Powell Keeps Fed on Hold as Markets Crater, Trump Demands Rate Cuts

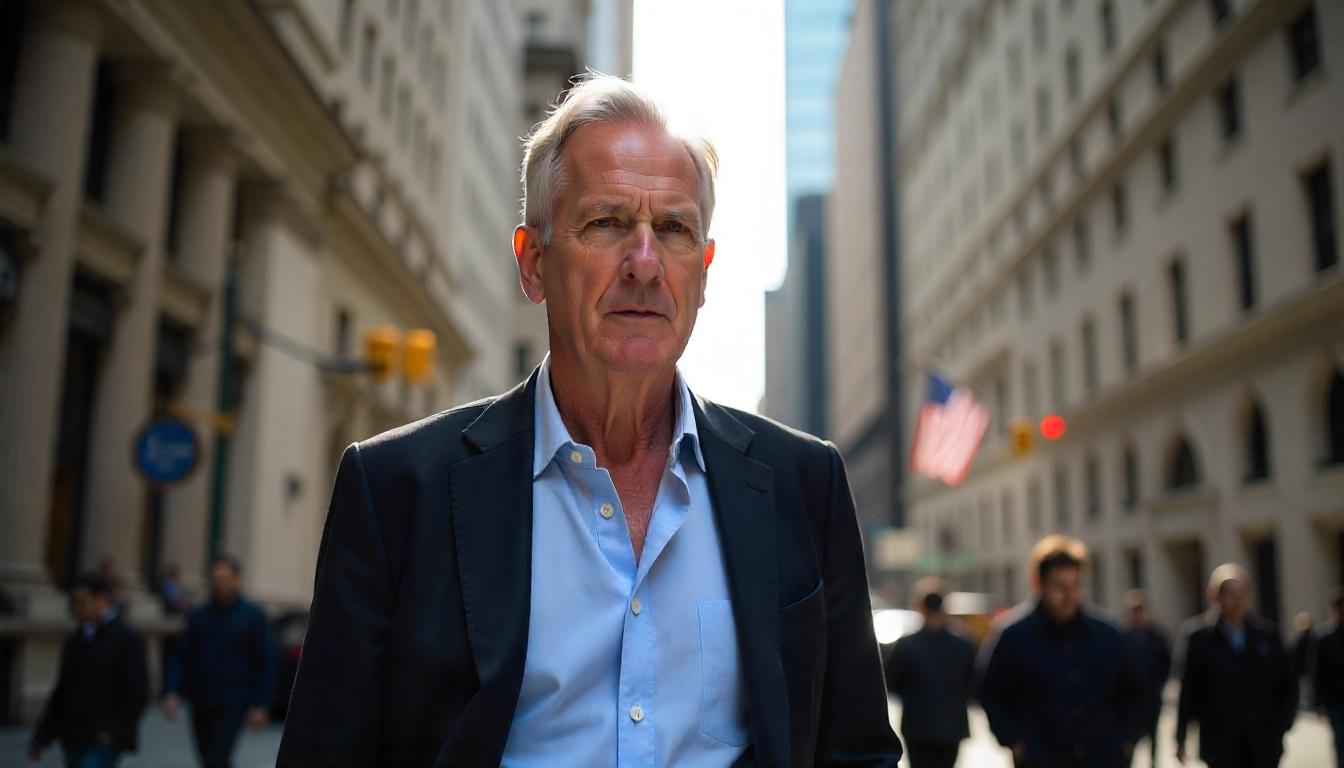

With financial markets in freefall following President Trump’s sweeping tariff announcement, all eyes turned to Federal Reserve Chair Jerome Powell on Friday — but those hoping for immediate relief were left empty-handed.

Speaking at the Society for Advancing Business Editing and Writing conference, Powell made clear the central bank isn’t rushing to change course. “It’s too soon to say what will be the appropriate path for monetary policy,” he said, adding the Fed is “well positioned to wait for greater clarity” before adjusting its stance.

The tariffs, which Powell described as “significantly larger” than anticipated, are expected to temporarily drive inflation higher — a development the Fed will be watching closely to prevent long-term price instability.

Markets had briefly bounced in anticipation of more dovish commentary, but bitcoin (BTC) slipped back below $83,000 after the remarks. Equities remained deeply in the red, with the Nasdaq shedding another 4.2% on top of Thursday’s historic 6% drop.

Trump Turns Up the Heat

Just before Powell took the stage, President Trump amped up the pressure. “This would be the perfect time for Fed Chairman Jerome Powell to cut interest rates,” he wrote on Truth Social. “Cut interest rates, Jerome, and stop playing politics.”

But Powell didn’t take the bait. His message was steady: The Fed is focused on data, not drama — even in the face of mounting political pressure and global financial turbulence.