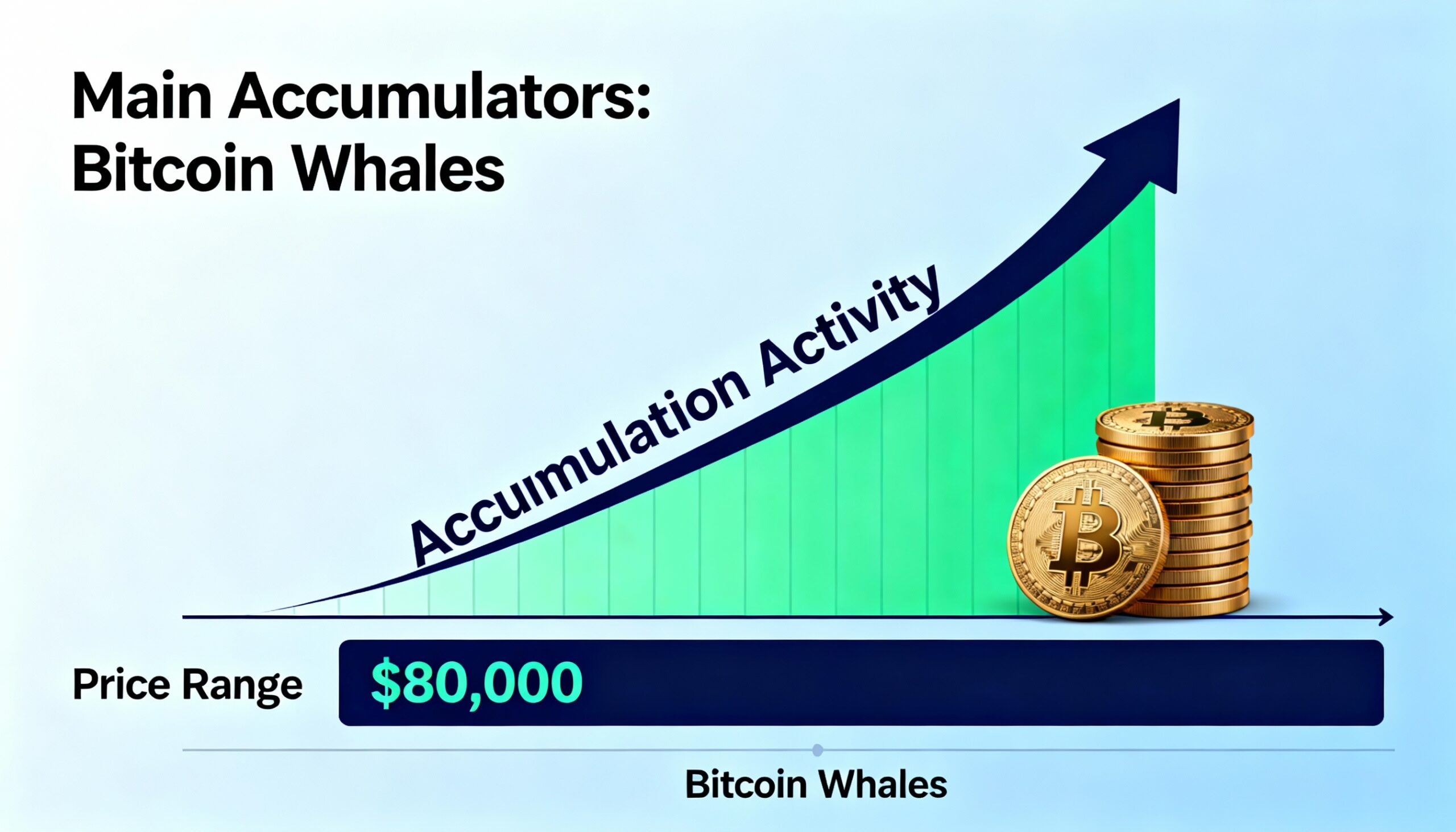

Bitcoin whales — wallets holding at least 1,000 BTC — have emerged as the primary buyers since the largest cryptocurrency found a floor near $80,000 in late November, according to Glassnode data. The cohort continues to lead accumulation even as bitcoin trades just below the $90,000 mark.

Glassnode shows that the 1,000–10,000 BTC bracket is currently the only group demonstrating sustained accumulation, with an Accumulation Trend Score approaching 1. The indicator tracks net buying and selling across wallet cohorts over the past 15 days, factoring in both entity size and balance changes. Scores closer to 1 signal accumulation, while readings near 0 indicate distribution.

The data indicates that large holders have been steadily accumulating bitcoin around the $80,000 level — a price zone where BTC has spent relatively little time compared with other ranges. This pattern stands in sharp contrast to smaller holders, all of whom are showing varying degrees of distribution.

With the Crypto Fear and Greed Index lingering in “fear” or “extreme fear” territory for roughly the past month, selling by smaller entities likely reflects capitulation-driven behavior.

Meanwhile, wallets holding more than 10,000 BTC were aggressively accumulating when bitcoin dipped toward $80,000 in late November, though their buying activity has moderated in recent weeks. Even so, this cohort has yet to shift into net selling — a behavior that dominated when bitcoin peaked above $100,000 earlier in the year.