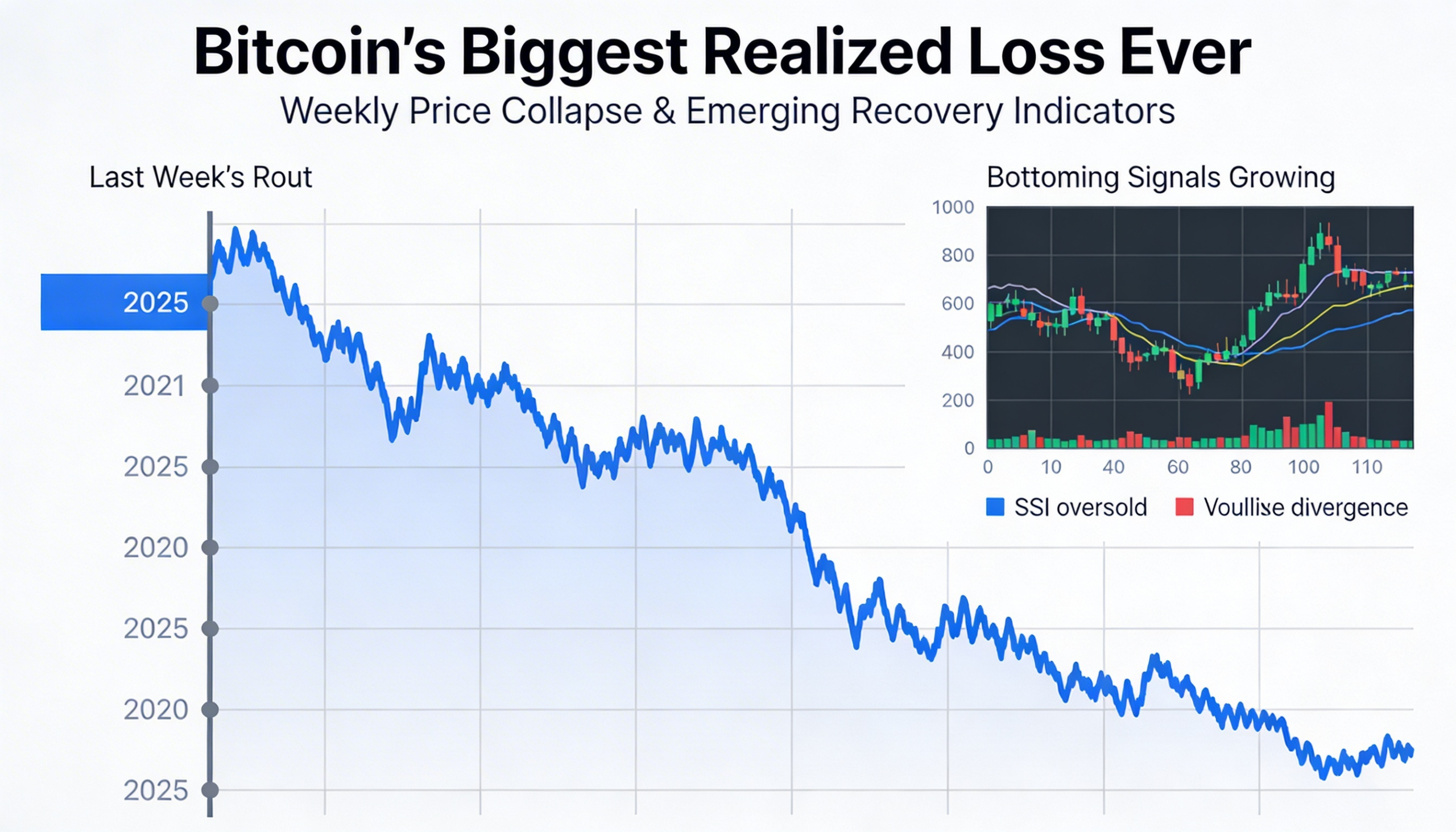

Bitcoin recorded the largest realized loss in its history during last week’s sharp market downturn, as the price tumbled from $70,000 to $60,000 on Feb. 5.

Data from Glassnode show that Entity-Adjusted Realized Loss surged to $3.2 billion. The metric measures the U.S. dollar value of coins moved at a loss — meaning sold below their acquisition price — while excluding transfers between wallets controlled by the same entity.

The scale of the capitulation eclipsed prior records, including the $2.7 billion in realized losses logged during the 2022 collapse of Terra (LUNA), one of the most severe episodes in crypto market history.

According to analytics platform Checkonchain, the sell-off fits the profile of a “textbook capitulation event.” The decline unfolded rapidly, was accompanied by heavy trading volume, and forced lower-conviction holders to exit positions at a loss.

Daily net realized losses exceeded $1.5 billion at the height of the move, marking the largest absolute U.S. dollar loss ever crystallized on the Bitcoin network. Historically, such extreme loss events have coincided with late-stage bear market conditions, potentially signaling the formation of a market bottom.

At the time of writing, Bitcoin was trading near $67,600, having partially recovered from last week’s lows.