German payments processor DECTA said euro-pegged stablecoins are poised for wider use in payments and tokenized finance as the EU’s Markets in Crypto-Assets (MiCA) regulation comes fully into force.

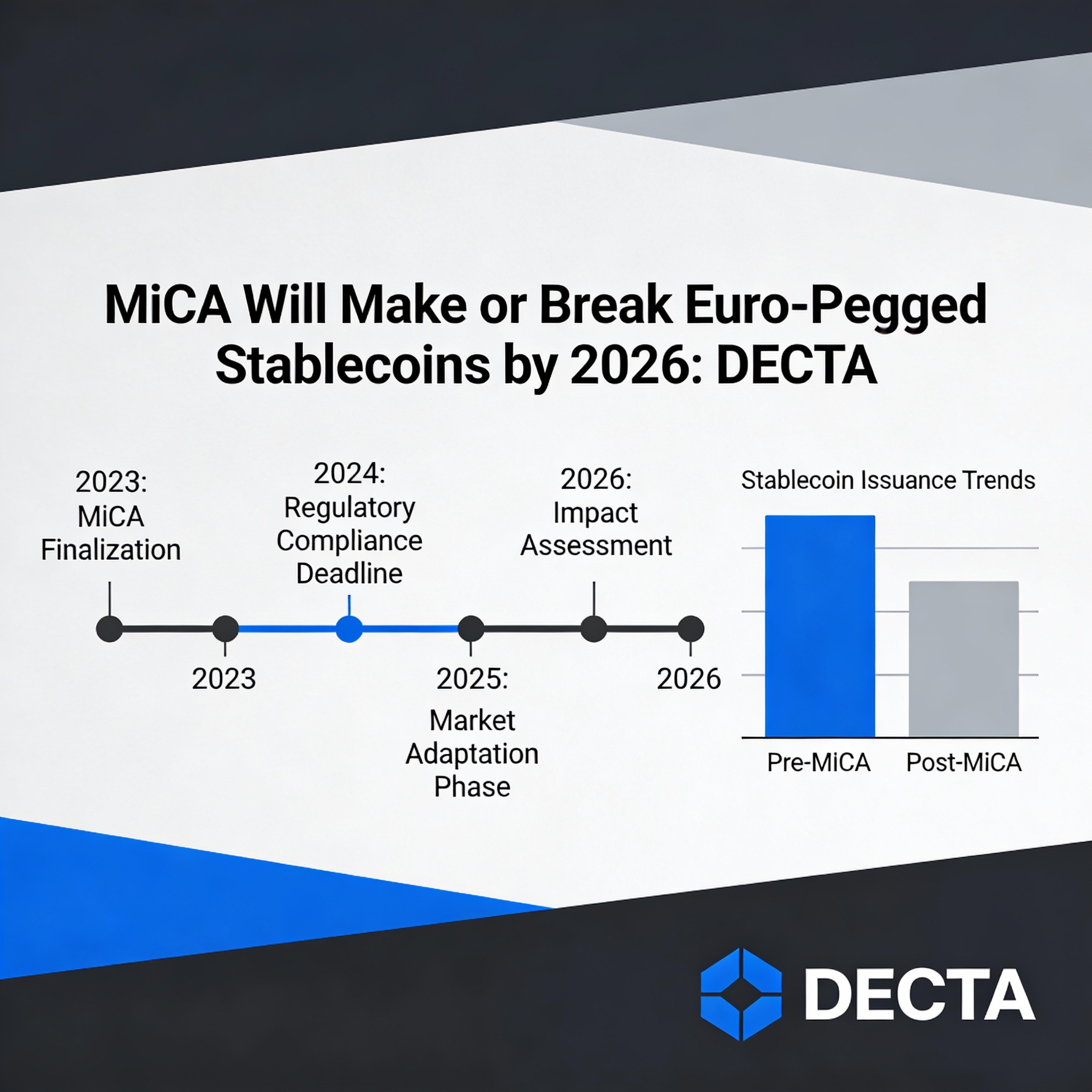

In a report published earlier this month, the company said the euro-denominated stablecoin market will continue to evolve through 2026 as MiCA establishes a single regulatory framework across the bloc, setting clear rules on reserves, issuer supervision and operational requirements.

That regulatory clarity should make it easier to integrate compliant euro stablecoins into payment rails, trading venues and tokenized financial systems, DECTA said.

According to the firm, growth over the next two years will hinge on how quickly MiCA-authorized issuers expand distribution and secure banking partnerships, the extent to which financial institutions adopt stablecoin-based settlement for tokenized assets and programmable payments, and the strength of demand for euro-denominated digital assets across exchanges and payment applications.

DECTA expects EU platforms to gradually move away from non-compliant or synthetic euro tokens in favor of fully regulated stablecoins as MiCA is implemented.

Even so, adoption is likely to be uneven across member states, reflecting differences in consumer awareness, national digital-asset policies and market maturity.

By 2026, euro-pegged stablecoins should occupy a clearer and more regulated position within Europe’s digital-asset ecosystem, under a framework designed to promote stability, transparency and predictable oversight, DECTA said.