Bitcoin pushed back above $68,000 on Thursday, rebounding from a local low near $65,600, even as U.S. spot ETF outflows ballooned to $6.8 billion. Market watchers say a sustained move above $72,000 is needed to signal a meaningful bullish reversal.

The recovery built gradually overnight. Since midnight UTC, bitcoin has gained about 2%, while Solana (SOL) climbed 2.7% and ether (ETH) added 1.2%.

Still, the broader technical picture remains cautious. Bitcoin continues to form lower highs and lower lows, effectively retracing most of the gains recorded in the 12 months leading up to October 2025. In the near term, price action remains range-bound, fluctuating between established support and resistance. A decisive break above $72,000 would be required to shift momentum in favor of buyers.

At the same time, U.S.-listed spot bitcoin ETFs have recorded their largest drawdown of the current cycle. Since October, roughly 100,300 BTC have been withdrawn — translating to approximately $6.8 billion in additional selling pressure in an already sensitive market.

Derivatives markets show early signs of stabilization

Futures positioning suggests the recent wave of deleveraging may be easing. Open interest has risen to $15.8 billion, indicating renewed engagement after earlier leverage flush-outs. Retail sentiment is also improving, with funding rates turning flat to positive across major venues and reaching as high as 10% on exchanges such as Bybit and Hyperliquid.

Institutional positioning appears steady rather than aggressive. The three-month annualized futures basis remains anchored around 3%, signaling moderate conviction.

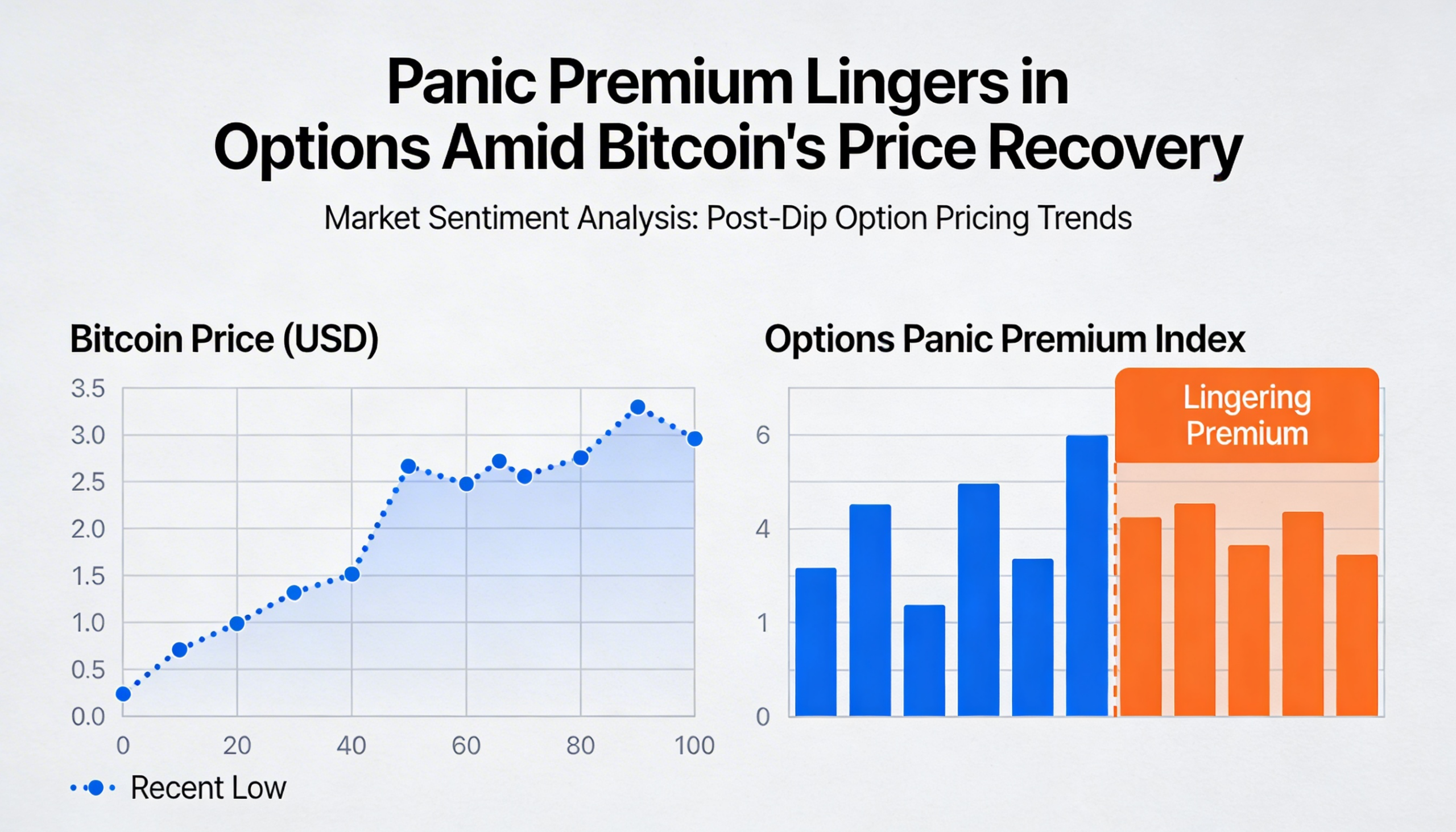

Options activity reveals a slight tilt toward bullish bets, with 24-hour volume split 51% in favor of calls. However, near-term hedging demand remains elevated. The one-week 25-delta skew has widened to 17%, while the implied volatility term structure continues to show short-term backwardation.

This indicates traders are still paying a “panic premium” for immediate downside protection, even as longer-dated implied volatility stabilizes near 49%.

Liquidation data reflects ongoing two-sided volatility. According to Coinglass, $179 million in positions were liquidated over the past 24 hours, with a 56% share attributed to longs and 44% to shorts. Bitcoin accounted for $59 million of those liquidations, ether $46 million, and other tokens around $16 million. Binance’s liquidation heatmap highlights $68,400 as a key level to watch if prices extend higher.

Altcoins gain ground during consolidation

Outside of bitcoin, altcoins showed relative strength. Lending token MORPHO surged more than 12% overnight, while AI payments token KITE advanced 11%, extending its 30-day rally to 153%.

DeFi names also participated in the move. Jupiter (JUP) climbed more than 3.6% after hitting a seven-day low earlier in the week.

Among broader benchmarks, the CoinDesk Smart Contract Platform Select Index (SCPXC) led performance with a 2.25% gain over the past 24 hours, followed by the CoinDesk Memecoin Index (CDMEME), up 2.2%. The bitcoin-heavy CoinDesk 20 (CD20) rose 1%, reflecting more measured gains among large-cap tokens.

Periods of sideways consolidation often allow traders to rotate capital into higher-risk assets without fearing they will miss a breakout in major cryptocurrencies such as bitcoin, ether or XRP — a dynamic currently supporting selective strength in altcoins.