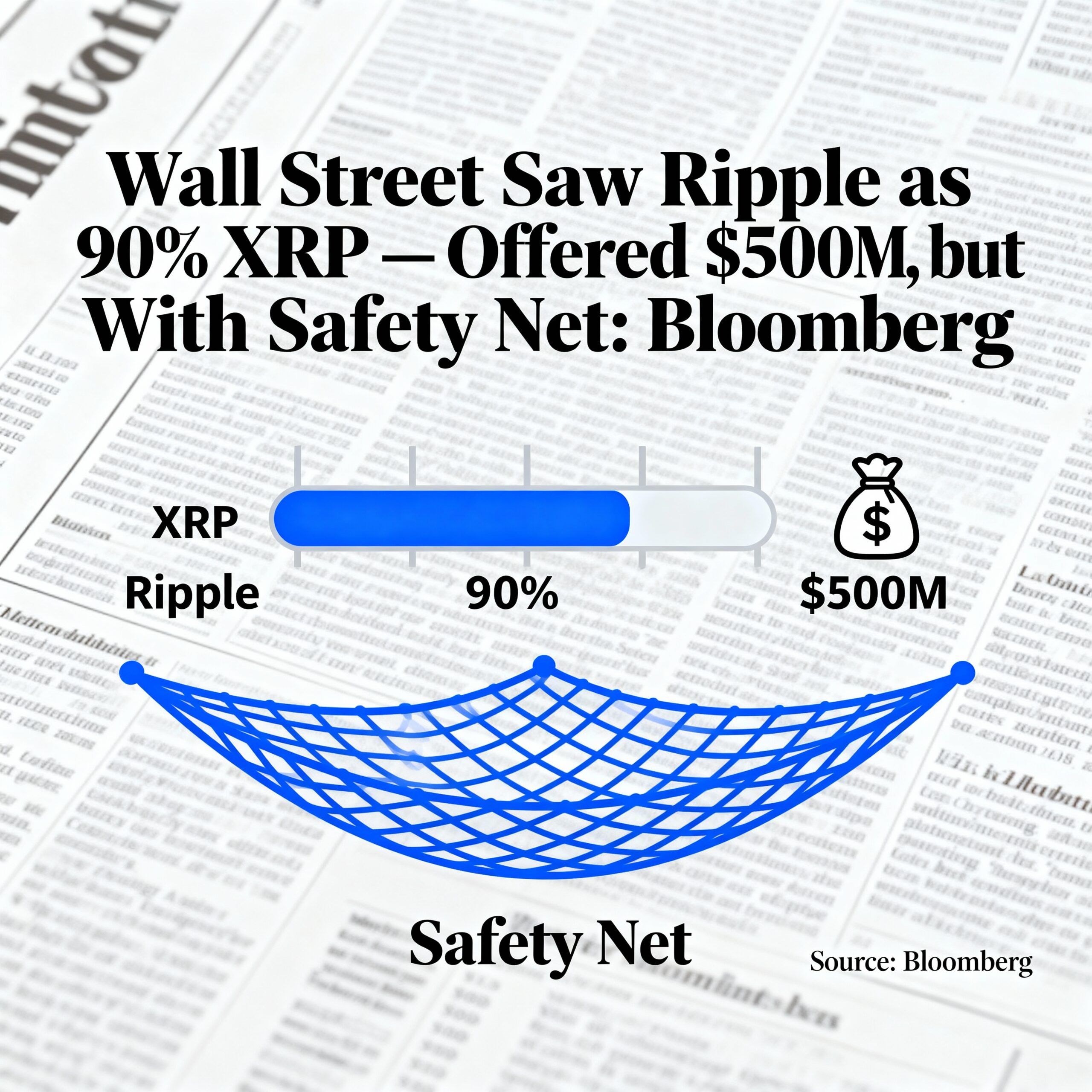

According to a Bloomberg report, many of the institutions that backed Ripple’s recent $500 million fundraising concluded that the company’s valuation was overwhelmingly tied to XRP. Several investors estimated that more than 90% of Ripple’s net asset value was effectively linked to the token, which remains legally separate from the company but represents a massive portion of its balance sheet. As of July market prices, Ripple controlled roughly $124 billion worth of XRP in its treasury.

The share sale attracted major global players—including Citadel Securities, Fortress Investment Group, Marshall Wace, Brevan Howard–connected entities, Galaxy Digital and Pantera Capital—at a lofty $40 billion valuation, the highest ever recorded for a privately held crypto firm. But investors only moved forward after securing unusually strong risk protections that looked more like structured-credit terms than a conventional late-stage equity round.

Bloomberg’s Ryan Weeks noted that several funds approached the deal as a concentrated bet on a single volatile asset, prompting negotiations for a suite of protections:

- A put option allowing investors to sell their shares back to Ripple after three or four years with a guaranteed 10% annualized return.

- A 25% annualized return if Ripple forces a buyback.

- A liquidation preference that puts new investors ahead of older shareholders in any sale or insolvency scenario.

Together, these provisions create a firm downside cushion—an approach that has become more common as traditional finance applies its risk-management frameworks to the crypto sector.

XRP has slid nearly 40% from its mid-July highs amid broader market weakness through October and November.

Despite the downturn, U.S. spot XRP ETFs are closing in on $1 billion in net inflows, supported by a 15-day streak of fresh investments. Their strong performance has been buoyed by the SEC’s August ruling, which clarified that XRP is not a security, giving institutions a clearer regulatory foundation.