Binance has surpassed CME as the top exchange for bitcoin (BTC $87,886.25) futures open interest (OI), according to CoinGlass. Binance holds roughly 125,000 BTC ($11.2 billion in notional value), slightly ahead of CME’s 123,000 BTC ($11 billion).

The shift reflects a sharp decline in the profitability of the basis trade, where traders buy spot bitcoin while selling futures to capture the price spread. CME’s OI began the year at 175,000 BTC but has steadily fallen as returns from this strategy dwindled. Binance, favored by retail traders for directional bets, has maintained steady OI.

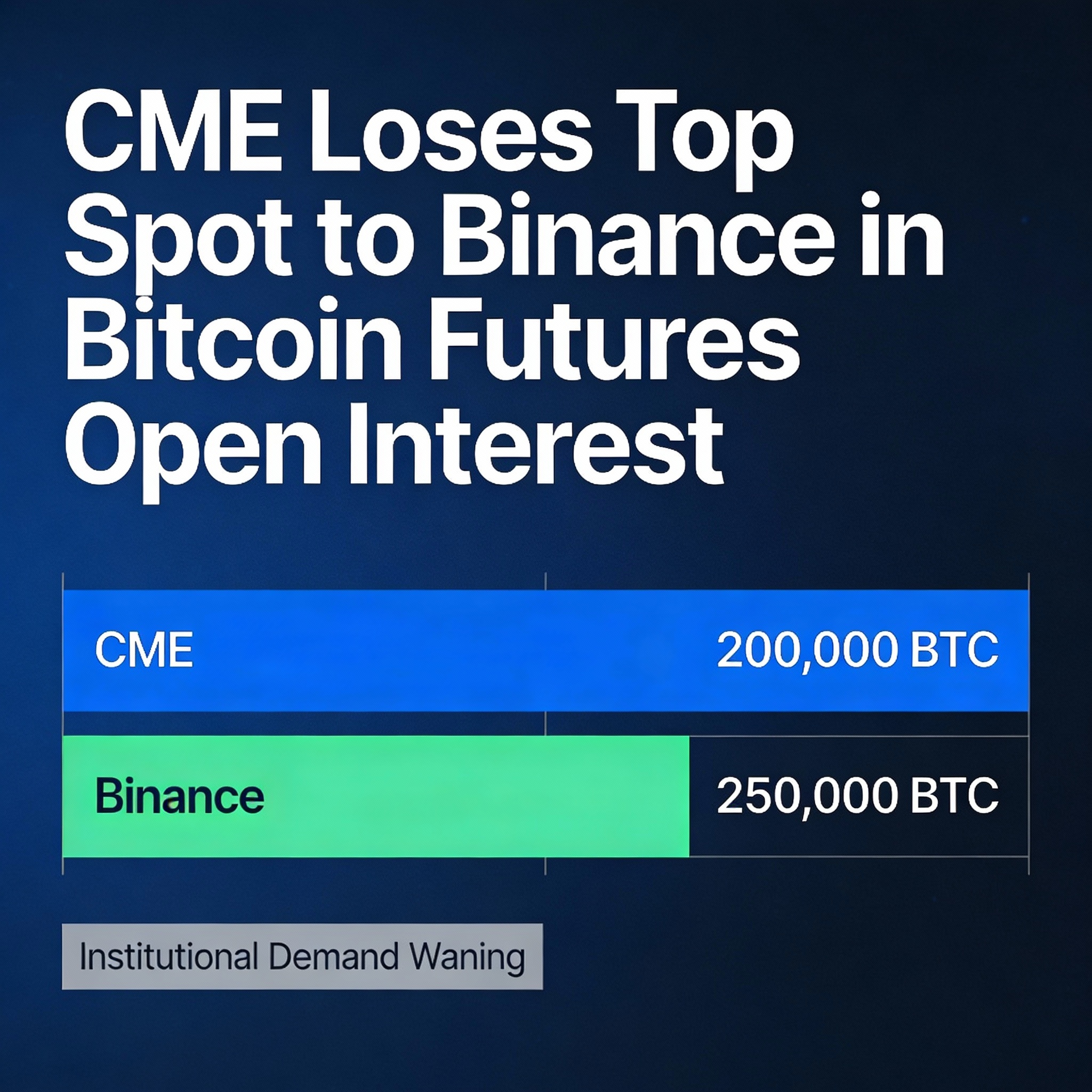

A year ago, CME’s OI reached a record 200,000 BTC as bitcoin approached $100,000, with the annualized basis rate peaking near 15%. Today, that rate has compressed to around 5%, according to Velo data, signaling reduced returns for institutional basis traders.

As spot and futures prices converge, arbitrage opportunities continue to shrink. CME had dominated bitcoin futures OI since November 2023, driven by institutional positioning ahead of January 2024 spot bitcoin ETFs, but that advantage has now faded.