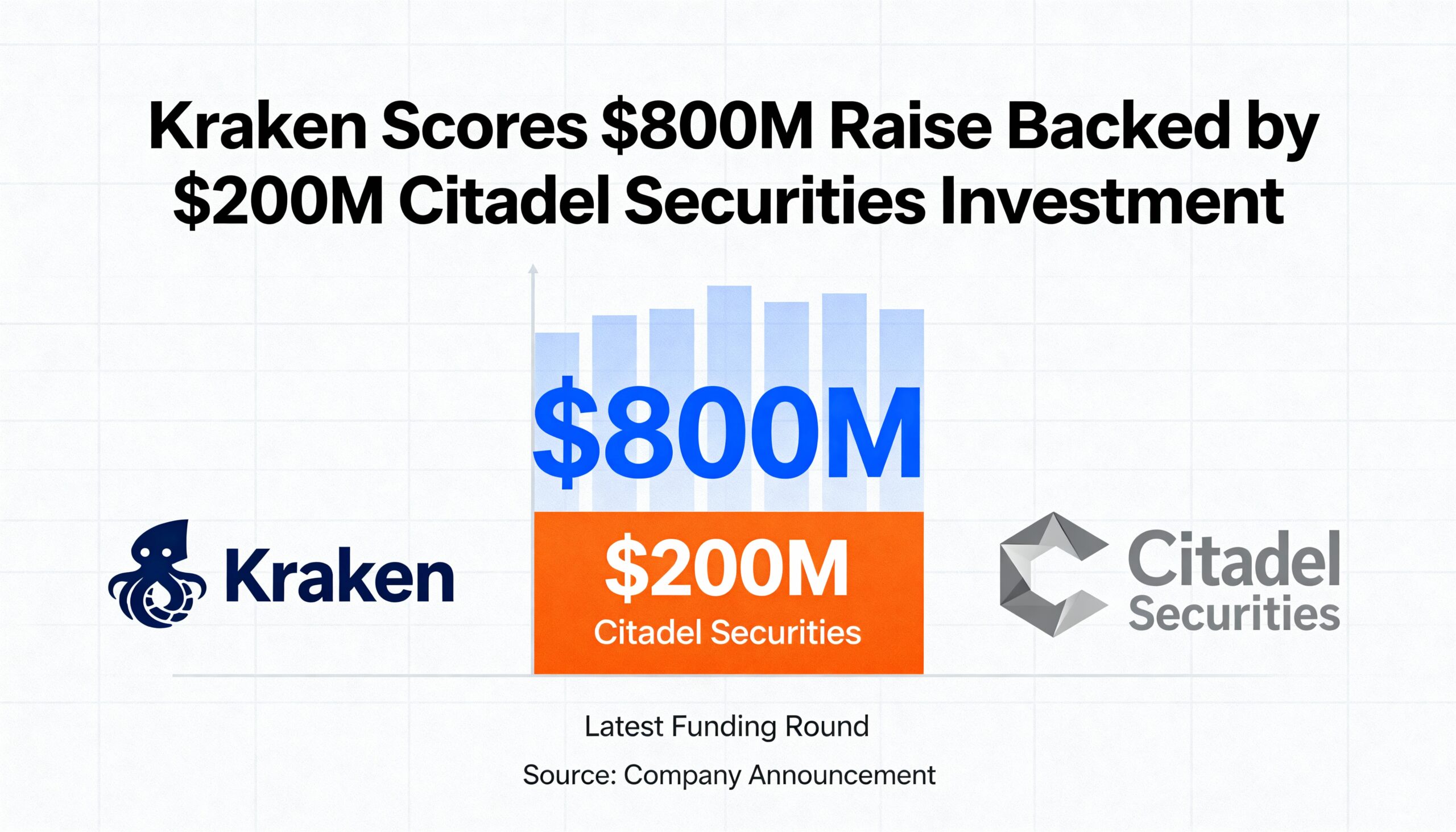

Kraken has secured an $800 million funding round — including a $200 million investment from Citadel Securities — pushing the crypto exchange’s valuation to $20 billion and accelerating its ambition to merge traditional financial markets with blockchain-based infrastructure.

The raise was completed in two parts. The primary tranche brought in major institutional backers such as Jane Street, DRW Venture Capital, HSG, Oppenheimer Alternative Investment Management and Tribe Capital. Citadel Securities then added a standalone $200 million follow-up investment, strengthening the exchange’s ties with one of the most influential firms in global market making.

Founded in 2011, Kraken operates a regulated trading ecosystem supporting spot and derivatives markets, tokenized assets, staking, custody, payments and settlement. Its vertically integrated design allows the company to introduce new products rapidly while maintaining robust compliance controls across custody, clearing and execution layers.

“Our mission is simple: build a platform where any asset can be traded by anyone, at any time,” said Kraken co-CEO Arjun Sethi. He noted that participation from Citadel Securities and Jane Street reflects growing institutional confidence in Kraken’s infrastructure-led approach.

The latest raise represents a major milestone for Kraken, which had previously taken on only $27 million in primary capital. Despite that, the company generated $1.5 billion in revenue in 2024 and surpassed that total again by the third quarter of 2025.

Over the last year, Kraken has expanded aggressively into multi-asset trading. The firm acquired NinjaTrader to support U.S. futures markets, introduced tokenized stocks, and launched its global KRAK application for payments, savings and investment services.

Citadel Securities President Jim Esposito described Kraken as a pivotal force in “the next chapter of digital market innovation.” The firm plans to work alongside Kraken on liquidity provision and risk management — areas where Citadel Securities has long been a dominant player in traditional finance.

With the fresh capital, Kraken intends to scale its presence across Latin America, Asia-Pacific and EMEA, while rolling out new trading tools, institutional-grade products, staking features and payment infrastructure. The company aims to capture surging demand for compliant access to digital and tokenized markets worldwide.