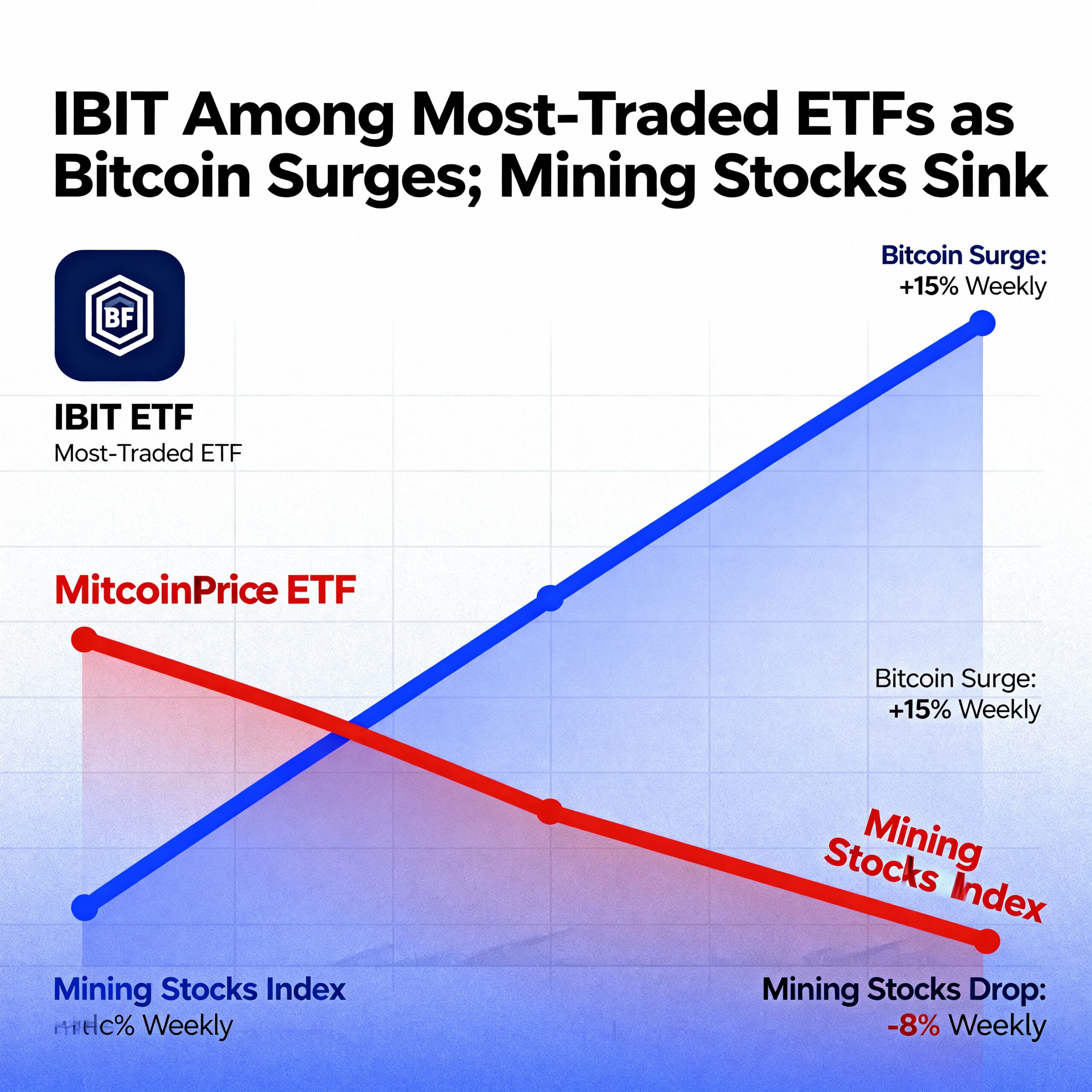

Bitcoin rebounded about 6% on Tuesday following an early-week sell-off, driving heavy activity in crypto-focused ETFs. BlackRock’s iShares Bitcoin Trust (IBIT) emerged as one of the most-traded ETFs in the U.S., surpassing even Vanguard’s S&P 500 ETF (VOO).

IBIT recorded roughly $3.7 billion in trading volume, topping VOO’s $3.28 billion, according to Barchart. The surge underscores growing investor demand for bitcoin exposure and positions IBIT among the market’s most liquid ETFs.

The volume spike coincided with bitcoin’s price recovery and came a day after Vanguard announced it would allow bitcoin ETFs and crypto mutual funds on its brokerage platform, signaling wider adoption.

Despite launching less than two years ago, BlackRock’s bitcoin ETFs have become key products for the firm. IBIT now holds $66.3 billion in assets, making it the firm’s top revenue-generating ETF out of more than 1,400 funds under $13.4 trillion in total assets.

Other cryptocurrencies also gained on Tuesday. Ether (ETH), XRP, and Dogecoin (DOGE) rose roughly 7%, while Cardano (ADA) led with a 14% jump. Chainlink (LINK) increased 11% after the launch of a Grayscale ETF tied to LINK on NYSE Arca.

The bitcoin rally boosted crypto-related stocks. MicroStrategy (MSTR), holding over 174,000 BTC, climbed 6%, Robinhood (HOOD) rose 2%, Bullish (BLSH) added 5%, and Circle (CRLC) gained 4%.

Not all crypto equities benefited. Coinbase (COIN) fell 5% after shareholders filed a lawsuit alleging executives sold billions in stock while misleading investors after the 2021 IPO.

Bitcoin mining stocks lagged behind. Iren (IREN) fell 15%, Cipher Mining (CIFR) dropped 10%, and TeraWulf (WULF) lost 7%, despite the broader market rebound.