Schwab Report Breaks Down Crypto, Shows Most Value in Networks

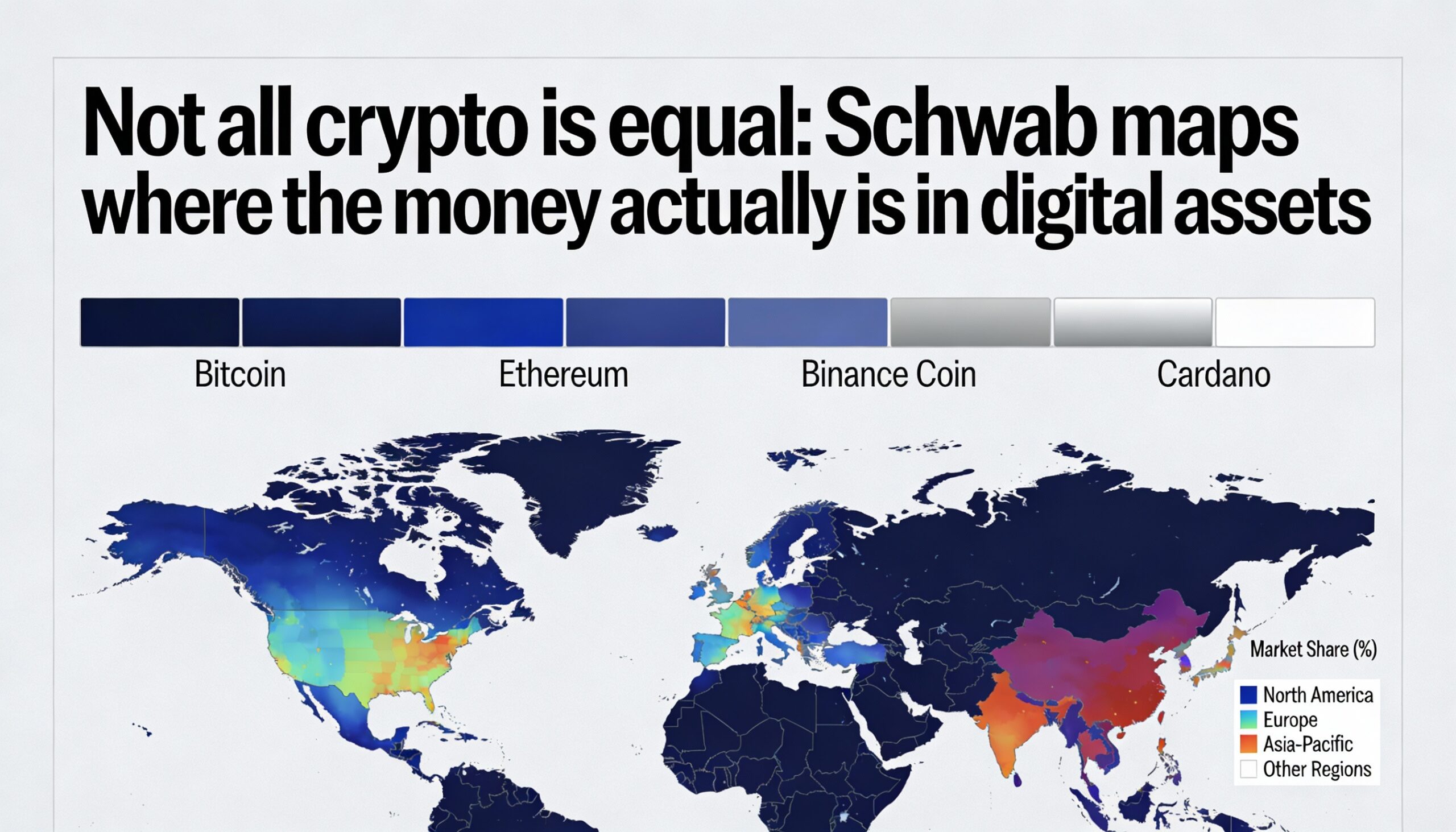

A new report from Schwab’s Center for Financial Research divides the crypto market into three layers—networks, infrastructure, and products—and finds that most value remains concentrated in foundational blockchains like Bitcoin and Ethereum.

Schwab emphasizes that crypto is not a single asset class but a complex ecosystem. As spot crypto ETFs open the market to mainstream investors, understanding where value resides is more important than ever.

The three layers:

- Networks: Bitcoin and Ethereum form the foundation. These blockchains process transactions and support nearly every other crypto application. Schwab notes that as of the end of 2025, these networks accounted for nearly 80% of crypto’s $3.2 trillion market cap.

- Infrastructure: Middle-layer protocols like oracles, bridges, and scaling solutions connect blockchains and applications. While essential, they face challenges: users rarely interact directly, and switching to competitors is easy.

- Products: User-facing applications such as exchanges, lending platforms, and staking services. These tend to have higher switching costs and the potential to become industry standards. Schwab cites Aave (AAVE) and Lido (LDO) as examples.

The report compares crypto to traditional software: networks are like cloud platforms (AWS, Azure), infrastructure is like back-end tools, and products resemble applications like Salesforce or Netflix.

Schwab also offers a framework for evaluating crypto: network effects, market share, scalability, and tokenomics. Ethereum illustrates the model, leading the smart contract sector with strong adoption, though slower transaction speeds and concentrated ownership present risks.

Key takeaway: infrastructure protocols often struggle to hold value, while foundational networks dominate the market. Schwab stresses that crypto remains speculative, and investors should focus on where value truly resides—networks and widely used products.