Nvidia Earnings Beat Expectations, AI Demand Drives Markets; Bitcoin Tops $90K

Nvidia CEO Jensen Huang said, “Blackwell sales are off the charts, and cloud GPUs are sold out,” underscoring the surging demand for AI hardware.

The chipmaker reported a strong third quarter and provided an upbeat outlook for Q4, temporarily easing concerns of an AI bubble. Revenue reached $57.01 billion, up 62% from a year earlier, surpassing Wall Street estimates as AI investment fuels demand for Nvidia’s chips.

“Compute demand continues to accelerate across both training and inference — each growing exponentially,” Huang added.

Shares of Nvidia jumped 4% in after-hours trading following the announcement.

Data Centers Continue to Lead Growth

Nvidia’s data center business, the largest contributor to revenue, generated $51.2 billion, exceeding analyst forecasts of $49.34 billion. For the fourth quarter, the company expects revenue of $63.7-$66.3 billion, well above the Street’s $62 billion estimate.

Positive Ripple for Crypto and AI-Linked Stocks

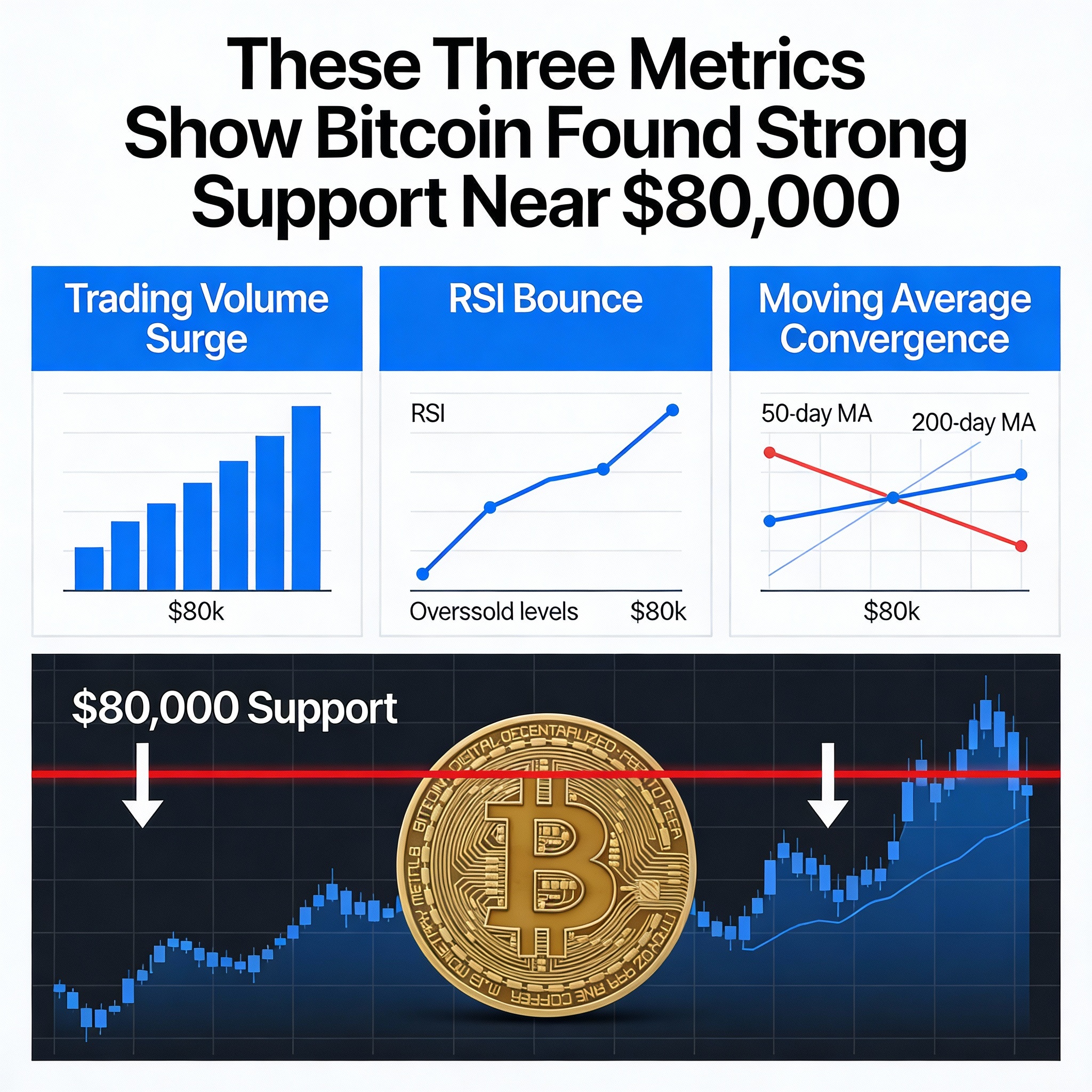

The earnings report also bolstered cryptocurrency markets. Bitcoin (BTC) reclaimed $90,000 after nearly slipping below $88,000 earlier in the day. AI-focused tokens including TAO, Near Protocol (NEAR), ICP, and RNDR rose 4%-5% following Nvidia’s results.

Bitcoin mining companies shifting toward AI infrastructure also saw gains. Wednesday’s notable movers included IREN (+8%), Cipher Mining (CIFR) (+11%), and Hut 8 Mining (HUT) (+6%) after recent weakness amid tech and crypto selloffs.

Nvidia at the Center of AI Innovation

The results reaffirm Nvidia’s pivotal role in the AI ecosystem. Its GPUs power data centers, train large language models, and support machine-learning workloads for major tech companies.

Investors are awaiting the company’s 5 p.m. ET conference call for updates on how Nvidia’s investments in AI infrastructure, next-generation chips, and software tools are translating into sustained revenue growth.