Crypto Volumes Retreat as Market Pullback Triggers ETF Outflows, JPMorgan Reports

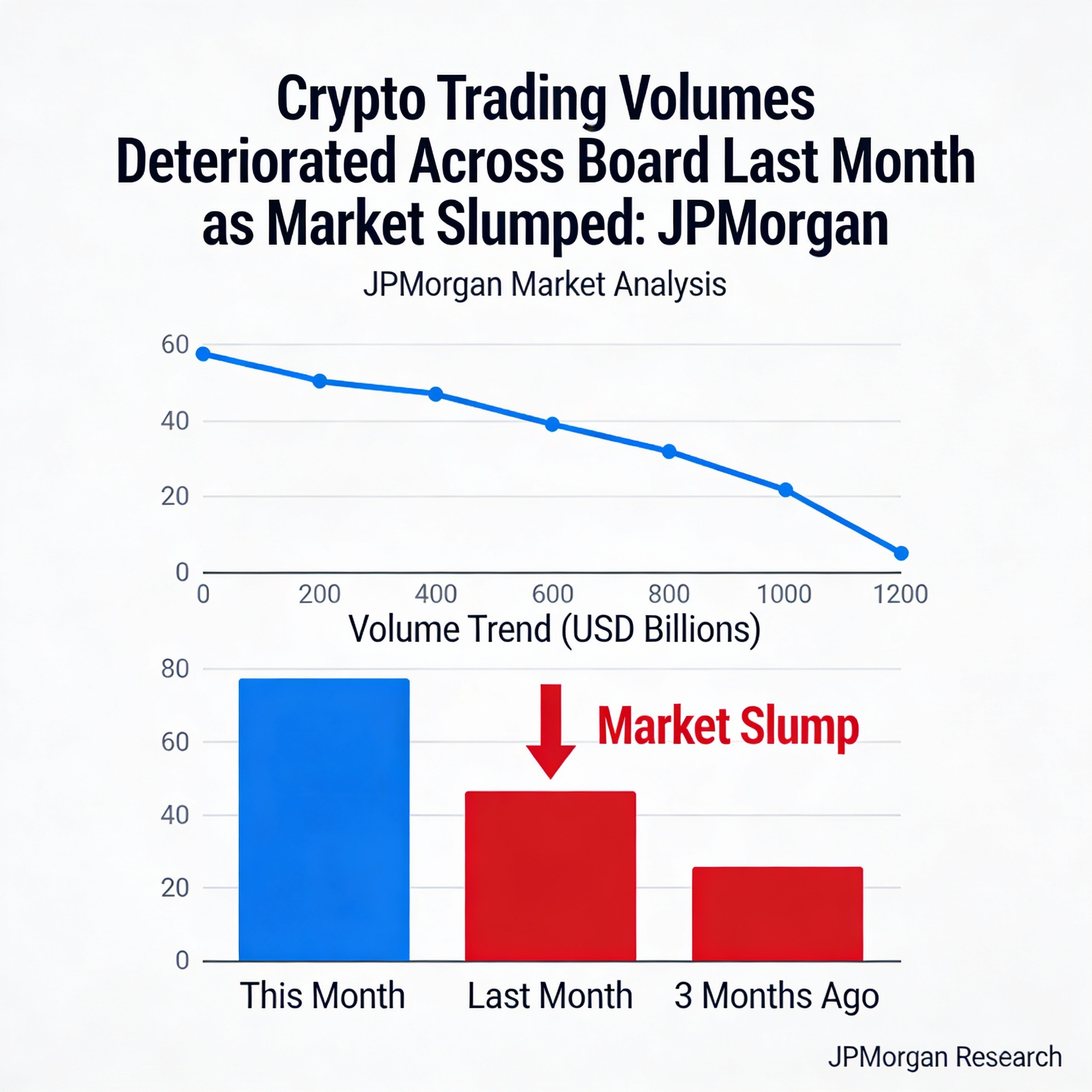

Crypto markets pulled back broadly last month, with prices and activity weakening across spot, derivatives and stablecoin markets, according to a new JPMorgan report.

The bank said trading volumes declined as bitcoin, ether and most major tokens fell. Stablecoin usage slowed markedly, with average daily turnover down 26% month-on-month, while activity across decentralized finance (DeFi) and non-fungible tokens (NFTs) also contracted.

Analysts led by Kenneth Worthington pointed to heightened concerns around leverage, renewed fears of a prolonged downturn and continued underperformance relative to equities as key headwinds. Those pressures overshadowed a limited number of mergers, acquisitions and product launches during the period.

Investor flows into U.S. crypto investment products turned negative. Spot bitcoin exchange-traded funds recorded $3.4 billion in net outflows in November, reversing the prior month’s inflows, JPMorgan said.

Liquidity deteriorated alongside prices. Spot trading volumes fell 19% in November based on CoinDesk data, while TradingView figures suggest a decline closer to 23%.

Bitcoin’s market capitalization declined 17% to $1.8 trillion, outperforming ether, whose market value dropped 22% to $361 billion. Even so, crypto assets lagged traditional markets, with the S&P 500 flat and the Nasdaq 100 down around 2% over the month.

Overall crypto market capitalization fell 17% to $3.04 trillion, while publicly listed crypto-related equities lost 21% of their value.