Bitcoin mining stocks that have pivoted toward artificial intelligence infrastructure extended their strong performance into the new year, and fresh earnings from Big Tech suggest the trend could have further room to run.

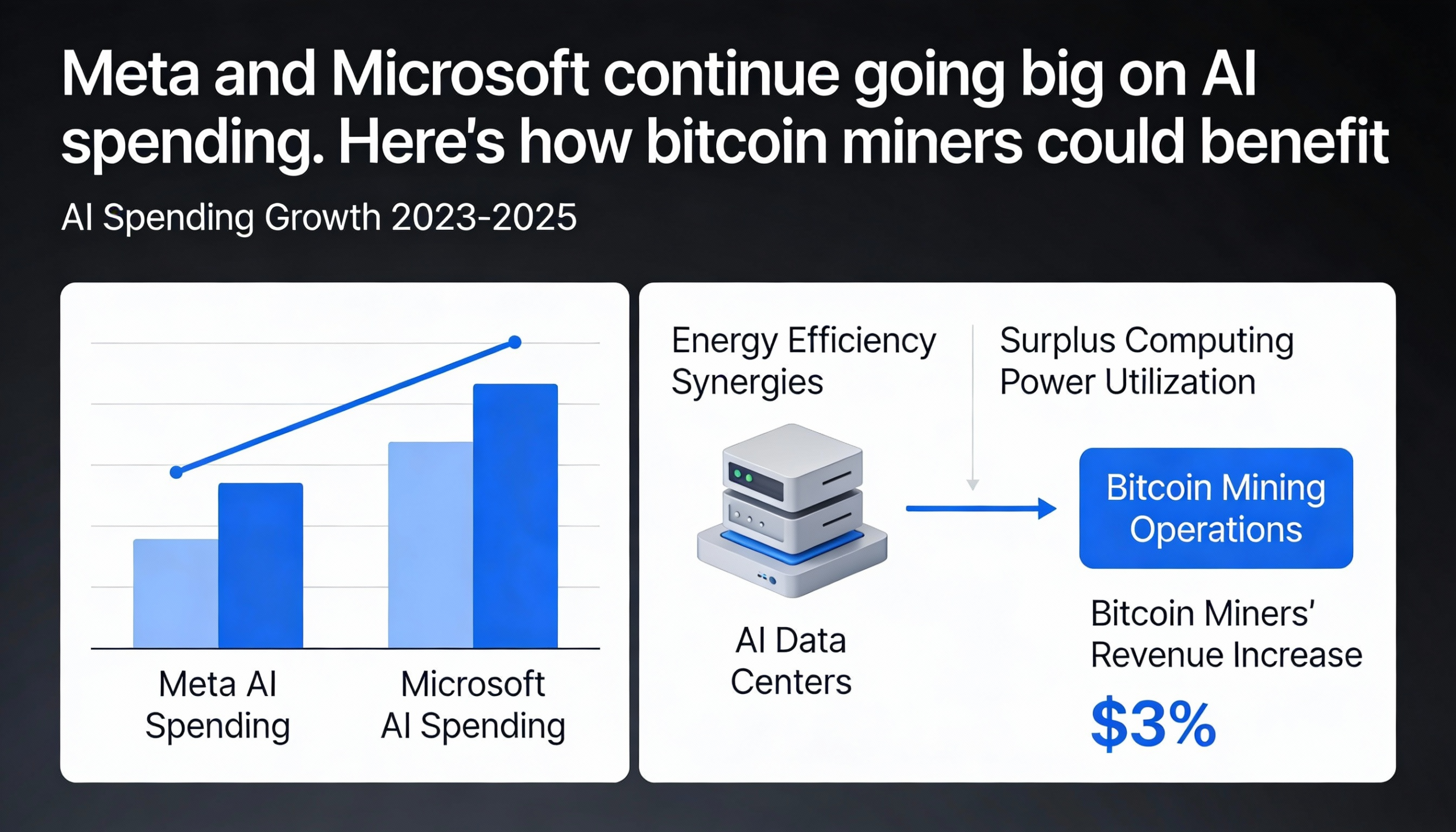

Meta and Microsoft both reinforced their long-term commitment to AI spending in fourth-quarter earnings released Wednesday, signaling that the industry’s investment boom remains intact. Meta said capital expenditures in 2026 are expected to reach between $115 billion and $135 billion, comfortably above consensus estimates of roughly $110 billion. Microsoft likewise positioned AI as a core growth driver.

“We are only in the early stages of AI diffusion,” Microsoft CEO Satya Nadella said, noting that the company has already built an AI business larger than several of its legacy franchises. “We’re pushing the frontier across the entire AI stack to create new value for customers and partners.”

The outlook bodes well for a subset of bitcoin miners that have retooled their data centers to support AI and cloud-computing workloads. The shift has helped offset pressure from April’s bitcoin halving, which cut block rewards in half, as well as rising competition and power costs. By hosting high-performance computing infrastructure, miners have diversified revenue streams beyond crypto mining and tapped into demand driven by the AI boom.

Several miners have already secured major partnerships. In November, Iren signed a multiyear agreement with Microsoft to provide cloud services for AI workloads using Nvidia chips. Around the same time, Cipher Mining reached a deal with Amazon to supply 300 megawatts of capacity to Amazon Web Services, one of the largest infrastructure commitments yet from a bitcoin miner targeting AI demand.

The strategy has paid off in the market. Iren shares rose nearly 5% Wednesday ahead of earnings, bringing year-to-date gains to 47% and year-over-year gains to more than 500%. Cipher Mining was up modestly on the day and is now up 17% this year and more than 300% over the past 12 months. Hut 8, another miner that has leaned into AI and high-performance computing, is up 26% year-to-date and roughly 230% year-over-year.

The durability of AI-driven optimism across the sector may face its next major test when Nvidia reports earnings on Feb. 25, a closely watched signal for the pace of spending across the AI supply chain.