Bitcoin’s options landscape has undergone a sharp reversal, shifting from last year’s heavily bullish bias to a distinctly bearish posture as the asset drops more than 25% from its early-October levels, now trading near $91,000.

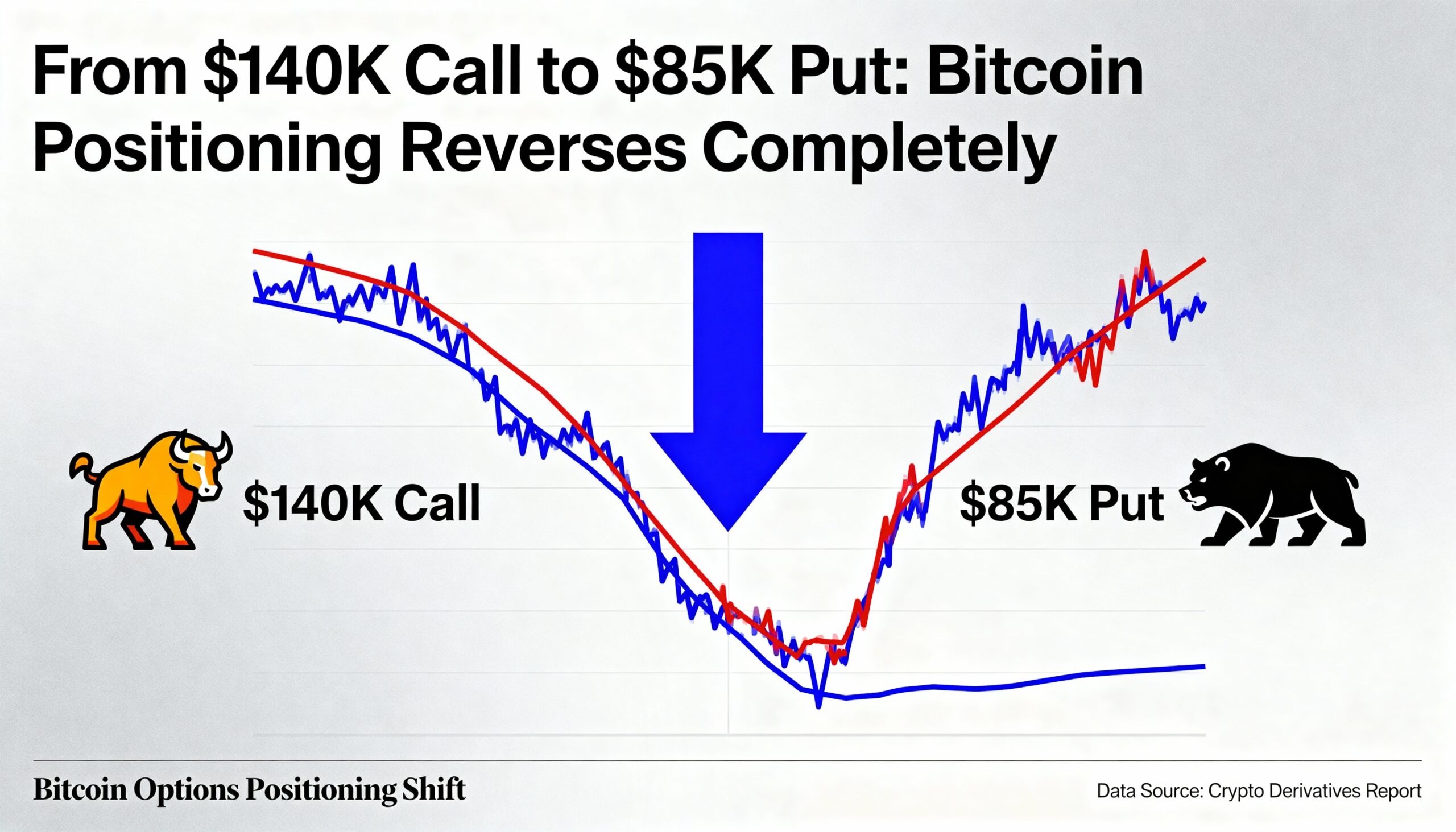

Throughout much of the past year, Deribit traders were positioning for major upside, with open interest concentrated in high-strike call options at $100,000, $120,000 and even $140,000. The $140,000 call was the standout favorite, carrying more than $2 billion in notional open interest for most of the year.

That trend has flipped. Open interest on the $140,000 call has slipped to $1.63 billion, while downside positioning has surged. The $85,000 put has become the single largest strike on the board, with open interest climbing to $2.05 billion. Put options at the $80,000 and $90,000 strikes have similarly overtaken what was once the dominant $140,000 upside bet.

The shift signals a market increasingly braced for further weakness. Traders are accumulating put options—used both as hedges and as outright bearish wagers—with the largest buildups occurring in out-of-the-money strikes, indicating expectations for a deeper slide or a desire for protection against sharper declines.

Even though calls still outnumber puts in absolute quantity, bearish contracts are commanding significantly higher premiums. The pronounced skew toward puts reflects heightened concern around downside risks.

“Options positioning is showing clear caution as we approach year-end,” said Jean-David Pequignot, chief commercial officer at Deribit. “Short-term puts between $84K and $80K are seeing the strongest activity today. Front-end implied volatility is near 50%, and the curve shows a notable put skew of 5% to 6.5%.”

That defensive tone extends to decentralized platforms as well. On Derive.xyz, the 30-day skew has fallen to -5.3% from -2.9%, highlighting growing demand for downside insurance.

Dr. Sean Dawson, head of research at Derive.xyz, noted that traders are clustering around the December 26 expiry, where a significant block of puts—particularly near the $80,000 strike—is building rapidly.

Dawson said macro uncertainty continues to weigh on sentiment. Questions around U.S. labor-market strength and diminished expectations for a December rate cut—now hovering just above 50%—have reduced appetite for bullish positioning into year-end.

Still, several indicators point to potential exhaustion in the sell-off. Sentiment and momentum measures are nearing historically oversold thresholds.

“The Fear & Greed Index is sitting around 15, and RSI is approaching 30,” Pequignot said. “We’re also seeing a notable pickup in whale wallets holding more than 1,000 BTC, suggesting smart-money accumulation at lower prices.”

Pequignot added that while the short-term outlook remains fragile, such heavily bearish positioning has, in previous cycles, created attractive openings for contrarian traders.