Bullish leverage on Bitfinex continues to rise, pointing to sustained conviction among traders even as bitcoin remains under pressure.

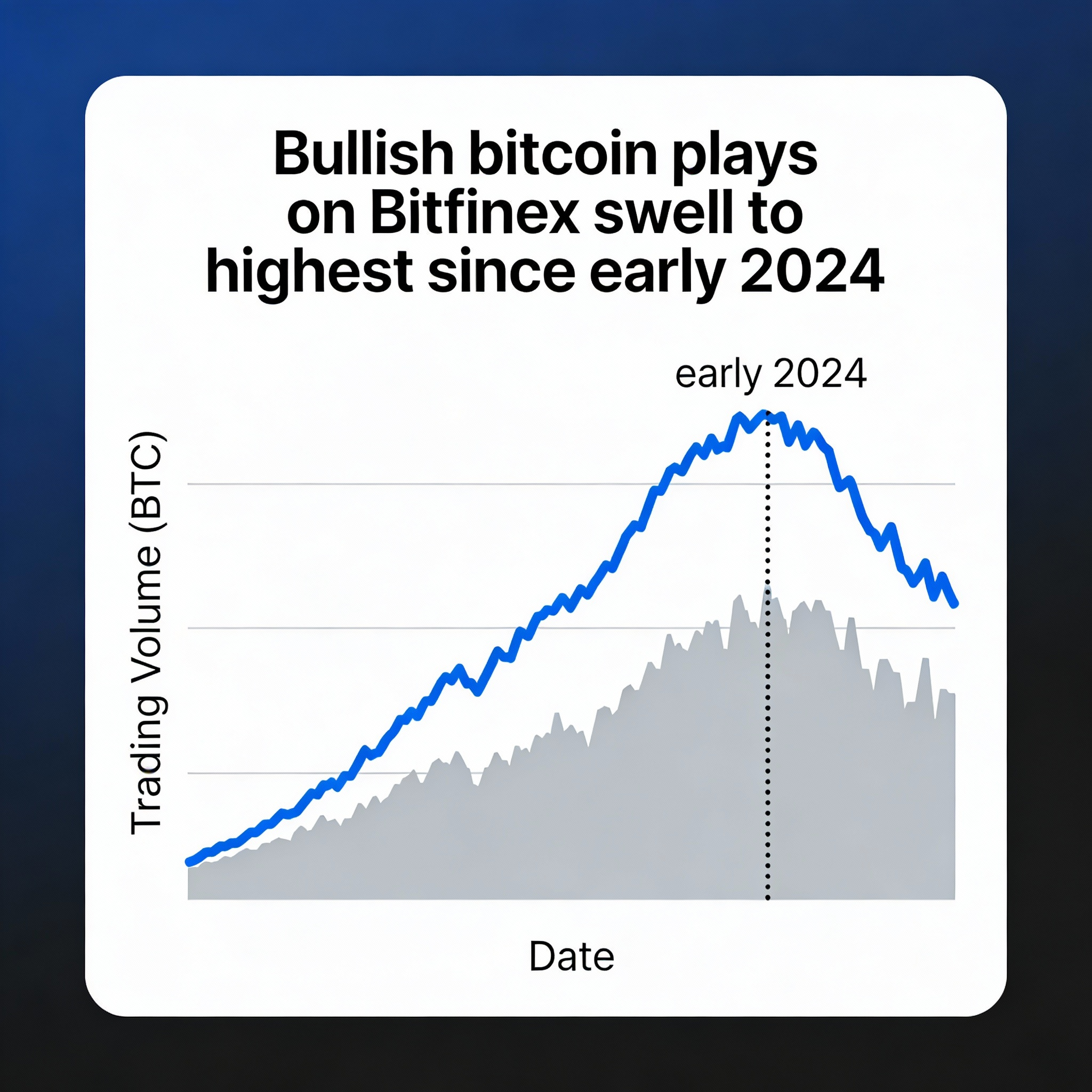

Data from TradingView show margin long positions — leveraged bets on higher bitcoin prices — have increased to about 72,700 BTC, the highest level since February 2024. The total has climbed steadily from roughly 55,000 BTC in October.

The buildup reflects ongoing dip-buying as bitcoin retreated to around $89,000 from highs above $126,000. During the sell-off, prices briefly dropped to nearly $80,000 on some exchanges in November.

The growing use of leverage comes despite bitcoin being on course for a third consecutive monthly decline, a pattern last seen during the 2022 bear market.

Historically, elevated margin long positioning on Bitfinex has tended to act as a contrarian signal. These leveraged bets often peak during periods of market stress and unwind just as prices begin to stabilize and recover.

Previous cycles show that sustained reductions in margin longs have coincided with market bottoms or the early stages of a rebound. This relationship was clearly visible during the August 2024 yen carry trade unwind, when bitcoin bottomed near $49,000 as leveraged exposure was sharply reduced.

A similar dynamic emerged during the tariff-driven sell-off in April 2025. As prices slipped toward $75,000, margin longs declined, indicating that weaker hands had exited and setting the stage for a subsequent bounce.

For now, the continued expansion in leveraged bullish positioning suggests bitcoin has yet to find a lasting bottom.