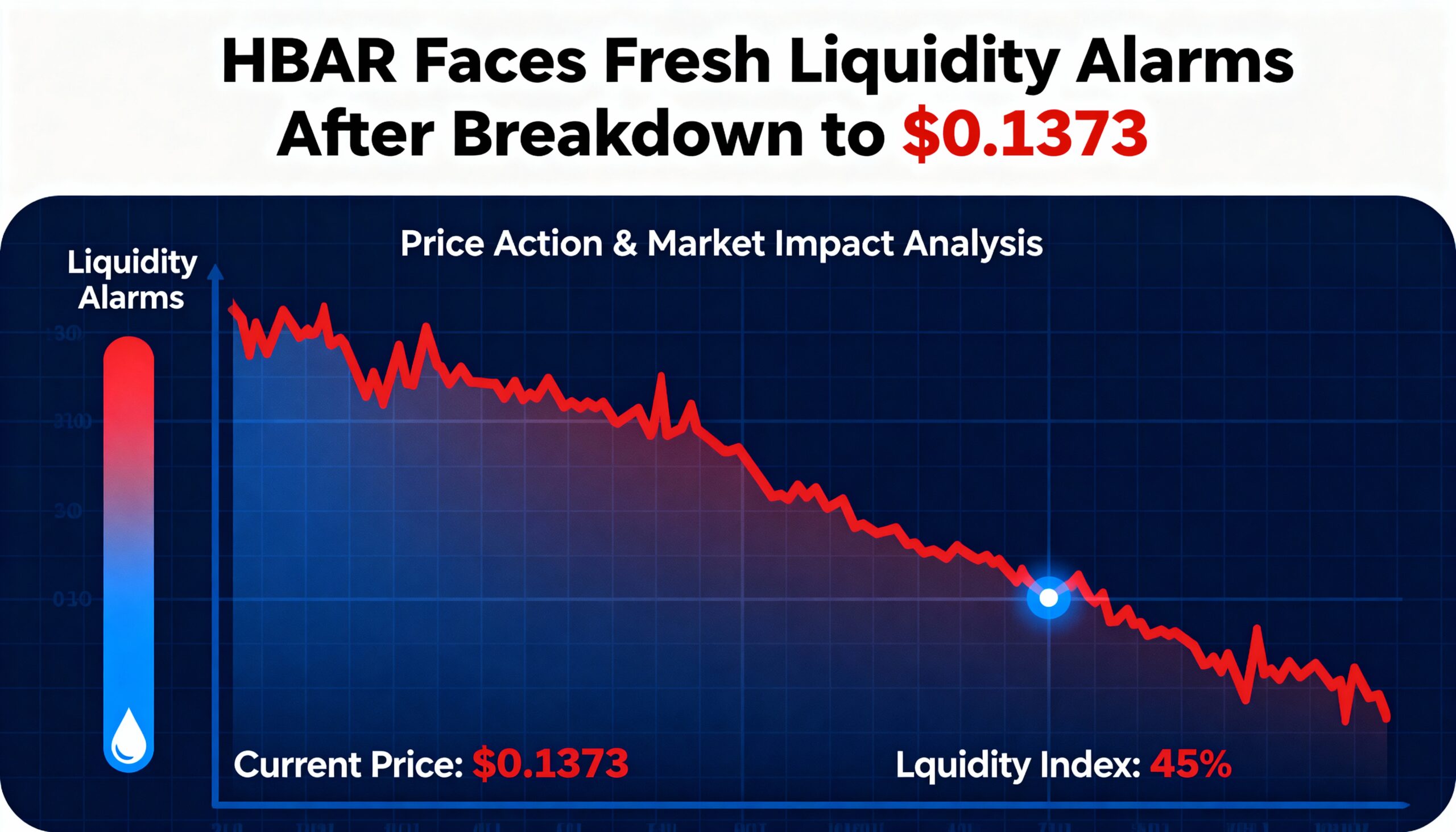

Hedera’s HBAR token extended its downturn after slipping under major support levels, as a sudden late-session trading pause, thinning liquidity, and repeated failed rebounds signaled growing structural fragility in the market.

HBAR dropped to $0.1373, breaking well below its long-standing support at $0.145 after bulls were unable to maintain the recent consolidation zone. The late-day decline confirmed a transition from a neutral setup to a clearly bearish structure, with price action weakening steadily into the close.

Market depth deteriorated rapidly in the final hour. A brief trading halt between 14:12 and 14:14—during which the market printed zero volume—raised concerns about potential structural faults or an acute liquidity squeeze, either of which can accelerate downward moves during stress events.

Earlier in the session, a sharp 138% surge in trading volume revealed firm resistance at $0.1486. HBAR briefly staged a swift V-shaped rebound from its $0.1382 intraday low, but the recovery stalled almost immediately, leaving the token exposed to renewed selling pressure.

Technical Indicators Outline Increasing Breakdown Risk

Support and Resistance Landscape

- The $0.1382 support level becomes a key downside target following the collapse of the consolidation range.

- The previous support area near $0.1445 is expected to act as resistance on any bounce.

- The $0.1486 zone remains the main resistance where earlier volume spikes marked rejection.

Volume Profile

- The 146.94 million token spike—138% above the 61.8 million average—signals a distribution phase.

- A stark drop to 9.76 million tokens preceded the breakdown.

- The zero-volume gap during the trading halt highlights intense liquidity strain.

Chart Structure

- The former consolidation channel between $0.1446 and $0.1477 has now been invalidated.

- The V-shaped rebound off $0.1382 failed to generate follow-through demand.

- A total range of $0.0096 (6.5%) suggests heightened volatility.

Risk/Reward Perspective

- Sustained weakness below $0.1440 puts the $0.1382 support level in focus.

- Any recovery attempt is likely to encounter immediate resistance at the reclaimed $0.1445 zone.

- The brief trading suspension adds to concerns around market depth and the resilience of liquidity infrastructure.