LIBRA Crash Deepens Solana’s Memecoin Woes as SOL Sinks

Solana’s memecoin ecosystem is facing another major setback, with the collapse of LIBRA adding to the chain’s ongoing struggles. The latest turmoil has weighed on Solana’s price, which has slumped against both the U.S. dollar and ether (ETH).

A new report from Galaxy Research on Monday highlighted LIBRA’s apparent rug pull as the most recent blow to Solana’s speculative token scene. The memecoin frenzy had already lost momentum following the January launch of TRUMP, which triggered a liquidity drain across the ecosystem. Now, LIBRA’s implosion threatens to accelerate that decline, reducing the appeal of SOL, which has been largely propped up by demand for its memecoins.

Since LIBRA’s meteoric rise and subsequent crash, Solana (SOL) has dropped 8.6% in 24 hours, trading at $168.73 at publication time.

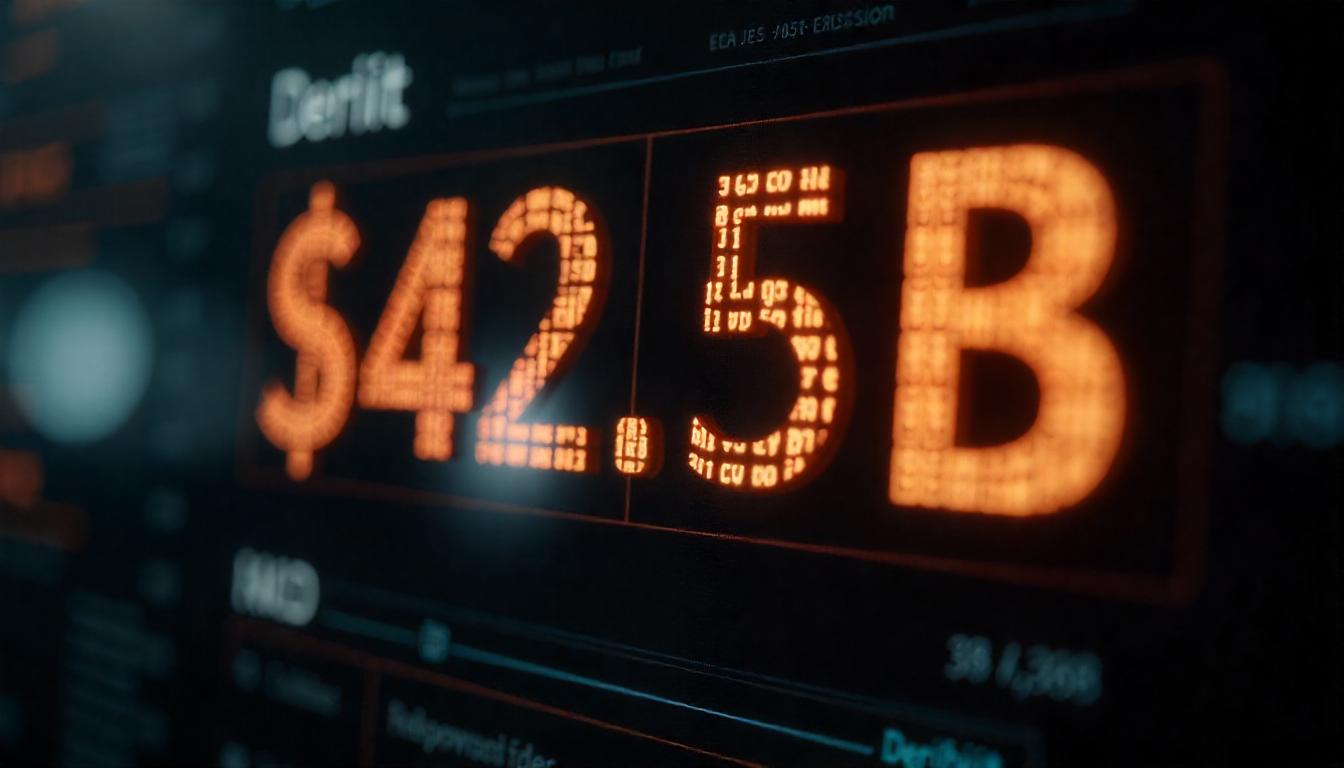

The LIBRA fallout has also sparked controversy in Argentina, where President Javier Milei—who previously promoted the token as a tool for small businesses—is now facing political backlash, including impeachment threats. The token surged to a staggering $4.5 billion market cap before collapsing by 90%, leaving investors with massive losses.

“This is just another chapter in the volatile Solana memecoin saga,” said Alex Thorn, Galaxy’s head of research. “The space has been in decline since TRUMP’s brief surge to a $75 billion fully diluted valuation (FDV) in January.”

Further fueling the drama, Kelsier CEO Hayden Davis admitted that his team not only launched LIBRA but was also behind MELANIA. He also revealed that they sniped both contracts immediately after launch for personal gains.

“This isn’t a rug pull,” Davis insisted in an interview with crypto investigator Coffeezilla. “It was a strategy that completely unraveled, and now I’m left managing $100 million in a way I never expected.”