Bitcoin (BTC) may face continued pressure in the near term, presenting potential “buy the dip” opportunities for investors, according to Andre Dragosch, Head of Research for Bitwise Europe. After a recent 8% decline, Dragosch, who has been consistently bullish on BTC for months, has become more cautious, warning that further losses may be on the way.

The leading cryptocurrency by market capitalization, Bitcoin saw an 8.8% drop last week, dipping to nearly $95,000. This marked its largest decline since August, based on data from TradingView and CoinDesk Indices. The price drop followed signals from the Federal Reserve indicating fewer rate cuts in the coming year, alongside the central bank’s statement that it does not hold Bitcoin and has no intention to alter this position. The Fed’s “hawkish” outlook on rates also had broader market implications, leading to a 2% drop in the S&P 500 and a 0.8% gain in the dollar index, which reached its highest level since October 2022. Additionally, the yield on the 10-year Treasury note rose 14 basis points, breaking out from a technical pattern in a bullish direction.

Dragosch believes that this “risk-off” sentiment could persist for some time. “The Fed is caught between a rock and a hard place,” Dragosch said. “Despite three consecutive rate cuts since September, financial conditions continue to tighten. Meanwhile, inflation indicators, such as Truflation’s U.S. inflation gauge, have shown a recent uptick.”

Dragosch was one of the few market observers who accurately predicted Bitcoin’s surge in late July when sentiment was largely negative. At that time, BTC was near $50,000, and it has since surpassed $100,000 for the first time ever.

While Dragosch expects continued volatility and potential losses in the short term, he sees this as a potential opportunity for long-term investors, pointing to Bitcoin’s ongoing supply shortage as a positive factor for future growth.

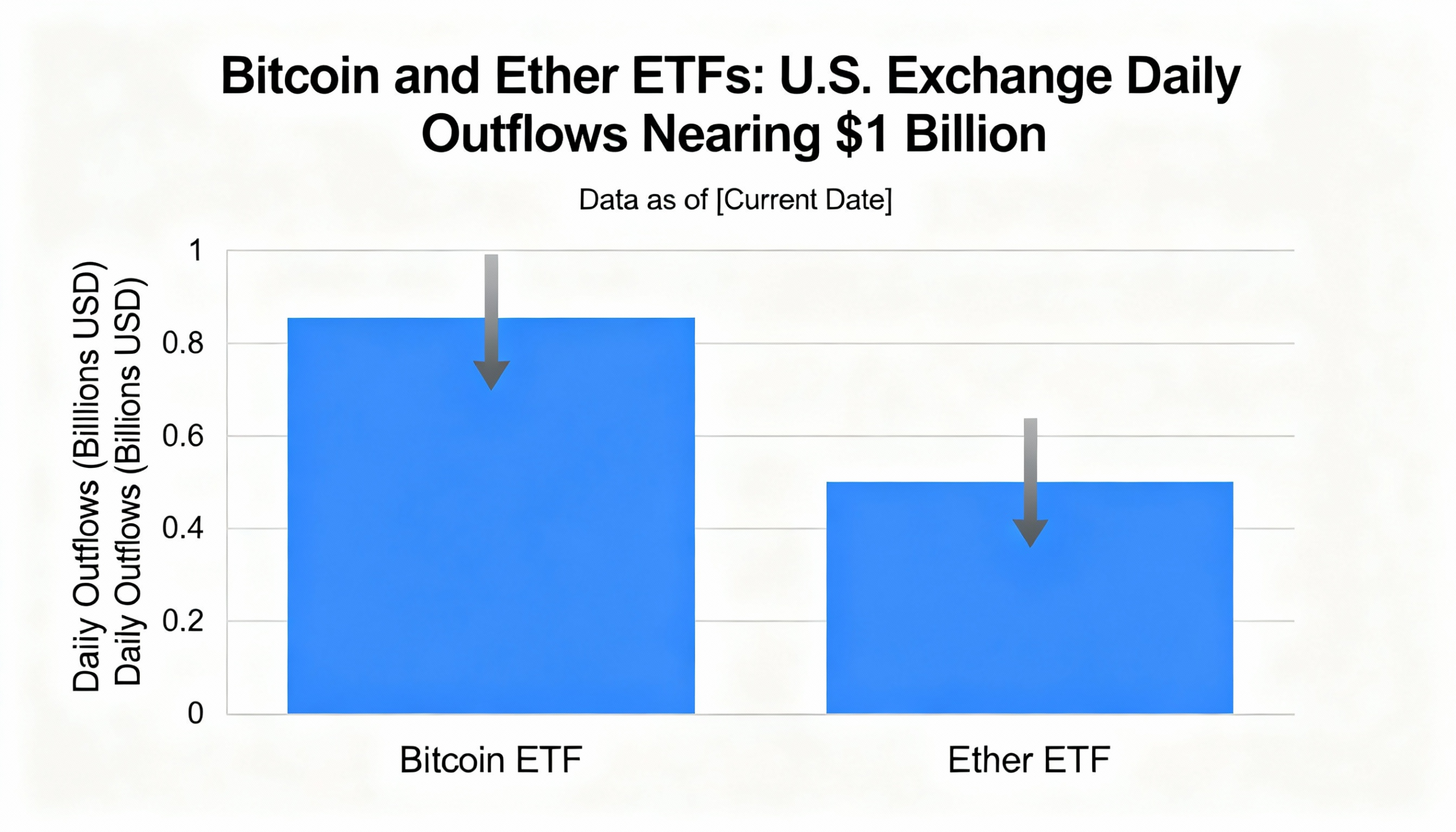

The rise in Treasury yields, which typically signals higher borrowing costs and increased appeal of fixed-income investments, tends to lead to outflows from riskier assets like cryptocurrencies and equities. Additionally, a stronger dollar makes U.S.-denominated assets more expensive, discouraging foreign investment in markets like Bitcoin.

Dragosch also draws comparisons to inflation trends seen in the 1970s, noting that recent CPI data has raised concerns within the Federal Reserve about a potential second wave of inflation. This, Dragosch believes, has led to a more cautious stance on further rate cuts. “The Fed likely fears a resurgence of the inflationary spikes seen in the 1970s, which is why they are hesitant to cut rates too aggressively,” Dragosch explained. “If they cut too much, inflation could accelerate sharply. If they hold rates steady, the economy may suffer.”

However, Dragosch predicts that, eventually, the financial tightening caused by rising yields and a stronger dollar will force the Fed to take action. He emphasizes that Bitcoin’s scarcity, due to its limited supply, remains a key long-term bullish factor for the asset.