Digital asset treasury company Metaplanet (3350) climbed 4% in Tokyo on Wednesday after index provider MSCI opted not to exclude firms that hold cryptocurrency from its global indexes.

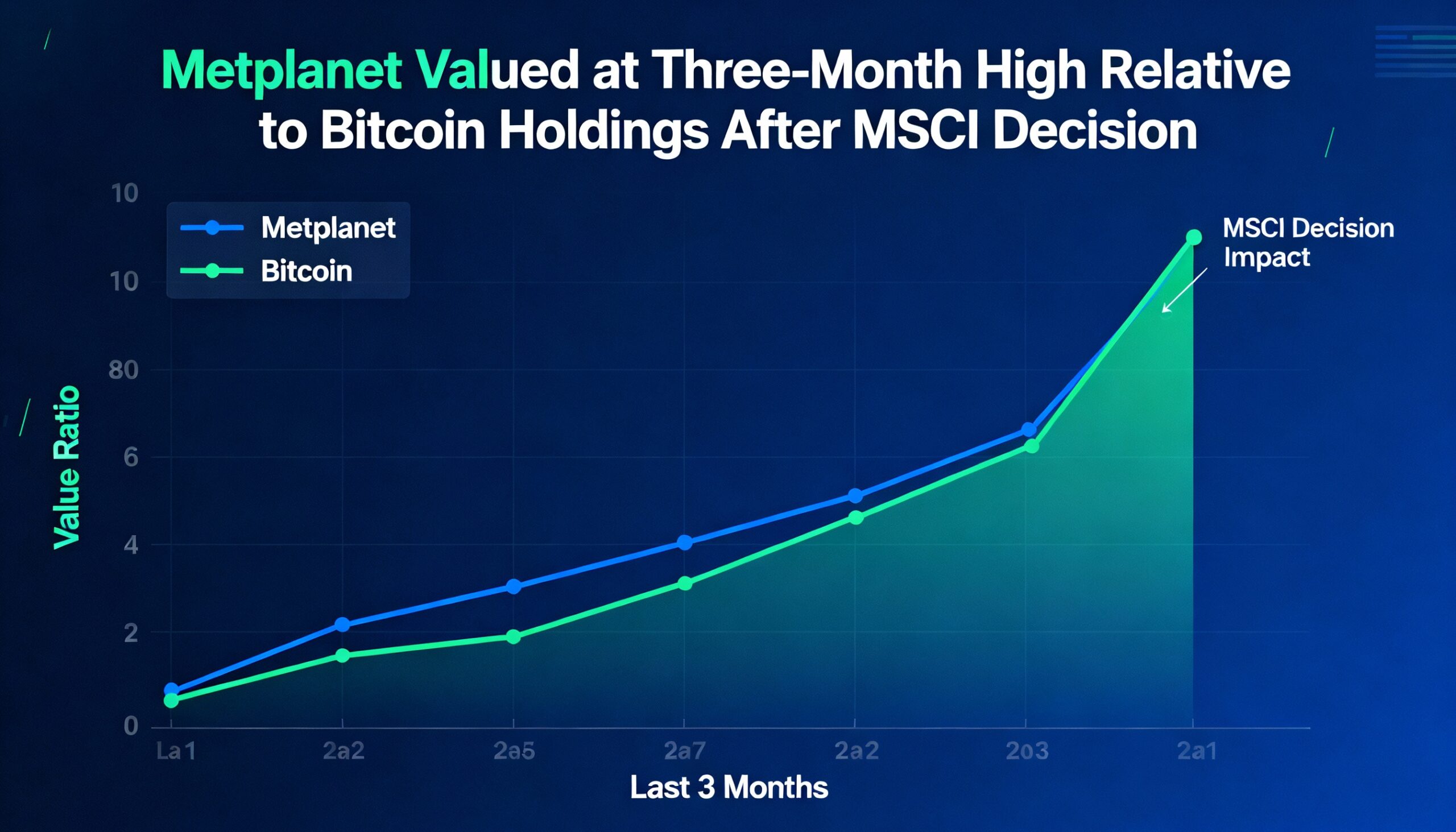

The gain pushes Metaplanet up roughly 20% year-to-date, placing the company at a premium relative to its bitcoin holdings. Its multiple of net asset value (mNAV) now stands at about 1.25 — the highest level since before the crypto market sell-off in October, according to the company’s internal dashboard.

MSCI’s decision ended months of uncertainty over index eligibility and provided a boost to U.S.-listed peers when the announcement came after Tuesday’s regular trading session. MicroStrategy (MSTR), the largest corporate bitcoin holder, rose about 5% in pre-market trading, while other digital asset treasury firms saw more modest gains.

Metaplanet shares closed at 531 yen ($3.40), up from a recent low near 340 yen on Nov. 18. The company currently holds 35,102 BTC, making it the fourth-largest publicly traded bitcoin treasury globally.

While the MSCI announcement removes near-term uncertainty for crypto treasury stocks already included in major indexes, the provider also indicated that a broader consultation on non-operating and investment-focused companies is forthcoming. This suggests that regulatory and index-related risks for bitcoin treasury firms have been postponed, not fully resolved.