U.S. equities are also fading from early strength, with the Nasdaq now up just 0.3% after a sharp morning rally.

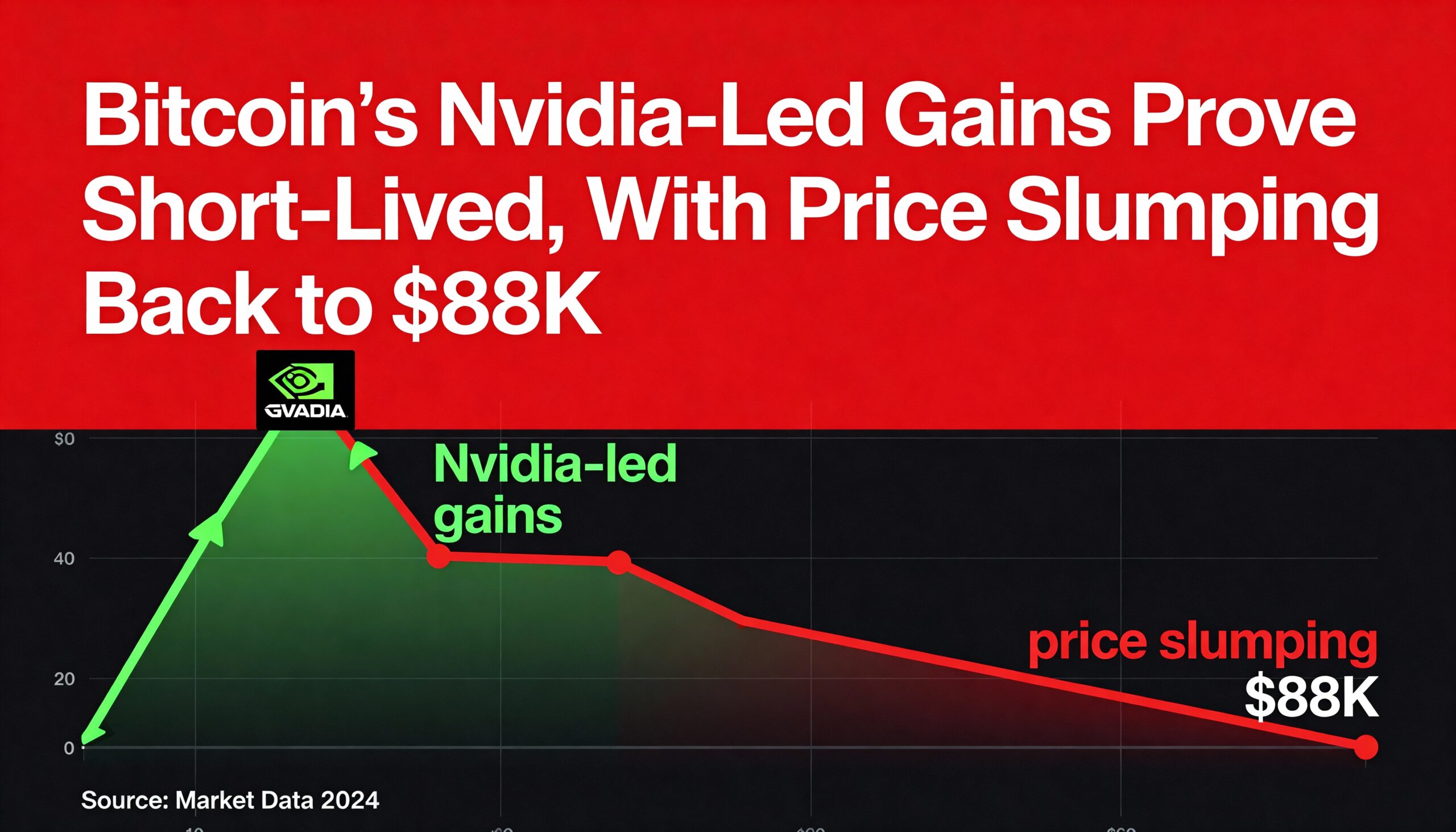

Crypto markets once again saw brief optimism swallowed by heavy selling on Thursday, with bitcoin sliding back toward $88,000 after surging above $93,000 earlier in the day. The move higher began late Wednesday after Nvidia (NVDA) delivered strong earnings and an upbeat outlook, briefly lifting sentiment across risk assets and pushing the Nasdaq more than 2% higher.

But the momentum quickly reversed. Nvidia has given back its premarket gains and is now trading flat, and broader equity markets have followed the same pattern, erasing most of the initial surge.

Macro pressures remain front and center. The delayed September jobs report — released today after the government shutdown — showed a far stronger-than-expected 119,000 jobs added. Combined with recent commentary from Cleveland Fed President Beth Hammack, who argued that firm inflation and elevated stock valuations don’t warrant a rate cut, markets are now increasingly convinced the Fed will hold steady in December. Hammack’s remarks have drawn comparisons to Alan Greenspan’s 1996 “irrational exuberance” warning, even though equities rallied for years afterward.

Ether (ETH) has been hit harder than bitcoin, falling almost 4% over the past hour. Part of the pressure may come from digital asset treasury firm FG Nexus, which reportedly sold a portion of its ETH stack to fund share buybacks after its stock collapsed more than 95% from summer highs.

Crypto-linked equities have flipped sharply lower as well. MicroStrategy (MSTR) is down 4.7% and trading at a fresh 52-week low of $178, leaving it 62% lower over the past year. Coinbase (COIN) and Gemini (GEMI) are off 4% and 5%, respectively, while stablecoin issuer Circle (CRCL) is down 3.5%.