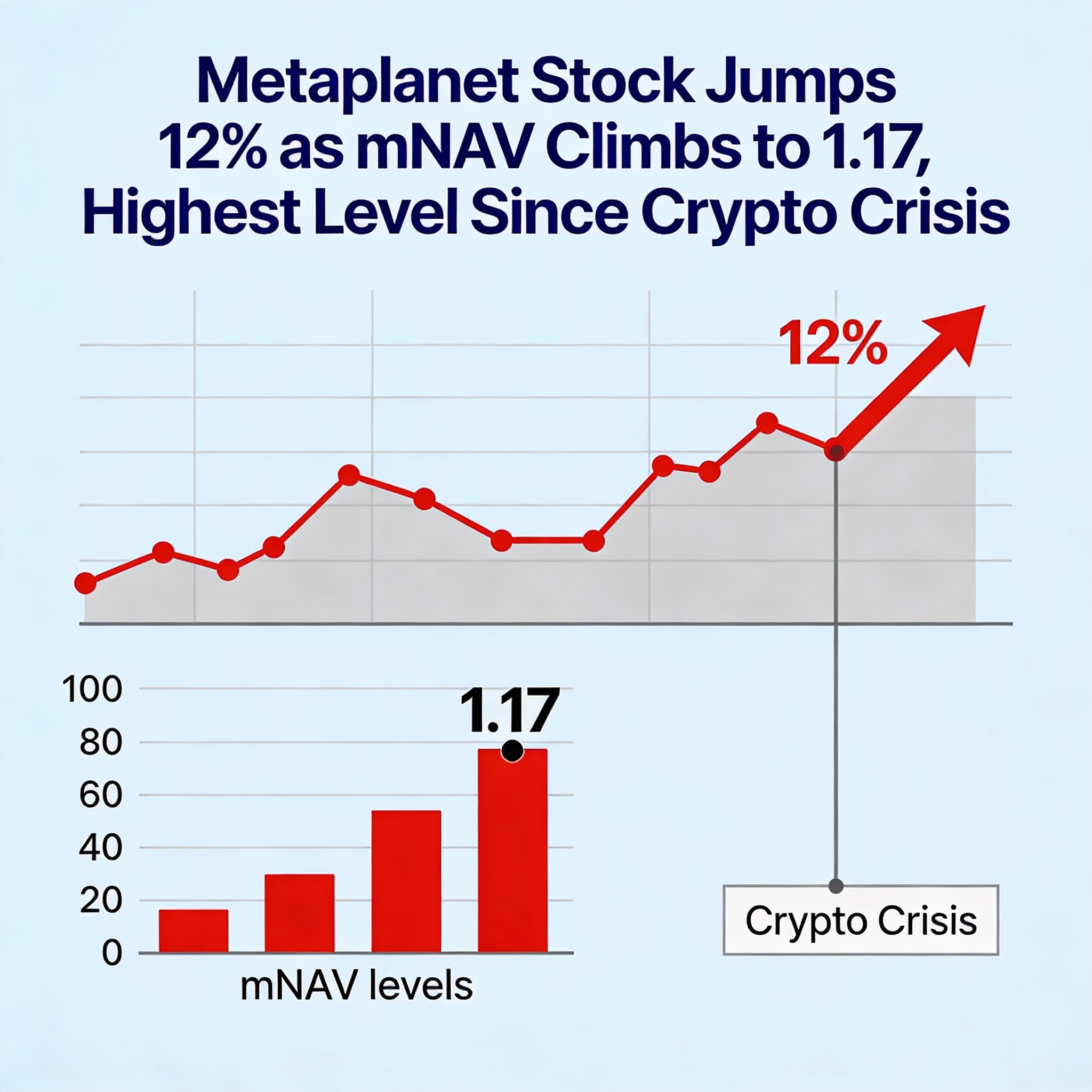

Metaplanet’s valuation premium has climbed to its strongest level in months, buoyed by bitcoin’s recovery and renewed momentum in equities. The company’s multiple to net asset value (mNAV) has risen to 1.17, according to its dashboard—its highest reading since before the liquidation-driven crypto crisis that began on Oct. 10.

The mNAV metric compares the market value of Metaplanet’s bitcoin holdings with its enterprise value, offering a snapshot of how much investors are willing to pay relative to its underlying BTC reserves.

Metaplanet currently holds 30,823 BTC valued at roughly $2.86 billion, making it the fourth-largest publicly traded bitcoin holder. With an enterprise value of about $3.33 billion, the company’s mNAV lands near 1.17. Its market capitalization stands around $3.43 billion, supported by approximately $304 million in outstanding debt.

From mid-October through early December, the mNAV sat below 1 and touched a low of 0.84 in November. The firm has not expanded its bitcoin stack since late September, when it added 5,268 BTC and 5,419 BTC in two large purchases.

Since bitcoin’s late-November low near $80,000, the asset has climbed roughly 15%, while Metaplanet’s share price has advanced nearly 30% over the same period—outpacing the crypto’s rebound.

The company has also filed for perpetual preferred equity as it leans further into a strategy that mirrors MicroStrategy’s approach.

Metaplanet shares closed 12% higher on Wednesday at 471 yen.